ISM falls. Construction spending falls. Market shrugs it off

The US ISM manufacturing index fell to 52.9 from 53.5 last month. This is the lowest level since January 2013. Employment, new orders, production, exports and imports show declines. ISM's Holcombe says that West Coast ports had an impact on exports and imports. Weather may also have had a negative impact on the data.

As for construction spending for January, it fell -1.1% vs. 0.3% estimate. The prior month was revised higher to +0.8 from +0.4%. US stocks are moving higher with the NASDAQ up 33.73 and banging on the 5000 door. This may be a contributor to the JPY pairs today.

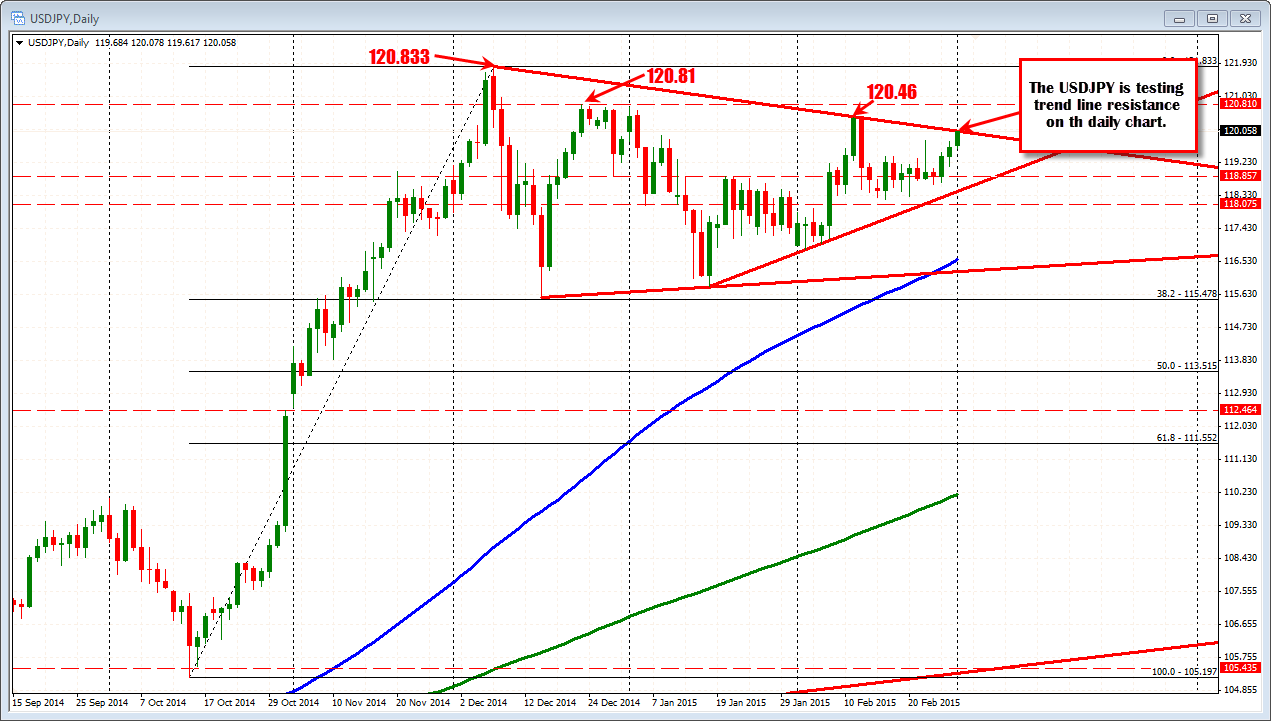

Despite the weaker data, the USDJPY is moving to new highs for the day and new highs going back to February 12. The pair is also breaking above the all-important 120.00 level and is testing trend line resistance on the daily chart at the 120.07 level currently (the high comes in at 120.078). Key test for the buyers. A move above this level will next target the highs for February at 120.46. Above that, are the highs from December at 120.81 and 121.833.

If the buyers are to remain in control today, I would expect that corrections would find support near the 119.93 area with stops below the 119.88 level.