Can go either way.

The USDJPY has rotated back lower in the current hour. The retest of the London high could not get above. The Asian Pacific session high remains the high for the day. There was a lack of momentum to push higher.

So sellers push the price lower.

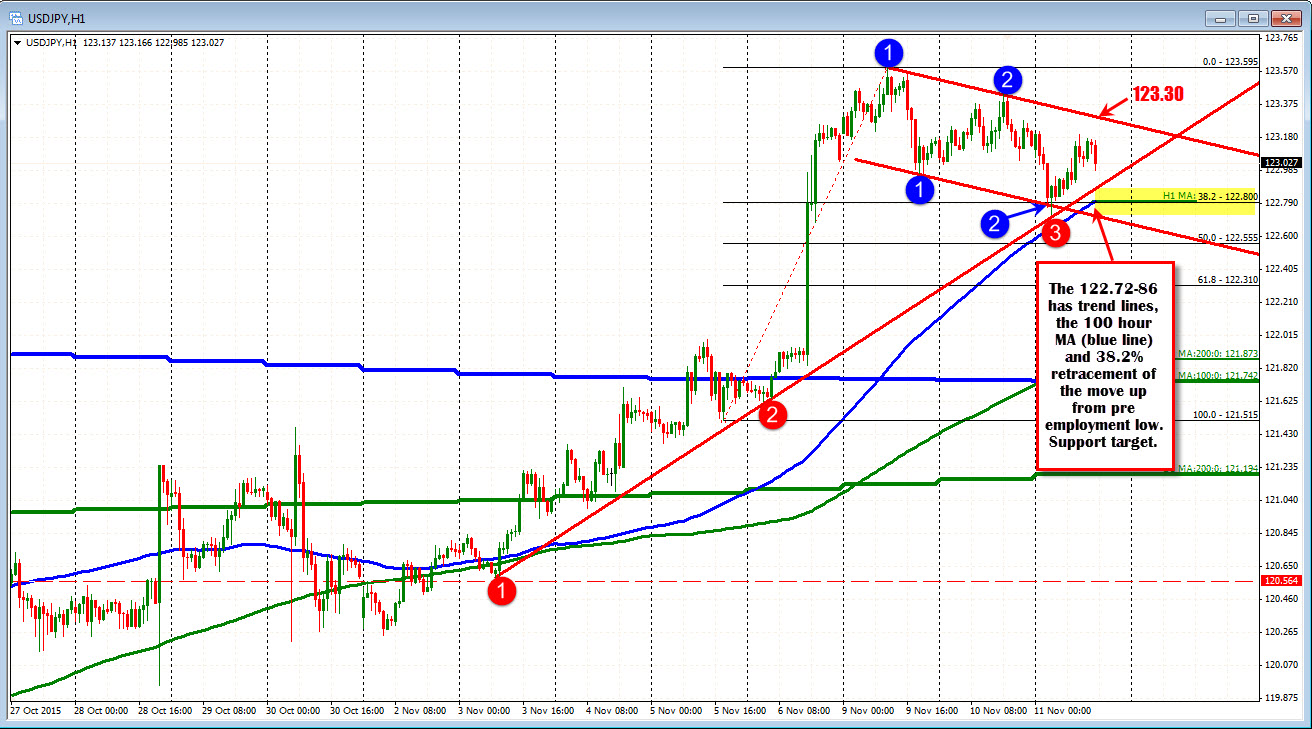

Looking at the hourly chart, the pair has been consolidating/correcting since peaking on Monday. The price remains near the higher extreme from the post US employment surge on Friday but the action has been balanced between buyers and sellers.

There is a cluster of support between 122.72-86 which the market may be eyeing to test the buyers resolve. The 100 hour MA, 38.2% retracement and a couple trend lines in the area. Earlier today, the trend line was tested and held. Look for patient buyers in the area to lean against the area with stops below.

You can pick a side at this level and make a case for it. Being in the middle of a channel, is a safe place for the pair to sit. That leaves traders asking "what next?" The bias with the Fed getting closer to tightening suggests buying the dip. Having said that if the price does rally (absent a real fundamental catalyst), we could still expect sellers at the topside trend line at 123.30 currently. The word today is patient. Wait for extremes if not in it...