CPI sends USDJPY to 99.50 but back above 100.00 on Dudley comments

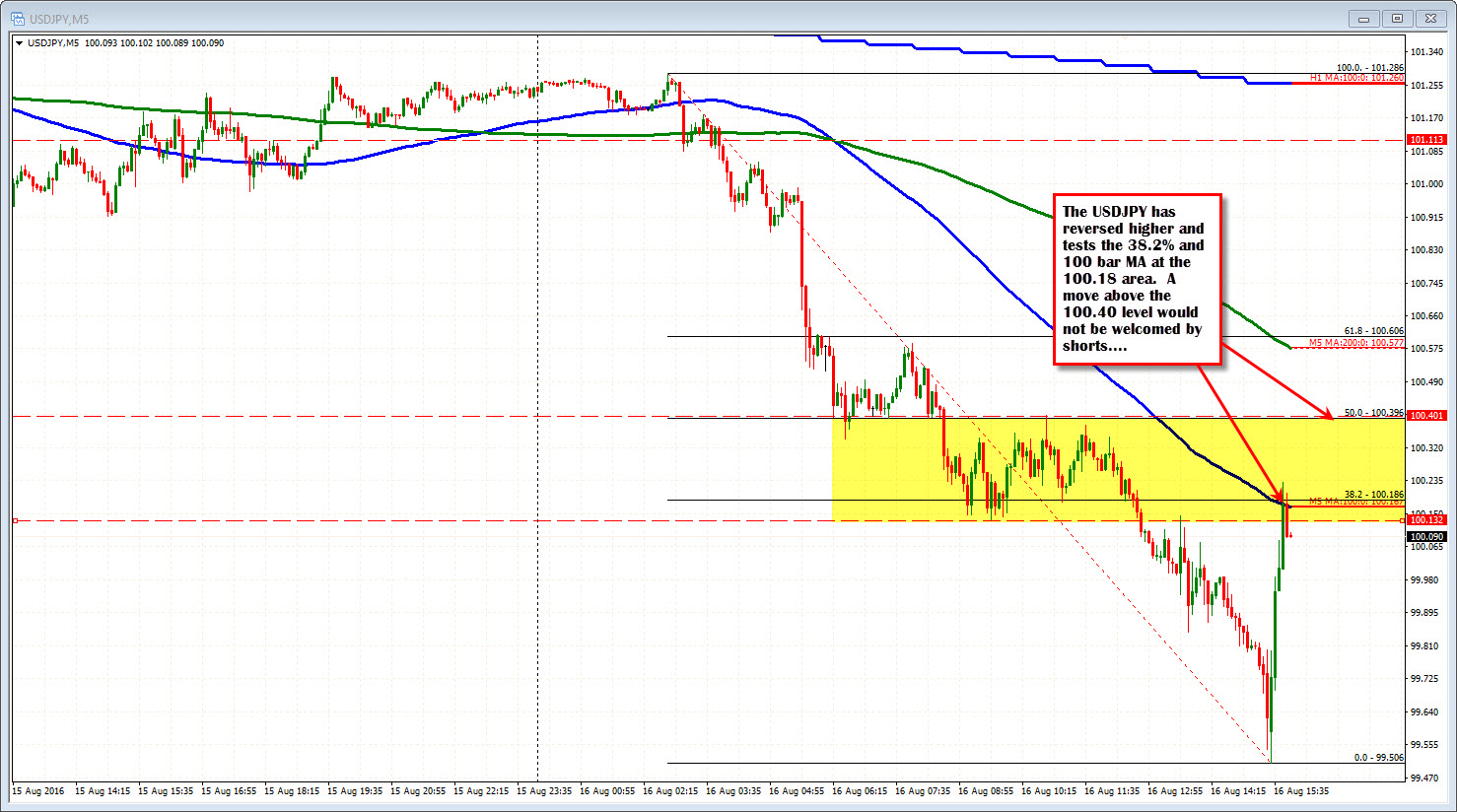

Blame Dudley. Blame summer time markets perhaps, but the trend lower in the USDJPY has snapped back after NY Fed's Dudley warned the market of complacency about rate rises (a reader correctly reminded me that it helped longs. So they can thank Dudley). That has sent the pair back up above the 100.00 level and into the congestion area from the London morning session (between 100.13 and 100.40).

