Weakness in growth, lower rates and internal conflict driving the USDTRY lower

The Turkish lira has tumble to yet another record low against the USD as expectations for further rate cuts and internal squabbles between government and the central bank officials lead to a selling of the lira. This is despite a pickup in inflation from 7.24% in January to 7.55% February.

The weakness from the political battle stems from a disagreement between President Recep TayyIp Erdogan and the Turkish central bank governor Erdem Basci. Basci cut the benchmark rate to 7.5% from 8.25% last month. However, that cut was criticized by Erdogan as not being sufficient to spur on increased economic growth. The criticism has increased in recent days and the markets are getting fearful that Basci may be replaced or resign before the end of his term - opening the door for a more dovish central bank head. This in turn has also contributed to the weakening of the currency as investors flee from the uncertainty. Needless, to say there is turmoil and that is never good for a periphery currency.

The central bank next meets on March 17. Expectations are for a further cut despite the higher inflation and sharply lower lira.

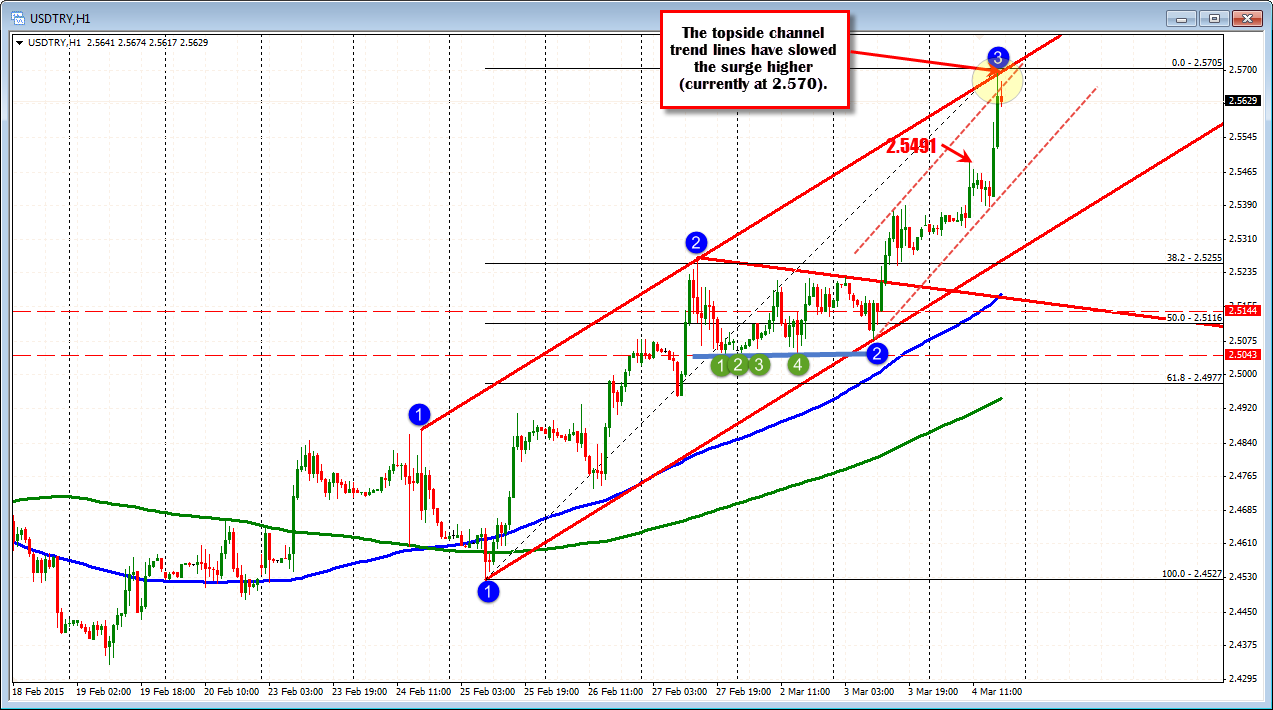

Technically, although the USDTRY pair has surged higher in trading today, it has stalled against perhaps the only resistance you can find on a chart (remember it is trading at all time highs). This resistance comes against a topside channel trend line on the hourly chart. It never ceases to amaze me that if there is a level that traders can define and limit risk, it can stop even the strongest of trends.

