Moves away from 200 day MA (?)

The USDJPY is slowing showing bullish tendencies - although there is a bit of caution in the bullish walk higher.

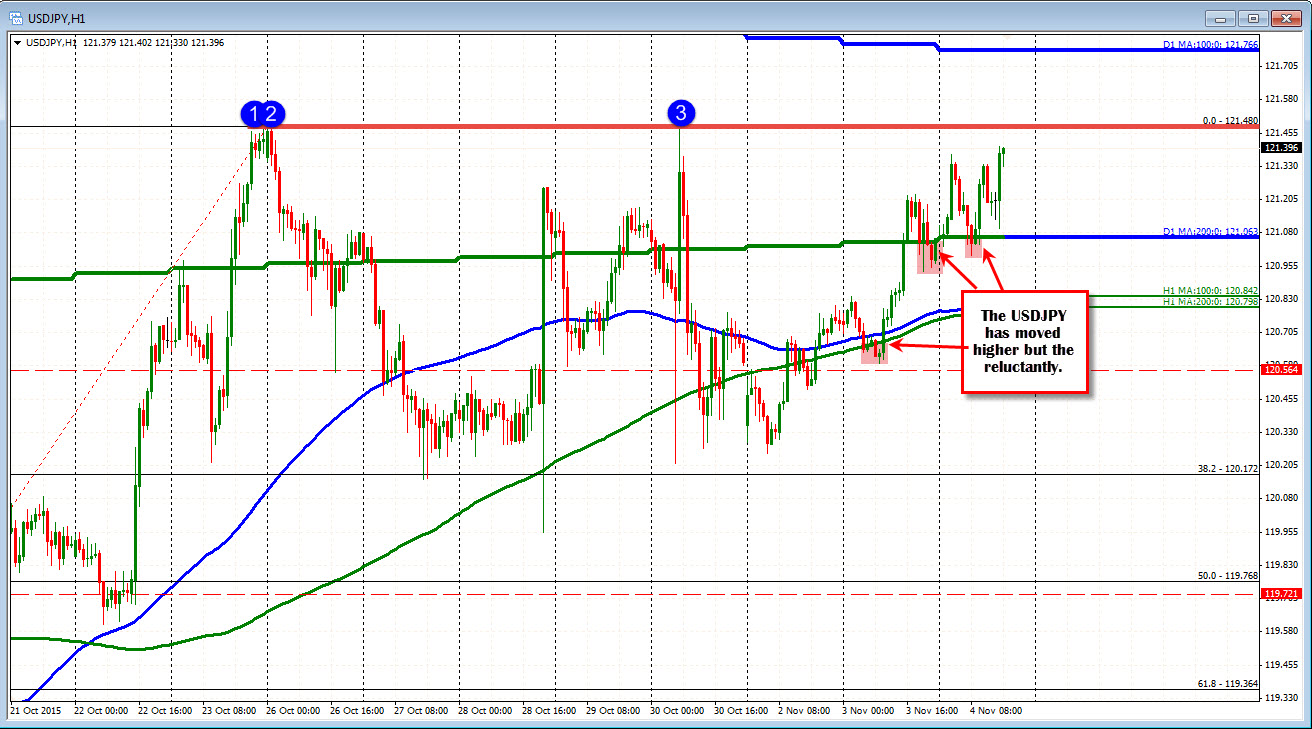

Yesterday, before moving higher, the pair dipped below the 100 and 200 hour MAs. Today the price dipped below the broken 200 day MA before moving higher. Even so, the moves higher today, have not been without corrections lower. Hence the caution in the bullishness.

Nevertheless, the pair is higher. It is trading at the highs for the day and it is getting closer to the double top form Oct 23/26 and October 30 at 121.48. The high today comes in at 121.406.

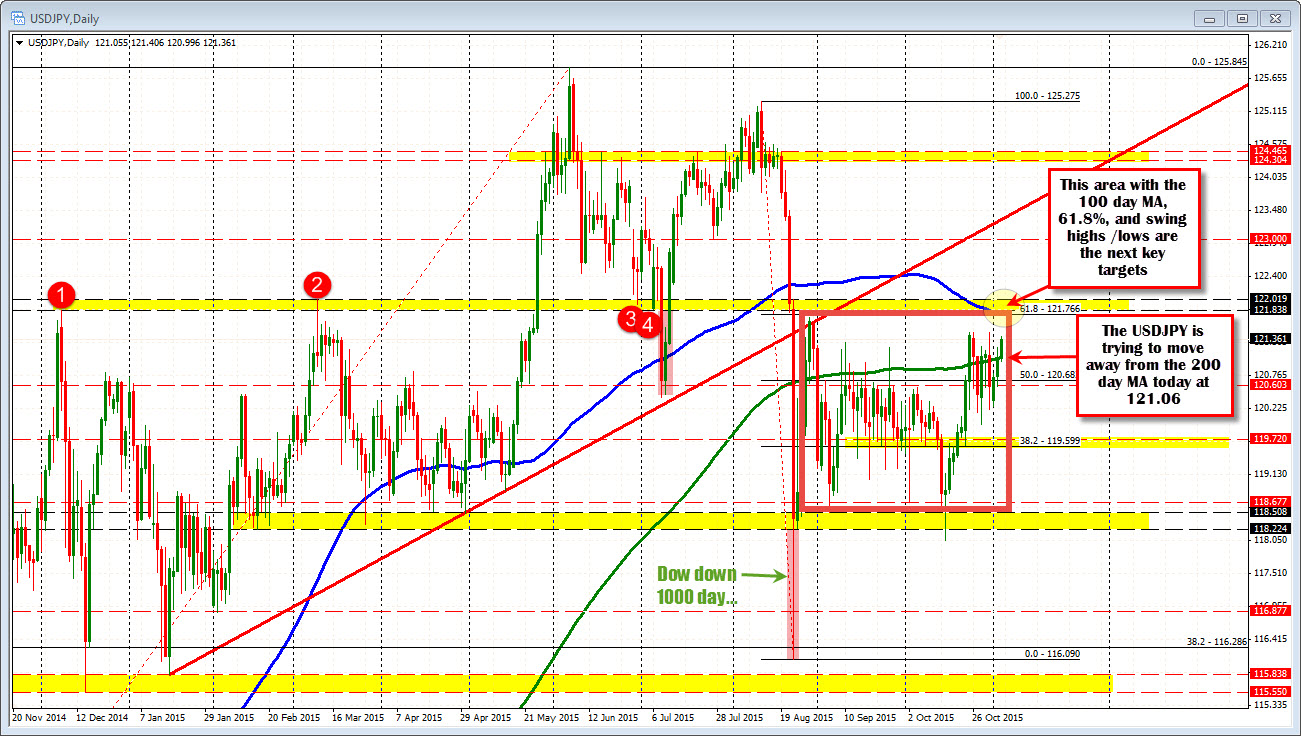

On a break to new highs, the next key target is the 100 day MA at 121.766 (see blue line in the chart below). The 100 day MA is also equal to the 61.8% of the move down form the August high. Swing highs from December 2014 and March 2015 are not far from that at 121.838 and 122.019.

The USDJPY has been in a consolidation range between 118.50 and 121.80 since the plunge from the Dow down 1000 day on August 24. The move away from the 100 and 200 hour MA is bullish encouraging, but we have been down this road before. Nevertheless, the pair will break out at some point and has to start from somewhere. The move away from a consolidation range always has a lot of hurdles. Hence the herky jerky cautious approach. So be on the lookout for the technical clues where support holds, and also pay attention to those targets. Right now, the bulls/buyers remain in control.