The 50% finds buyers

The USDJPY has been trading lower today - with the general direction of the dollar. BOJ kept policy unchanged as expected. US numbers were ok and don't hurt a tightening idea in December.

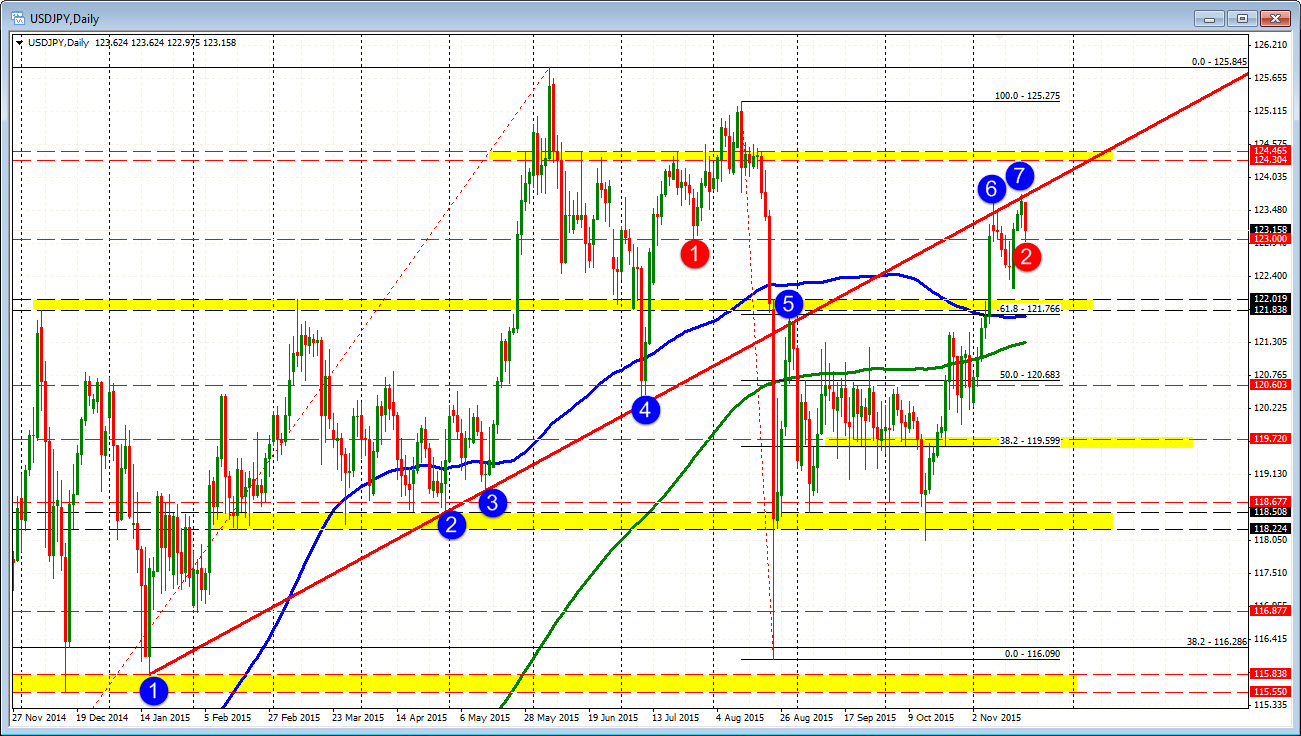

Technically, the pair traded at the highest level since August 20 after the FOMC minutes yesterday, but ran into the underside of a broken trend line on the daily chart near that peak (see blue circle 7 in daily chart above) The fall lower, came down to a low of 122.98. The swing low from July 27 came in at 123.00, and whenever, there is support at a nice round number like 123.00, there is the option wild card that may be providing support. Price decline stalls.