The 38.2% of the move lower comes in at 100.186 and the 100 bar MA on the 5-minute chart is at 100.175. That has stalled the pair a bit. The 50% of the day's range is at 100.396. If the sellers are to keep in control today, that would be a risk defining level to stay below.

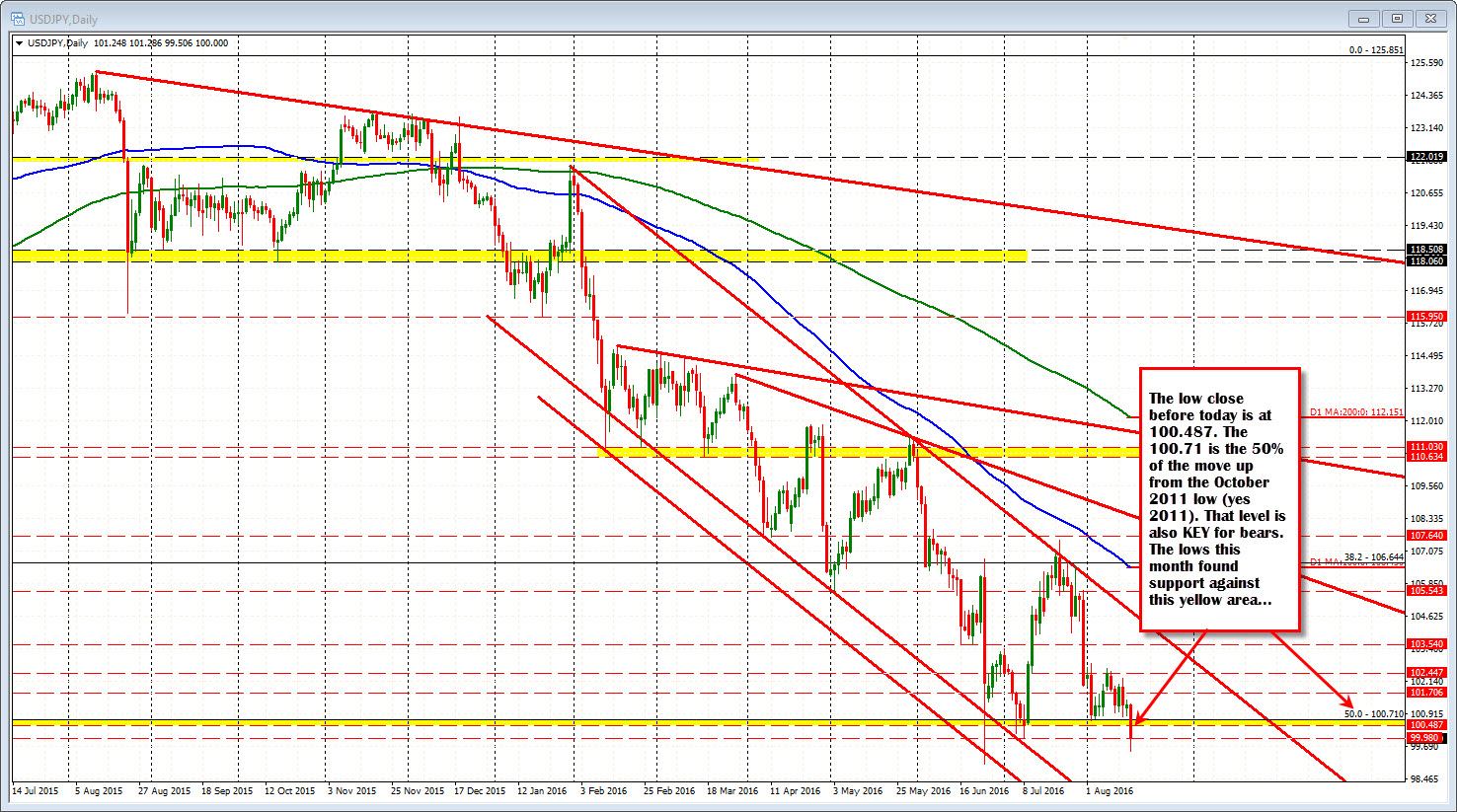

Looking at the daily chart, the 100.487 level has been the low close for the year before today. That too might give traders a reason to lean against a level like the 100.40. Finally, the 100.71 is the 50% of the move up from the October 2011 low (yes 2011). Putting it this way, buyers need to see the price move and stay above this level if today's extreme low at 99.50 is it. Before today, traders leaned against that 100.71 level this month as support. What was support becomes resistance. That makes that level KEY.