Forex news for Asia-Pacific trading Dec 13, 2015:

- Bank of Japan Q4 Tankan large manufacturers +12 vs +11 expected

- Japan tertiary industry index +0.9% vs +0.5% expected

- Japan October final industrial production +1.4% vs +1.4% initial reading

- PBOC sets yuan at weakest fix since 2011

- Rightmove UK house prices down 1.1% m/m

- South Africa replaces finance minister after 4 days

- New Zealand services PMI for November: 59.8 (prior 56.2)

- Hilsenrath on the Fed: "Their big worry is they’ll end up right back at zero"

- France - Regional Election results shut out Le Pen

Weekend news

- (ICYMI) China new loans beat expectations

- Autos drive solid China retail sales report

- China industrial production beats estimates, but may have been skewed

- Another junk bond fund suspends redemptions

Markets:

- WTI crude down 11-cents to $35.52

- Gold up $1.60 to $1076

- Nikkei down 2.2% to 18799

- Shanghai Comp +0.5%

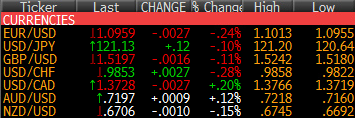

- CAD leads, CHF lags

Not a bad start to the week. There was some sense that the terrible US close on Friday would spill over into risk trades in Asia but it didn't happen.

USD/JPY slipped early and there was some choppy trading in a thin market ahead of the Tanken that led to a 20 pip drop but it stabilized from there as bids at 120.50/60 held and were the springboard for a recovery to 121.13 -- helping to take out the late Friday high.

EUR/USD was in a slow grind lower down to 1.0955 from as high as 1.0995 in very early trade. It was basically a one was slump lower with a little bounce from 1.0970 to 1.0985 mid-way through trading. It doesn't look good for the euro bulls here, especially with Friday's CFTC data showing no fear from the shorts.

Cable was a strong performer on Friday but it was a quick trip lower today as it sagged down to 1.5185 from 1.5225 at the open. The decline came almost like a gap at the open and continued in low liquidity. There's no great reason for the selling and it will be interesting to see how Europe reacts. Bids at 1.5175 are holding so far.

AUD/USD was on the defensive. There was no news out of Australia and better Chinese IP data didn't help the bulls. Steady selling down to 0.7160 eventually stopped and the pair recovered the loss and is now trading higher on the day at 0.7199.

USD/CAD was all over the place as it challenged Friday's high of 1.3757 and couldn't get through then fell back to 1.3728. We're near the lows of the day at the moment.

Overall, it was a better start for risk trades and that bodes well for a bounce. Keep a close eye on Chinese stocks.