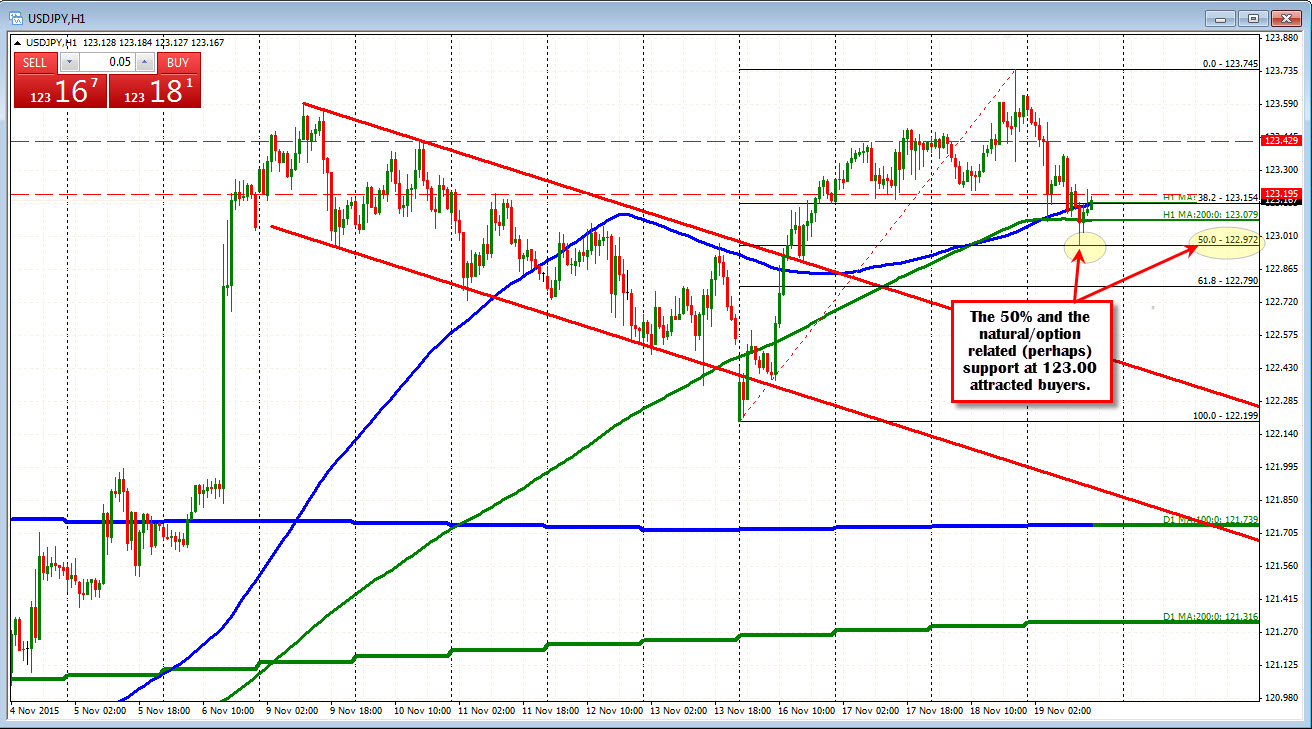

Looking at the hourly chart, the fall from the high fell below both the 100 and 200 hour moving averages. They come in today at the 123.154 and 123.08 levels respectively. That should have been more bearish but the 50% of the move up from the weeks low came in at 122.972. That and the 123.00 natural level helped contribute to support buying.

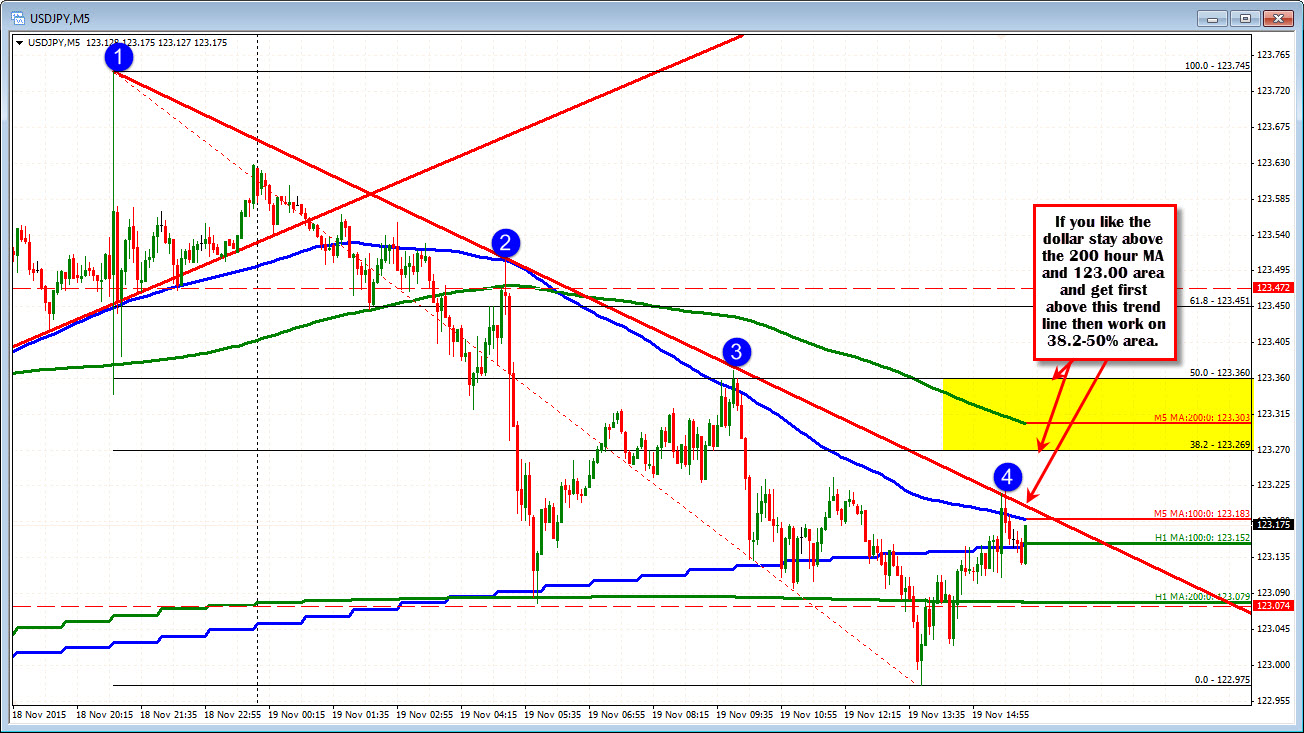

Drilling down further, anything from the 5-minute chart?

Well the high corrective price stalled at a trend line....

I guess the question for traders? Do you like the dollar or do you not like the dollar? If you like it, get above the trend line and then the 38.2-50%. If you don't love it, move back below the 200 hour MA and the 123.00 level and stay below.

Initial claims were as expected. Philly Fed index made it's way back above the 0.0 level at 1.9%. Positive...yes. but the high for the year in June was 15.2. In November of 2014 it had a 20 year high at 40.2 (really...wow. Was more of an aberration, but it is, what it was....)