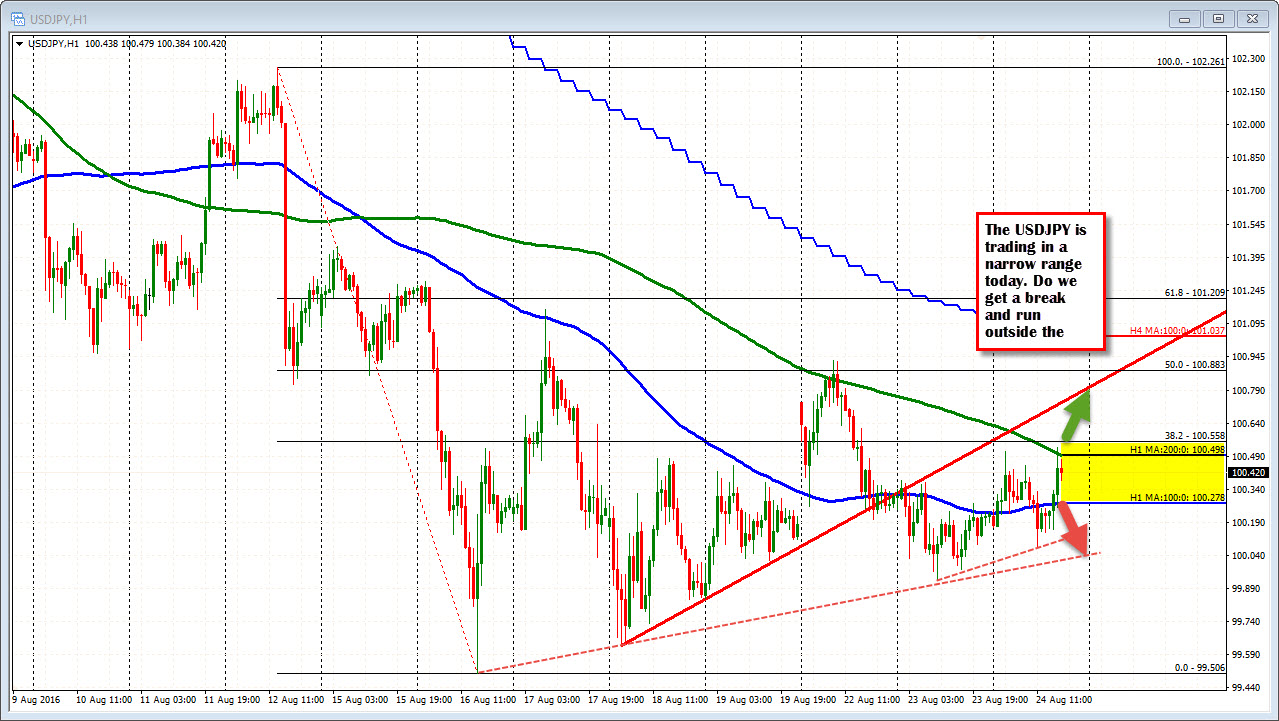

200 hour MA and 38.2% retracement attracting some sellers

The USDJPY is more of a bystander today. The pair is in a narrow 45 pip trading range. The 22 day average (about a month is 118 pips). That could mean there is room to roam so be aware for a break and run.

Looking at the hourly chart, the pair has been capped by the 200 hour MA and the 38.2% of the move down from the August 12 high (weak US retail sales day). Those levels come in at 100.498 and 100.558 respectively. The high today split the difference (more or less) at 100.53. On the downside, keep an eye on the 100 hour MA at the 100.278. The price had a period today where it tried to trade and stay below, but could not keep the pressure on.

IF the range is to be extended. a break above the 100.558 should be the upside trigger. On the down side, getting and staying below the 100.278 should be a catalyst for a retest of the lows (and perhaps a break). In between, traders are fighting it out (may see traders lean against extremes until the break).