Forex news for US trading on October 2, 2015

- Preview: 17 expectations for NFP data today

- September 2015 US non-farm payrolls 142k vs 203k exp

- US Sept average hourly earnings 0.0% vs +0.2% m/m expected

- US dollar hammered: Four terrible signs in the US jobs report

- Video: What's next after nonfarm payrolls

- Market pulls the rug out from the Oct FOMC trade

- Kocherlakota: Fed should not have financial stability as mandate

- Ex-Fed Fisher says Yellen has backed herself into a corner

- September 2015 ISM New York business conditions 44.5 vs 51.1 prior

- Here's five trades following Non-farm payrolls

- US August factory orders -1.7% vs -1.2% expected

- ECB's Benoit Coeure pumps ECB independence

- Markets stunned. What next? Don't look for the Fed to help.

- Fed's Mester: Fed should be more transparent about financial policies

- No NFP blues for European stocks

- S&P lifts Spain's sovereign rating to BBB+ from BBB

- FX clawing back the moves as it brushes NFP under the carpet

- Bully Bullard: Fed goals are nearly met

- My favorite quote from a central banker this week

- Baker Hughes US oil rig count 614 vs 640

- Fed's Fischer: Does not currently see financial stability risks

- CFTC Commitment of Traders report: Net shorts in the EUR increase a touch

- US stocks end the day up after down and up day

- The Forex Week Ahead for the week starting October 5 to October 10

US employment statistics for the month of September were released today and they disappointed. Non Farm Payroll showed an increase of 142K jobs vs. expectations of 200K. Thank goodness for 24K increase in state government employees or the number would have been worse. The prior months were revised down a combined -59K. Yuck. The Unemployment rates stayed steady at 5.1% thanks to a decline in the participation rate to 62.4% from 62.6%. The hourly wages came in at 0.0% and 2.2% YoY. They were expecting +0.2% and 2.4%. Not good. The average workweek fell to 34.5 hours from 34.6 hours. Surely, the dollar got hammered? Well a little but not a lot.

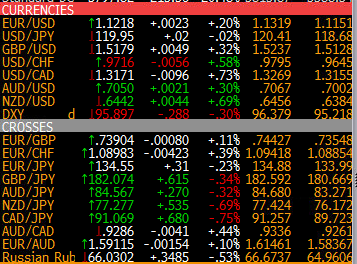

The EURUSD spiked up to resistance at the 1.1319-31 area (high reached 1.1317) and preceded to give back more than 1/2 of that gain - closing up about 23 pips.at 1.1218.

The USDJPY tumbled from 120.39 to 118.68. In the process, the price moved outside a lower triangle trend line at 119.38. Surely the USDJPY was breaking out. NOPE. The price rebounded back higher, moving back into the meat of the triangle and closing nearly unchanged. at 119.95.

GBPUSD rallied to 1.52.26, closed at 1.5179 area. Traders need to see the price move back above - and stay above 1.5200 to get buyers involved going forward.

The AUD, NZD and CAD all rallied against the greenback as there was a flight into the risk as stocks rallied, bond yields declined.

Speaking of the stock market, the S&P was as low as 1893.70, but closed at the tipity top at 1951.36 up 1.43%. Is it up because the US economy slowed and Fed will now not tighten? Did it rally because the US economy is slowing on top of the Chinese economy? It did help send the money flowing into risk.

We will see whether we can make another break next week.

Have a great weekend.