Forex news for US trading on July 1, 2015:

- ADP June US employment 237K vs 218K expected

- Tsipras: If there is a positive offer from Eurogroup, we will respond immediately

- EU's Dijsselbloem thinks there's fat chance of progress after Tsipras speech

- June 2015 US ISM manufacturing PMI 53.5 vs 53.1 exp

- May 2015 US construction spending 0.8% vs 0.5% exp m/m

- Atlanta Fed GDPNow model sees 2.2% growth in Q2 vs 2.1% prior

- US June total vehicle sales 17.11M vs 17.20M expected

- Wikileaks to drop a bomb on France, Greece and Germany tonight

- New Zealand Fonterra dairy prices -5.9%

- US EIA crude oil inventories +2386K vs -2000K expected

- Help Wanted OnLine survey shows lower demand

- Brokers tighten up ahead of another risk weekend

- Gold down $4 to $1168

- WTI crude down $2.65 to $56.82

- S&P 500 up 14 points to 2077

- USD leads, CHF lags

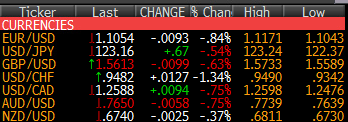

The US dollar was on the march today as a new quarter got underway. The dollar was strong before US traders arrived but the ADP numbers gave it another lift and then ISM sent it to fresh highs. But moments after the manufacturing data, the trend hit a hiccup and the US dollar pared its gains. In that time, the euro rebounded to 1.1110 from 1.1060. But those gains didn't last and as risk trades held strong, the dollar reasserted itself and EUR/USD finished at 1.1052, just above the 100-dma.

USD/JPY didn't make fresh highs in the US afternoon so the post-ISM high of 123.22 remains the first line of resistance. Still, the dip down to 122.90 was picked up nicely and the pair climbed to 123.16 at the close.

Cable a dog throughout the session as the June gains continue to fade away in the third day of declines. From 1.5650 at the start of US trading, it was a steady grind down to 1.5587 where it finally found some legs and bounced to 1.5614.

The commodity block was in trouble, in particular CAD. The US dollar rose to the highest against the loonie since April in a 100 pip rally to 1.2588. It was a Canadian holiday but the corresponding 4% drop in oil prices suggests the move wasn't about a lack of liquidity.

AUD/USD was similarly weak as it slide down to 0.7640. The kiwi fell 30 pips on the milk auction but quickly bounced back before a long fade down to 0.6735.

One of the mysteries in the day was the jump in EUR/CHF to 1.0492 from 1.0440 in a quick move. Lots of eyes were cast toward the SNB after they intervened earlier this week.

Don't forget to sign up for the Independence Day non-farm payrolls special. Win and we'll mail you a great book.