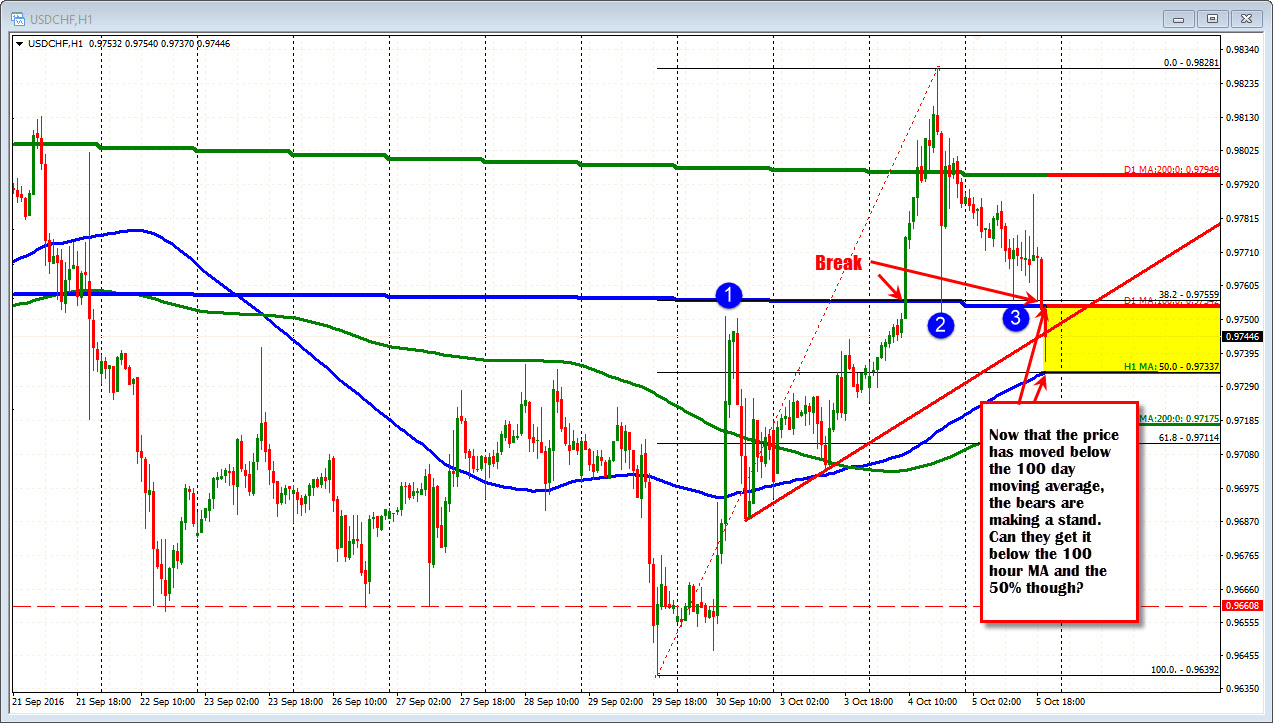

Below 100 day MA. Above 50% and 100 hour MA

The USDCHF has been more down, than up today and in the last few minutes we have seens a break and run below the 100 day MA (and 38.2% retracement). That level comes in at 0.9754.

The break is more bearish. It wasn't just yesterday that the price broke above this moving average for the first time since September 21. During the ECB headline volatility yesterday, the pair fell and tested that MA but found support buyers.

Today there was another test and hold.

Not this time. The MA has been broken.

Having said, that there is another tough level to get to and through. That his the 100 hour MA and the 50% retracement at the 0.97337 level.

As a result, there is a bit of a battle between the sellers below the 100 day MA, and the buyers at the 100 hour and 50% retracement level. Each can plant a stake in the ground and defense the level. We will see who will win.

PS for traders you have the opportunity to lean against either with limited risk. If you like the dollar if you like weak CHF and think the fall is enough, this is the level to buy. Look for a move back above the 100 day MA for some relief.

Dollar sellers or CHF buyers, the failure on the move above the 100 day MA is disappointing. Get below the 100 hour MA and the 50% and the 200 hour MA and we could see a further slide toward 0.9660.

Risk is defined and limited against the levels.