CSFB buys at 0.7220

Adam posted earlier about a trade proposed by CSFB (see post here). They like being long the carry trade at 0.7220 with a target at 0.7390.

The price is currently at 0.7255. So it is off to a good start.

They don't define a risk level (or one I can see). HMMMM.

I will let that slide and take a look at the trade technically.

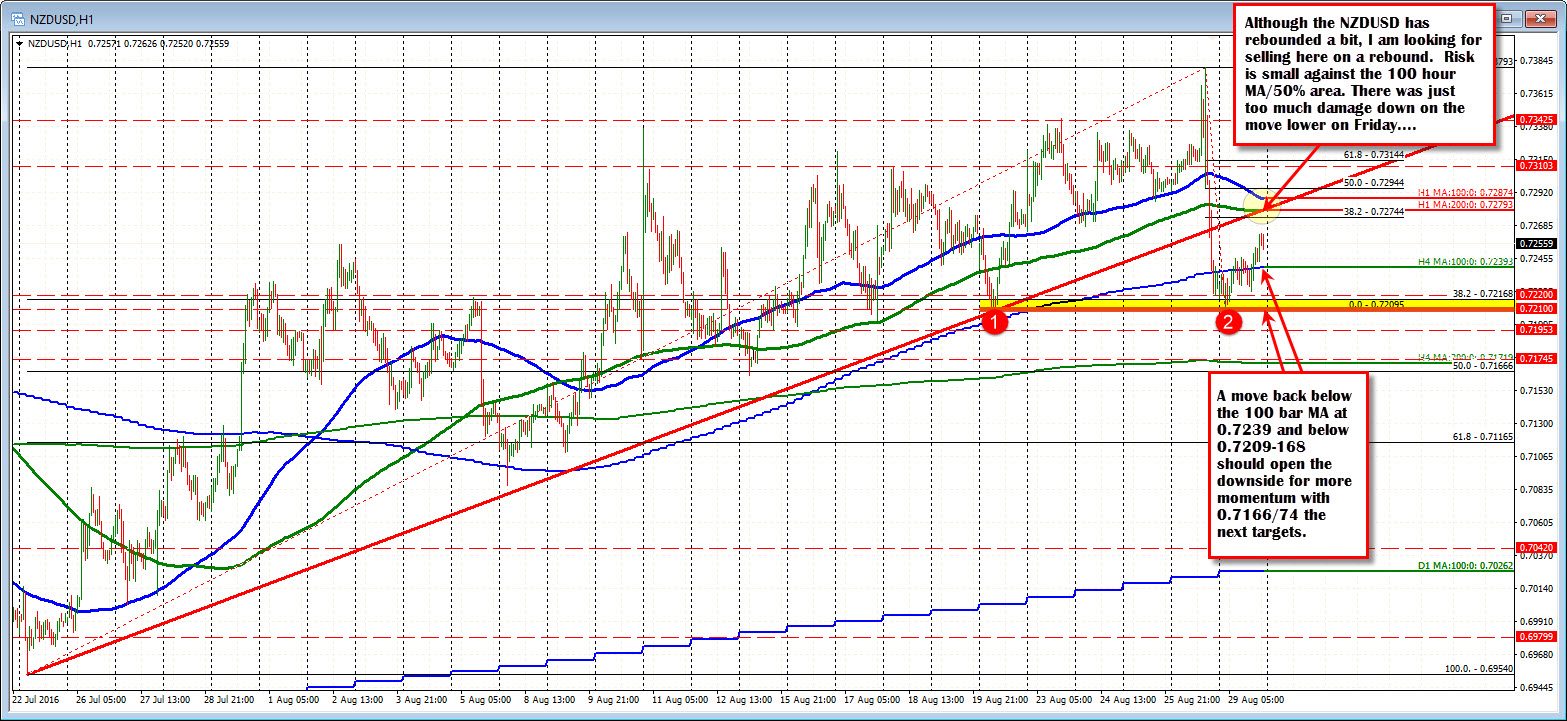

Looking at the hourly chart, the price bottomed on MOnday August 22 at the 0.7209 and rallied to a high of 0.7379 as Yellen's comments caused up and down volatility. When the market turned bullish the dollar, the pair was hit hard. Why? If the US Fed does raise rates, the carrry trade starts to lose part of it's attractiveness. Since the NZDUSD failed at making new highs that is a risky bet.

The pair closed Friday sharply lower at 0.7227 after reaching a low of 0.7220. The low was just above the 38.2% of the move up from the July 21 low. That level comes in at 0.72168. The price did settle below the 100 bar MA on the 4-hour chart (blue line currently at 0.7239). That was more bearish.

On the move lower, the price tumbled below the 100 and 200 hour MA and trend line support (bearish).

For me there was little reason to buy at 0.7220. One can argue that buying against the AUgust 22 low and 38.2% of the move up from the July 22 low was risk defining, but the bearishness from the price action on Friday keeps me more cautious.

Anyway, today the price first moved lower (to a low of 0.7209 equaling the low from August 22), but has rallied higher and trades at the session highs currently. That rally has taken some of the sting out of the sell off (i.e. the low today held last weeks lows, the price is above the 100 bar MA, the price found support near the 38.2% retracement at 0.72168).

However, I am more inclined to think that the overhead resistance against the underside of the trend line and the 200 hour MA (at 0.7279) will stall the rally with risk on a move above the 100 hour MA (blue line at 0.7288 currently)/50% retracement at 0.72944. That would be my preferred trade from a technical perspective.

Summary: Although the buying at tie 0.7220 level has some merit, and the price has moved higher, I think the damage technically from Friday should keep a lid on the pair on rallies. I don't see a move to the target at 0.7390 but instead sellers against the 0.7279 level with close risk to around 0.7295. A move back below the 100 bar MA on the 4-hour chart at the 0.7239 and the lows at 0.7209 should open up a move to 0.7166-74. Moving below that level leads to further downside potential.