Forex news for US trading on October 10, 2015:

- FOMC Minutes: Many Fed officials expected liftoff later this year

- US initial jobless claims 263k vs 274k exp

- BOE's Carney: UK labor market is feeling building wage pressures

- ECB Minutes: See "substantial degree" of stimulus still in the pipeline

- BOJ's Kuroda: No change to view Japan's economy to continue moderate recovery

- September 2015 Canadian housing starts 230.7k vs 200.0k exp

- Canada August new house price index +1.3%

- Bank of England frets about bank commodity exposure

- Bernanke says slow US productivity is a drag on economy

- Weidmann says he wouldn't paint a too gloomy picture of the global outlook

- Fed's Kocherlakota: FOMC should consider negative rates

- OPEC and non-OPEC countries will meet for technical meeting

- US sells 30-year bonds at 2.914% vs 2.920% WI

- Fed's Williams repeats that Fed liftoff warranted later this year

- Bill Gross sues Pimco

- S&P 500 up 17 points to 2013

- Gold down $6 to $1139

- WTI crude up $1.89 to $49.64

- US 10-year yields up 4 bps to 2.93%

- NZD leads, USD lags

What did we really learn from the FOMC Minutes. There was some speculation they would show a razon-thin decision about whether to tighten or not. When they didn't there was some dollar selling but the Minutes are edited and Fed members are still talking about hiking.

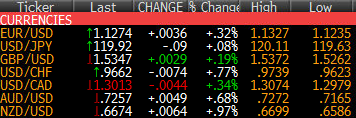

The US dollar hit session lows against the euro and commodity currencies on the headlines but reversed afterwards. EUR/USD rose to 1.1325 in a 30 pip move higher then fell back to 1.1275. Part of the reversal was stocks getting frothy but it was mostly the market unsure of what any of it means.

USD/JPY remains in the tightening range around 1.2000 and it almost finishes the day right at it after trading in a 119.70 to 120.11 range in NY trading. This pair is tightening like a coil and I think the best trade this month will be going with it when it finally breaks.

Then again, it's going to be tough to find a better trade than AUD/USD longs this month. The pair has climbed for seven straight days now as it erased an early decline down to 0.7180 and has climbed to 0.7256 in an impressive, steady round of buying. The Sept high of 0.7280 is nearby.

Cable also put on a solid display. It fell in Europe when the BOE wasn't as hawkish as anticipated. It skidded down to 1.5260 from 1.5372 but has climbed all the way back. The session high is creating a possible mini-double top at the moment and will be closely watched on Friday.

USD/CAD fell on the rally in oil prices. The pair rose to 1.3070 early but was under pressure as oil prices rose above $50 for the first time since July. Last at 1.3012 with eyes on yesterday's low of 1.2970.