Sharp fall after data today

The GBPUSD fell sharply today after PMI service data came in weaker than expected.

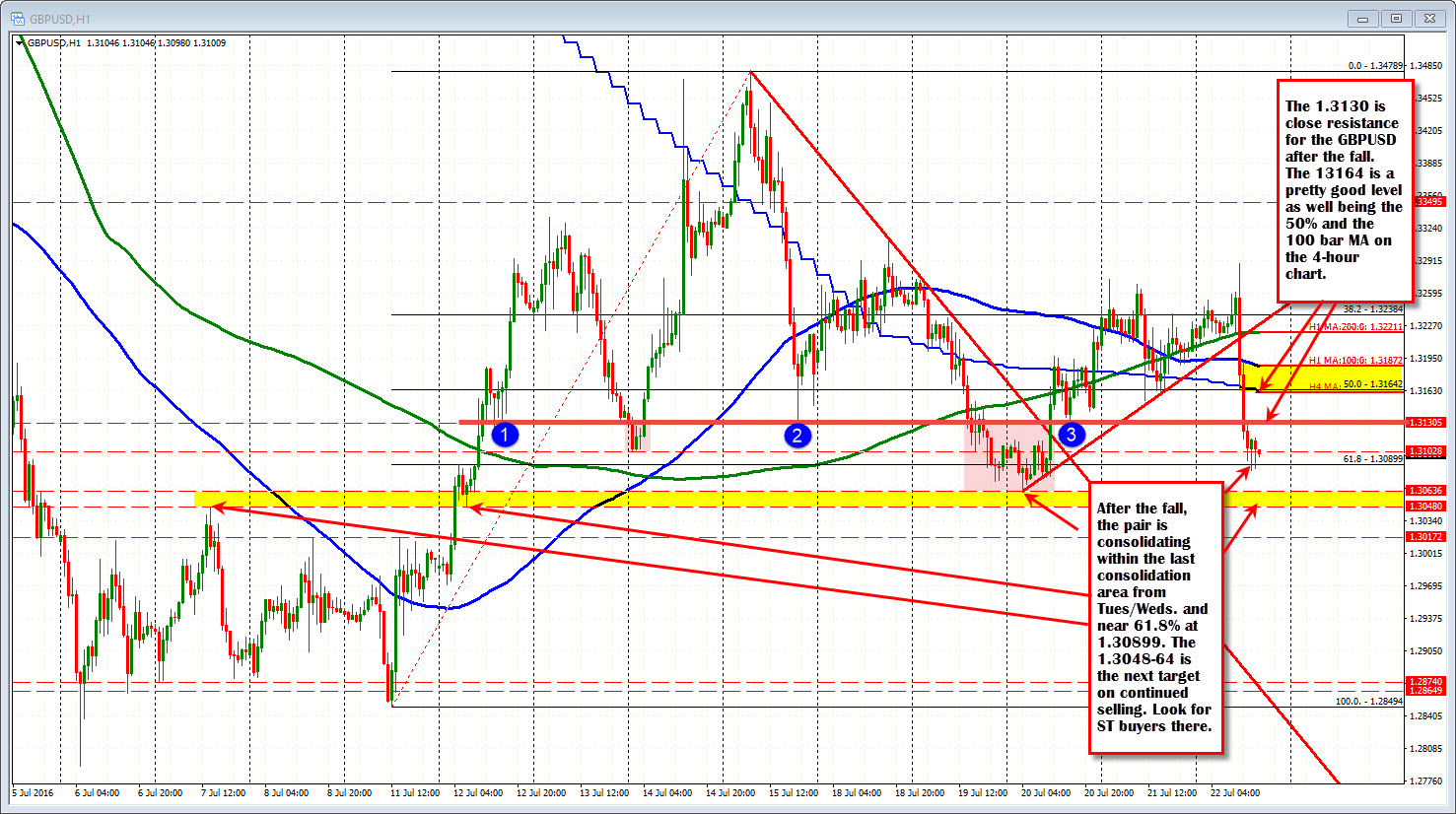

In the process, the pair fell below the 200 hour MA (green line currently at 1.3221) , the 100 hour MA (100 hour MA), the 100 bar MA on the 4-hour chart (at 1.3164) and the 50% of the move up from the July 11th low (also at 1.3164).

Those last two levels came in at the same level at the 1.3164 level. That level was also near the lows from yesterday. If you want to put a "line in the sand" going forward, that is a level to lean against should there be a correction toward. File it a way.

There is a closer resistance/risk level for shorts on the fall back lower today. That level comes in at the 1.3130 area. The low on July 15 and a corrective low on July 20th bottomed there. The 38.2% to 50% of the last trend lower in the pair (see yellow area in the 5-minute chart below) comes in at 1.31259-1.31385. Stay below on a correction off the stalled bottom and the sellers are remaining in control.

A move below the floor today will have traders looking toward the 1.3048-63. The highs from July 7 cam in at 1.3048. A low correction on July 12, held that level. This week, the low stalled above that line at the 1.3063 level. A move below that area will have the 1.3017 level (highs from July 8/11) as the next target.

The pair tried to inch higher over the last few trading days, but it was a struggle. The fall back below levels cited above took the wind out of any bullish idea.