Forex news for Asia trading Wednesday 27 2016

- Update to Abe's speech time - 0420GMT

- Japan MoF says not considering issuing 50 year bonds

- Citi revise its RBA rate cut call, from August to November now

- Japan PM Abe to speak today at 0400GMT

- AUD, NZD getting smacked

- Today's Japan stimulus 'news': FNN says size to be 27tln yen

- UBS' Gao China may cut RRR 1-2 times before end of 2016

- Moody's on China: Credit growth outpacing nominal GDP growth

- Japan chief cabinet secretary Suga: Spur consumption by raising minimum wage

- Australia Q2 inflation data - responses

- Australia inflation data - impact on the Reserve Bank of Australia

- China - MNI / Westpac Consumer Sentiment for July: -1.6% on the month

- China June Industrial profits 5.1% y/y (prior 3.7%)

- Australia Q2 CPI, headline 0.4% q/q (expected 0.4%)

- Stupid ad watch

- PBOC sets yuan reference rate for today at 6.6671(vs. yesterday at 6.6778)

- FOMC preview - BoA ML expect no signals from the committee

- More on PBOC academic wanting yuan to stop falling

- PBOC researcher says he wants to 'draw a line' under yuan drops

- AUD and NZD both edging higher

- BOJ preview - "too close to call"

- Citi on the FOMC, USD: "May see a shift in policy tone from the Fed"

- Australian Treasurer Morrison wants to cut spending to reduce deficit

- Japan overnight press - More cash for low earners, BOJ lean to ease

- Got the hump? Wednesday's trade ideas thread.

- Private oil inventory data out now, oil price down

- Apple Q3 EPS $1.42 (estimate $1.39)

It was Australian Q2 inflation data day, but it got upstaged by Japan stimulus rumours and yen moves.

OK, lets take it from the beginning of the session.

News flow was light, we got private oil inventory data showing a smaller draw in inventory than expected, enough to see a dip in the oil price, but it retraced and we now await official data Wednesday morning US time.

There were small moves higher for AUD, NZD, GBP, and to a lesser extent EUR (against the USD). But nothing large, and they retraced while the market awaited Aussie CPI.

The data showed an in line q/q headline inflation result but a higher than expected 'core' (trimmed mean) q/q reading. Meanwhile y/y headline came in lower than expected while y/y trimmed mean continued along its 30 year low path. The initial AUD reaction was an immediate mark higher, but this was not sustained for more than a few seconds before it came back down and then over the next hour or so fell to a new session low, under 0.75 then under 0.7465 before stabilising. Reactions to the data have been net mixed, some analysts saying it confirms there will be an RBA rate cut next week (the meeting is August 2) while others said no, the bank will be on hold.

NZD pretty much shadowed the AUD (not perfectly, but close) and after a high above 0.7070 it has dropped toward 0.70; it sits around 0.7020 as i update.

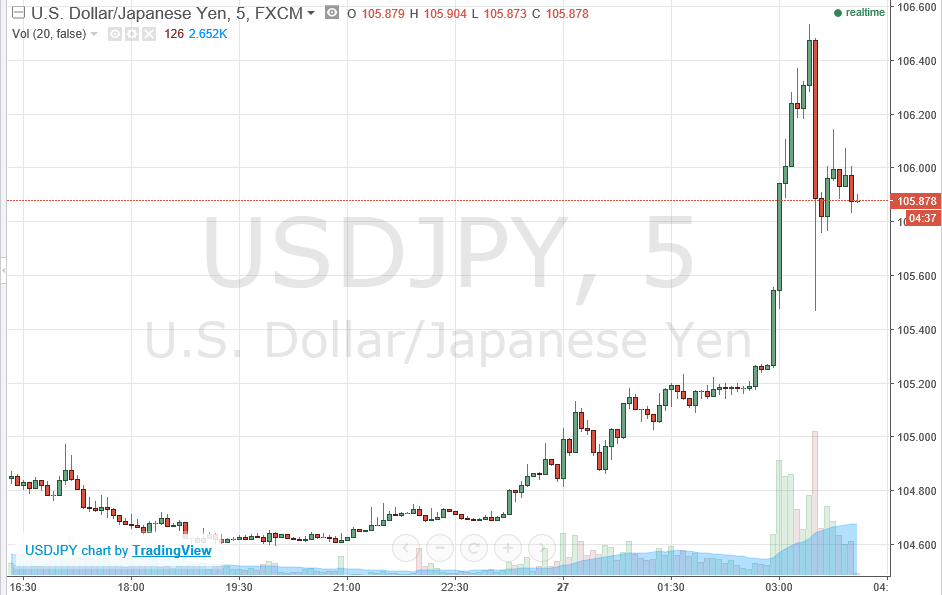

While this was going on USD/JPY had edged higher, and was actually substantially (or so it appeared at that stage) higher, from lows around 104.60 to above 105.15/20. But, we hadn't seen anything yet.

It moved up above 105.50 quickly, then above 105.80 and 106. The last surge came on headlines of a 27tln yen stimulus package (cooler heads pointing out that 13tln of it was from the BOJ low-interest lending), with details to be announced today, and then headlines saying the government was considering 50 year bonds. This took the USD/JPY rapidly above 106.50.

And the wild moves were not over.

The Japanese Ministry of Finance were quick to deny they were thinking about 50 year bonds, and USD/JPY plummeted 100+ points in seconds.

As I update its bounced and sits around 106. But try not to blink.

Still to come is a speech from Japanese PM Abe (due at 1.2pm Tokyo time, that's 0420GMT). It is unclear if he will be announcing any details of the stimulus pack, despite the rumours.

Elsewhere ... GBP/USD is net lower on the session. Gold is lower on the session also.

Regional equities:

- Nikkei +2.20%

- Shanghai -1.62%

- HK -0.14%

- ASX +0.10%