Forex headlines for US trading on Dec 1, 2015:

- November 2015 US ISM manufacturing PMI 48.6 vs 50.5 exp

- November 2015 US Markit manufacturing PMI final 52.8 vs 52.6 exp

- New Zealand GDT price index +3.6%

- Fed's Evans: Concerned that inflation has been below 2% for quite a long time

- Fed's Evans says will go into Dec meeting with "open mind"

- Atlanta Fed GDPNow Q4 forecast cut to 1.4%

- Special contest: Guess the ADP number, win a t-shirt

- US Oct construction spending m/m +1.0% vs +0.6% expected

- OPEC source warns prices could fall to $35 per barrel - RTRS

- Canada Q3 GDP matches estimates but growth fell at quarter-end

- Parked van full of explosives found near airport in Bulgaria

- S&P 500 up 22 points to 2102

- US 10 year yields down 6 bps to 2.15%

- Gold up $5 to $1069

- WTI crude up 14 cents to $41.79

- AUD & NZD lead, CAD lags

The worst reading in the ISM manufacturing report since June 2009 gave traders second thoughts about betting on a Fed hike and the US dollar.

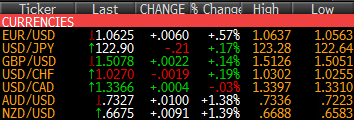

USD/JPY fell to 122.85 from 123.15 on the headlines. It chopped in a 122.77 to 122.96 range afterwards and wasn't able to get any support from the steady climb higher in stocks.

EUR/USD won on both fronts. It was higher on better Eurozone PMIs and employment data before US trading started and got a second lift from the ISM numbers but wasn't able to crack the European high of 1.0636. It finishes at 1.0625, up 60 pips on the day in a small relief rally.

Cable also did a poor job of taking advantage of a softish US dollar. It hit 1.5125 in Europe but had skidded back to 1.5080 by the time US traders arrived and despite a quick 20 pip pop on the ISM data, it eventually hit 1.5050 on heavy selling into the fix.

USD/CAD was in focus because of the GDP report. Canadian growth met expectations in the quarter but was very soft in September and the internals pointed to a tough road ahead. USD/CAD jumped 80 pips to 1.3397 on the headlines but couldn't match those lofty heights again. It slipped back to 1.3333 before a late push up to 1.3364. Oil wasn't much of a factor.

The real winners were the antipodeans. AUD/USD was steadily bid. Offers at 0.7300 capped early in Europe put gave way on ISM and the high was 0.7336 in a 100 pip rally. NZD followed a similar pattern and got a little lift from the GDT auction as well.