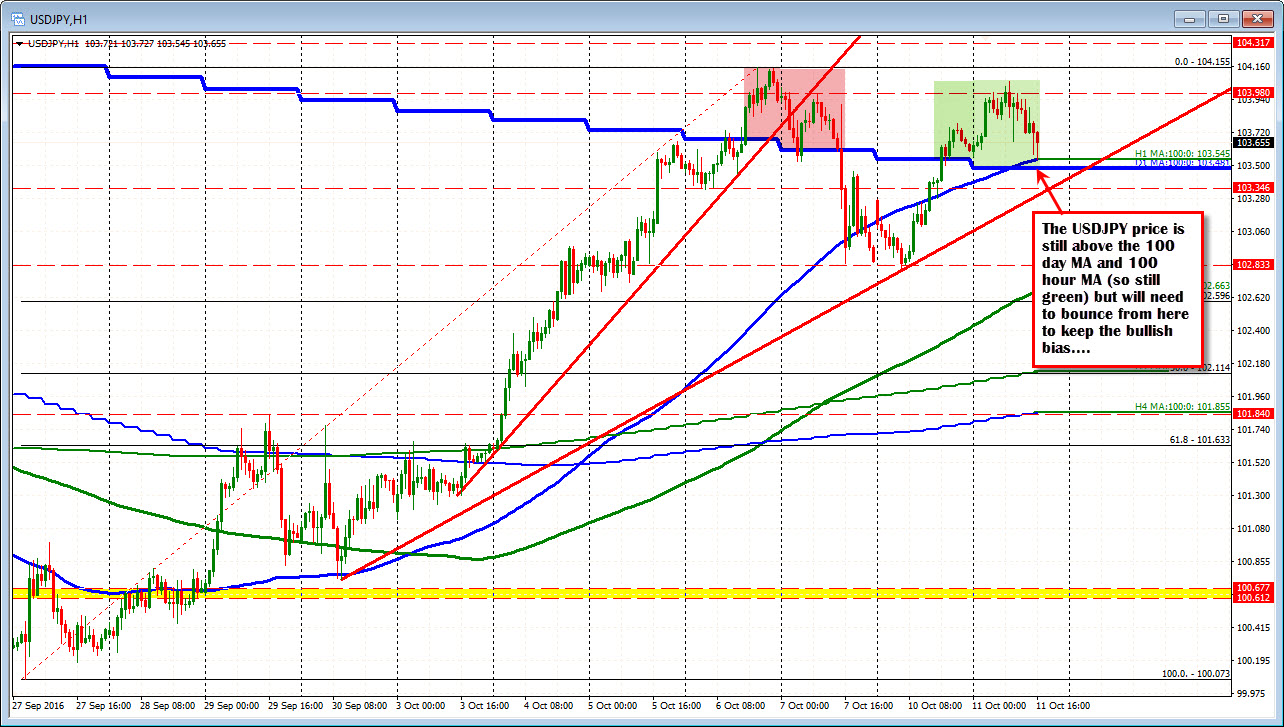

Can it keep the bullish bias...

The USDJPY moved above the 100 day moving average in trading yesterday. This is the second look above the key moving average since early February 2016. Last week there was a break that failed.

A break should solicit more buying and there has been a move higher in trading today. However, the peak stalled ahead of the next target - against the high from last week at 104.15. The high today could only reach 104.06.

As a result, we are seeing a back fill of the move higher and the 100 day MA and the 100 hour MA were both tested at the 103.48-54 area. Support held on the first look and we currently trade at 103.65 area. So the bulls hold onto control on the successful test - but just barely.

What we really have is a market that is trying to advance but needs to do more. More specifically, it needs to get and stay above the 104.00-15 area and probe higher. The line in the sand is the the 100 hour MA/100 day MAs below. Stay above, and the hope for higher levels remains alive, but understand, with the inability to get above the highs earlier today, there may also be sellers against the peaks too. The battle is on.

Are there any clues from the 5-minute chart.

The price action today has seen a move higher, followed by choppy action and a move back lower. The 100 and 200 bars on the 5-minute chart come in at 103.83 area. The 50% of the range comes in at 103.805. The chart shows the bounce off the 100 hour MA. However, if we are to go higher, a move back above the 50% of the range today (at 103.805) AND above the 100 and 200 bar MAs would be the next steps. If the sellers are take more control, that area will be a ceiling. Watch that area today for clues. In an up and down market - when the market is in a battle - the levels between the extremes can tilt the momentum one way or the other. The 103.80-83 is shaping up as one of those bullish above/bearish below intraday levels to eye.