Activity remains confined

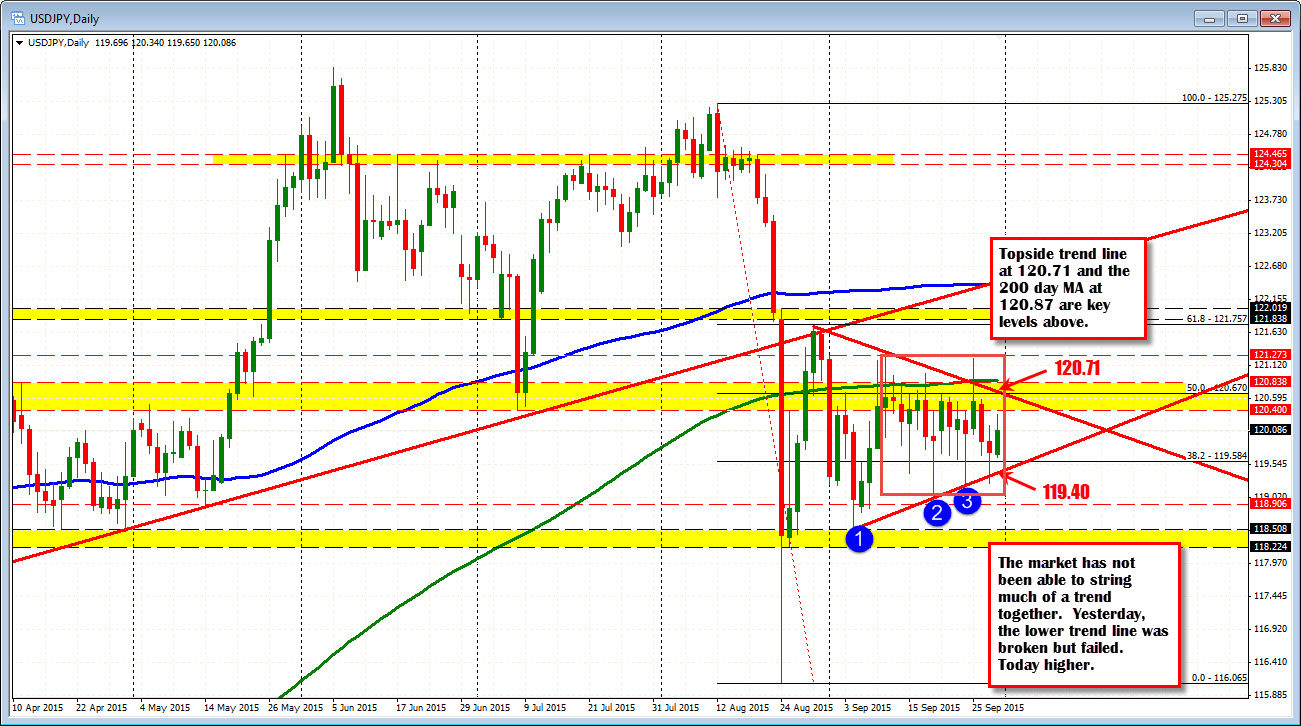

The USDJPY continues the up and down choppy trading conditions. The pair has had a tough time stringing together any upward or downward moves. A two day directional move is the best the pair can do since September 10.

On Monday and Tuesday the pair moved lower but the fall yesterday failed on a break of the lower trend line and today we are seeing more upside (with higher stocks?). The pair closed at 119.72 yesterday.

Looking at the daily chart, the action for the month is quite pathetic. The upper trend line was busted last Friday but failed. As mentioned, the lower trend line break yesterday was a dud. The 200 day MA (green line in the chart above) saw the price move above it on 5 separate occasions during the month and each failed to have a close above. It currently comes in at 120.87. The 50% of the move down from the August high comes in at 120.67.

Until there is a break, traders will be cautious and distrusting of the moves. However with September soon out of the way today, perhaps traders wake up and force the break and run. Be on the lookout.