The pair is consolidating against the level as trader take a breather from the surge.

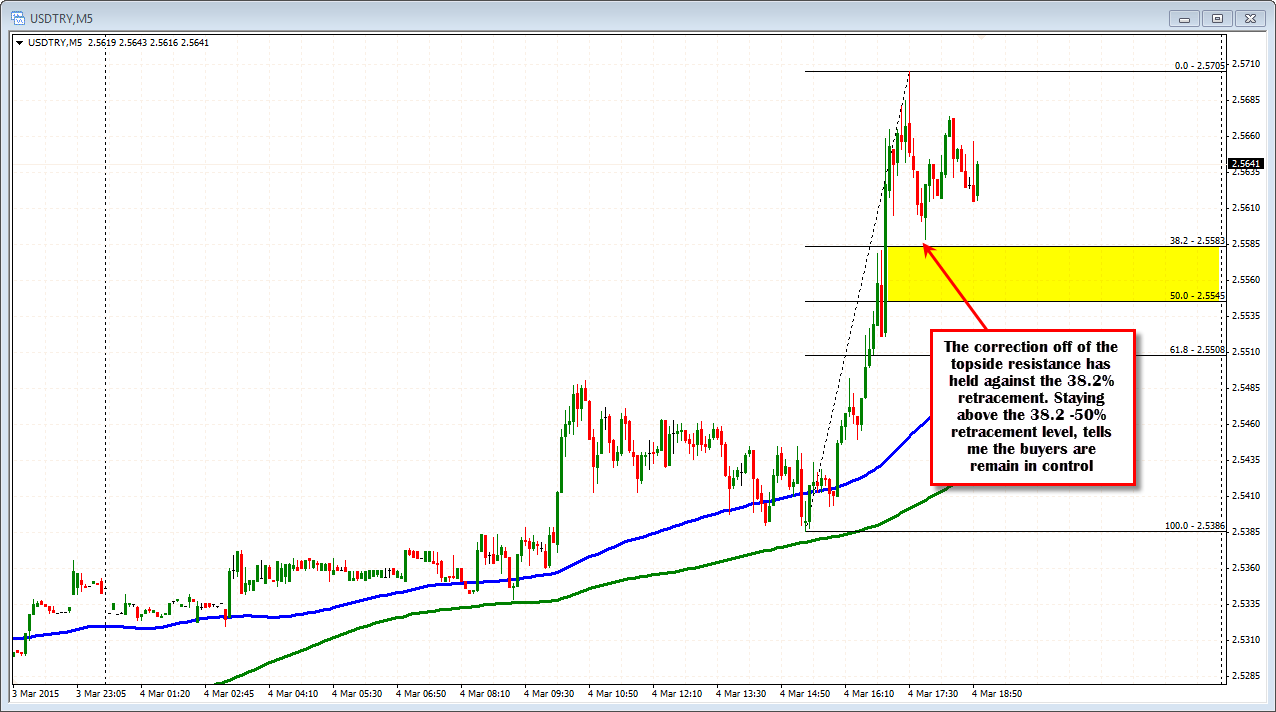

Looking at the 5 minute chart below, the correction off the high has found support against the 38.2% retracement of the last leg of the trend move higher in trading today (see chart below). In a trend move, I look for the 38.2 to 50% retracement to hold support. if It holds, it tells me that buyers are anxious to remain in control. Look for support buyers against the 2.2554 to 2.2558 level now. On a break lower, there could be some further liquidation. However, the dips are likely to continue to find support buying - at least for the time being. It would take a move below the 2.5491 (earlier swing high) to solcit more downside concern. Even then, there are the lower trend lines to contend with on corrective moves lower.