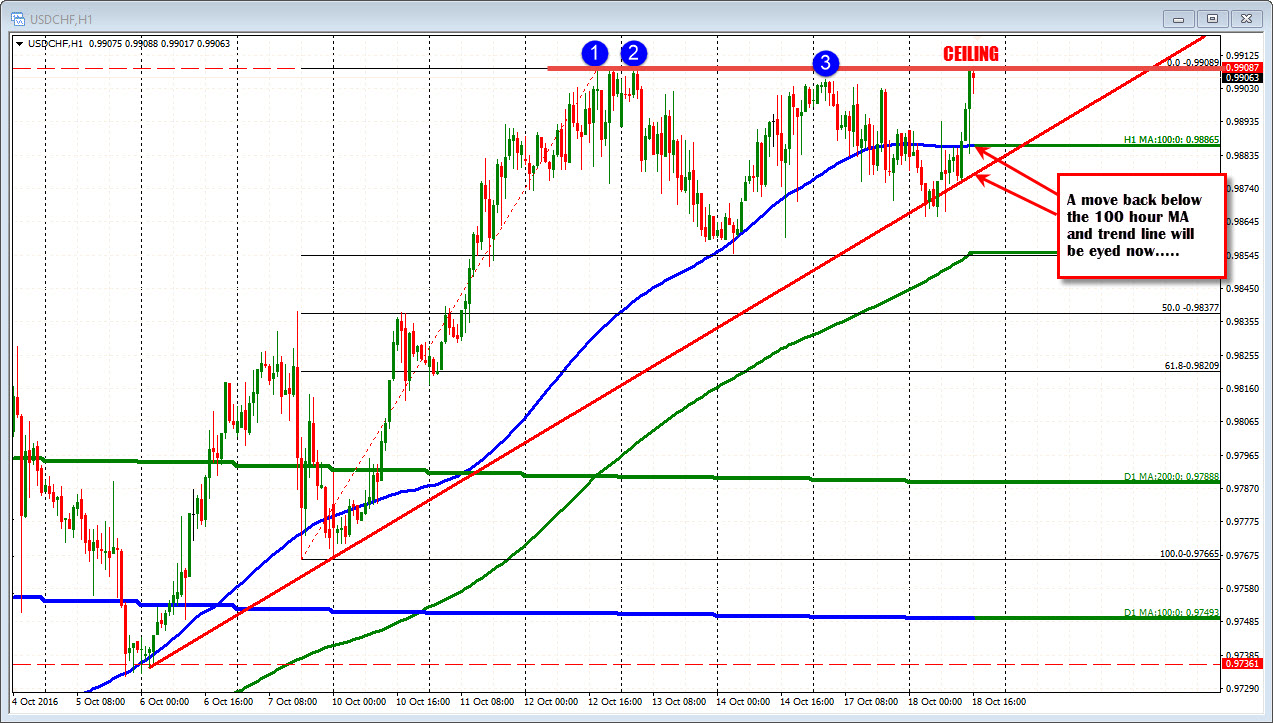

A move above 0.9909 eyed

The USDCHF is banging against a ceiling at the 0.9909 area. The high from October 12 came in at 0.99089. The high on October 13 was also near that level. The high yesterday reached 0.99057 before moving back lower. The price just banged against that high and could not quite get though the level on the test (we are trading back down at 0.99017 currently).

Can the pair retrench and push through. That is the bet for traders. Right now, the sellers against the prior highs (with stops likely above) are winning the battle. We will have to wait and see, if the dollar buying we just saw, are serious about that side or are those buyers just playing the range.

PS on the downside for this pair, sellers will want to see a break back below the 100 hour moving average at 0.98865 and then the lower trend line at 0.9878 to help confirm a more bearish/ corrective technical picture.

The ceiling on the hourly chart is really ceiling #1 for this pair. Looking at the daily chart, the 0.9550 area is ceiling #2 (actually 0.9949-55). That was the highs in May and July. A trend line connecting the November 2015 and Jan 2016 cuts across at 0.9942 as well. Be aware of that overhead target on a break higher today (going forward).