Forex news for New York trading, April 17, 2015:

- US March CPI ex-food and energy +1.8% vs +1.7% y/y expected

- US March avg weekly earnings 2.2% vs 2.6% prior

- Canada CPI March mm nsa +0.7% vs +0.6% exp

- Canada retail sales rises by 1.7% vs est. 0.5%. Ex auto/revisions also better.

- U Michigan April prelim consumer sentiment 95.9 vs 94.0 expected

- Fed's Mester says March CPI was 'good report'

- Greece counting its final dollars - report

- Baker Hughes rig count April 17, 2015 954 vs 988 prior

- Japan's Aso says G20 didn't criticize weak yen

- CFTC Commitments of Traders: US dollar longs hit four week low

- Gold down $24 to $2081

- WTI crude down 66-cents to $56.05

- Gold up $6 to $1204

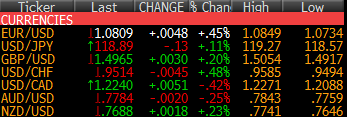

- CHF leads, CAD lags

The Canadian dollar was the star of New York trading. You could argue that's been the case all week as the market was offside on the BOC message and the techs broke down in USD/CAD. It looked like the drop could be coming to an end but great retail sales and high inflation numbers threw gasoline on the red-hot CAD to send the pair to 1.2088, down another cent in a flash.

The story then quickly changed as fast-money shorts rang the register ahead of the weekend and longer-term USD/CAD bulls loaded up. The pair bounced all the way to 1.2271, nearly two cents from the lows. I think CAD buying might continue at the margins because the BOC doesn't sound like it will cut this year and oil has recovered a bit but it will be a slower process from here and we might see 1.24 before 1.20.

At the same time as the Canadian data, US core inflation numbers were a touch better than expected and that was all the beaten-up dollar needed for a relief rally. USD/JPY jumped a half-cent to 119.25 and EUR/USD dropped to 1.0734 -- a session low.

That might have been enough for the week in many weeks but the market is filled with jitters at the moment and from there a steady trickle of dollar selling took over. EUR/USD climbed back above 1.08 and USD/JPY completely erased the declines. An easy culprit to blame would have been stocks but markets everywhere took a pounding today and even risk-sensitive currencies like AUD made headway against the dollar.

Cable grabbed many headlines as it ripped above 1.50 in European trading (see the European wrap) but it was a sag lower from there. The low was 1.4918 in US trading and that perfectly matched the Asian lows and provided the support for a rebound to 1.4975 late. Sometimes it's the simplest technical that work, especially in a market as volatile as this one.

It was a fun week in FX and we sure enjoyed bringing it to you. Have a great weekend and watch out for Chinese stocks at the open on Monday. Margin trading curbs promise to send them for a spill at the open.