Forex trading news for April 24, 2015, US edition:

- March US durable goods orders non-defense ex-air -0.5% vs +0.3% expected

- Prior capital goods orders non-defense ex-air reading -1.1% (revised to -2.2%)

- Headline durable goods orders +4.0% vs +0.6% expected

- US growth forecasts slashed

- Belgian business confidence -6.2 vs -5.7 exp

- Poloz: Very optimistic about the US economy

- HSBC sizes up the UK exit door on increased taxes and regulation

- ECB to discus raising Greek collateral haircut 6th May

- Varoufakis says agreement with lenders will be difficult

- Varoufakis says the cost of not finding a solution would be huge for Greece and the Eurozone

- Federal reserve flouts Congressional request for the names of leakers

- ECB's Constancio: European recovery is broadening

- ECB's Constancio: Confident deal to be reached on Greece

- Baker Hughes rig count 932 vs 954 prior

- S&P 500 up 5 points to 2118

- Gold down $15 to $1179

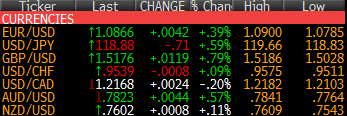

- GBP leads, CAD lags

The durable goods orders report was the highlight of the day and it disappointed in a big way. There was a slight whipsaw on the numbers as the algos and amateurs focused on the headline reading but the core number is what matters and that meant US dollar selling (once again).

Dollar declines were most-focused in USD/JPY. It was at 119.50 before the data and wobbled for a few minutes as traders sorted out the headlines before heading lower to 119.30. From there it was a bit of consolidation and then a steady decline to 118.81 at the lows.

Cable jumped to 1.5170 at first from 1.5125 but then some profit-taking hit in what has been a surprisingly good week for the pound despite election worries. It fell back to 1.5115. From there it found a base and then raced higher to 1.5184.

The euro didn't get quite the lift as the headlines about Greece started to sour a bit. There was a chop in the 1.0805 to 1.0875 range throughout the day but we look to be finishing close to the US highs (and not far from the 1.0900 European high).

The comments from Poloz had no effect on CAD but oil did. It fell back to 1.2103 not long after the durable goods orders report but as oil started to roll over the pair climbed up to 1.2170. It then ranged from 1.2160-80.

AUD/USD took advantage of the dollar weakness and looks to be finishing at a one-month closing high of 0.7821. A rally topped out at 0.7841, just a few pips below last week's high. That's the first hurdle to clear next week.

Have a great weekend!