Morgan Stanley did say the pair would run out of steam at retracement level

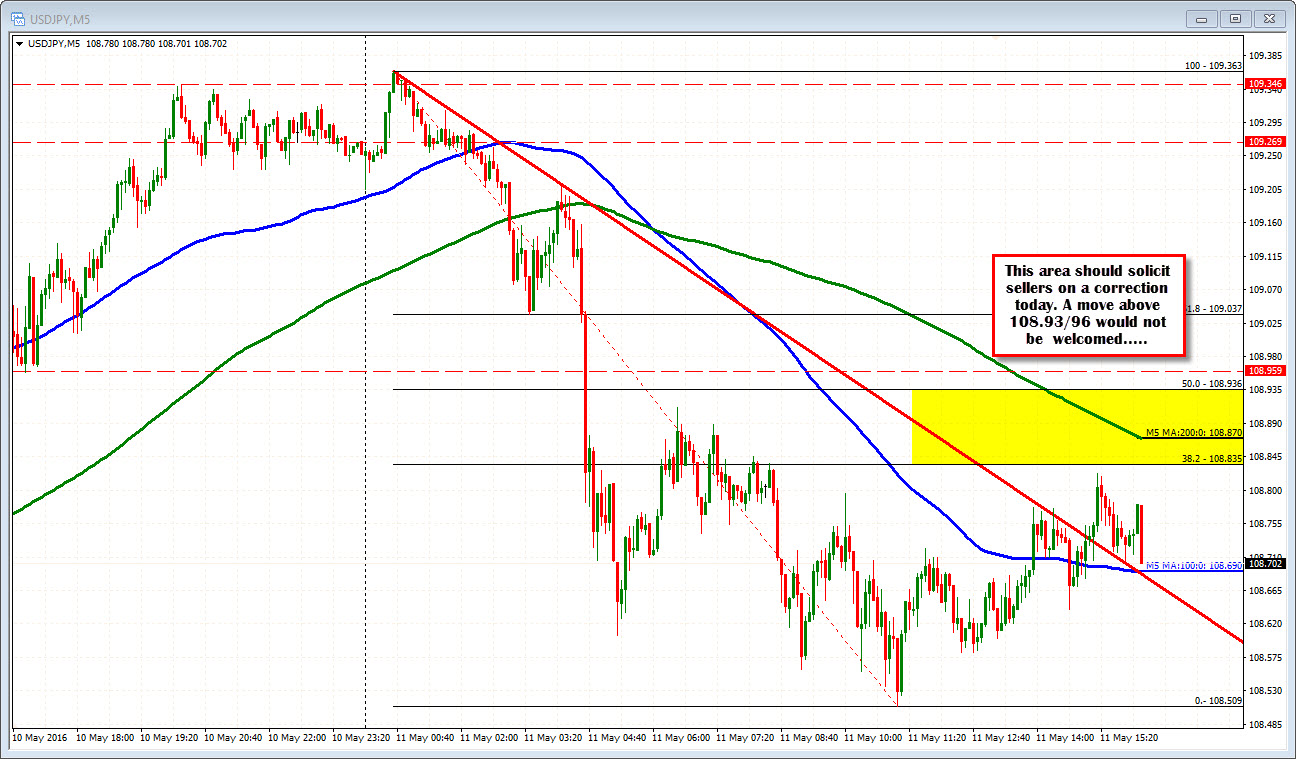

Yesterday, Mike posted a trade recommendation from Morgan Stanley. They said the USDJPY's current rally was running out of steam between the 108.65/109.43 retracement level. The retracement level they speak of is the move down from the pre-BOJ decision from April 28th (see chart below).

I had the 50% to 61.8% retracement at the 108.71/109.46 (they have a different high and low vs my feed) but we are both in the same area. The high price got to 109.363 in the first hour of trading - close to that topside limit - and the price started to tilt lower. As the Tokyo market opened more selling entered and the price has pushed lower. Good call MS. A nice risk defining level to lean against. Perhaps they were one of the big boys who helped the push lower.

The fall has taken the price to - and through - the lower extreme. That is the 50% retracement. But momentum has slowed a the midpoint level and we currently trade above and below the level. In the London morning session the price has traded 109.50-80. The 50% midpoint is 109.71). The 108.59 level was a high from Monday. The 100 bar MA on the 4 hour chart is a pip or so away from the 50% level. So I am not surprised the market has a pause for cause. There is a lot of stuff in that yellow area.

Traders short (and who are looking for more - i.e. not taking profit here) will be looking for that move back below the 108.70 level and then 108.59. A move below that will have traders thinking a date with the rising 100 hour MA (currently at 108.00 - see chart above) will be in the future. THe low from yesterday at 108.26 will be eyed as well.

Corrections higher should find sellers in the 108.83-93 area (see chart below).