Forex news for US trading on October 20, 2015:

- September 2015 US housing starts 1.206m vs 1.150m exp

- New Zealand Fonterra global dairy prices fall 3.1%

- Fed's Powell says market turmoil affects investor confidence

- US Treasury's Weiss says congress must avoid gambling over the debt ceiling

- Canadian wholesale trade sales -0.1% vs 0.2% exp m/m

- Philip Lane named as new Irish central bank governor

- BOE's McCafferty: Zero inflation doesn't influence his vote

- Philly Fed non-manufacturing bucks the manufacturing trend in October

- Atlanta Fed Q3 GDP forecast at 0.9%

- PBOC to name Chen Yulu as deputy governor

- Zambian President calls for divine intervention to save currency

- Gold up $6 to $1177

- S&P 500 down 3 points to 2031

- US 10-year yields up 4.6 bps to 2.07%

- WTI crude oil down 34-cents to $45.55

- CAD leads, NZD lags

One event that grabbed the market's attention was a rise in one-month T-bill yields to 0.10% from right around zero near the end of last week. They hit the highest since April yesterday and today and the fear has begun to percolate.

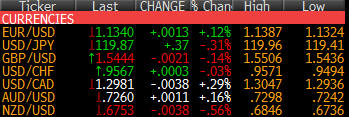

EUR/USD peaked at 1.1387 in early US trading and was in a steady slide afterwards. The low of 1.1331 was about 10 pips above the Asian low and it bounced back to 1.1358 afterwards.

It was part of a broader theme of US dollar strength. USD/JPY was in a steady track up to 119.96 from 119.50. It got a bit of a lift from the housing data, which helped the US dollar broadly.

Cable was under pressure as it failed at the 100-day moving average once again. BOE comments weren't a big factor, rather it was general USD selling in the slide down to 1.5435 from 1.5480.

USD/CAD fell on signs of stability in Canadian politics with a Liberal majority. There was a bit of an unwind of the fear trade before. Early on, a climb in crude prices hurt USD/CAD and it hit a session low at 1.2940. As crude prices came off, the pair rebounded to 1.2980.

Kiwi took a hard hit on the milk auction numbers. The market was looking for a flat reading but prices fell and so did the New Zealand dollar as it dropped to 0.6736 from 0.6820 in several waves of selling.

AUD/USD finishes the day up 11 pips. The RBA Minutes gave it a lift and that continued in Asia and early Europe but it couldn't break 0.7300 and skidded to 0.7250 with the US dollar broadly higher.