Tests the next downside targets..Room to roam

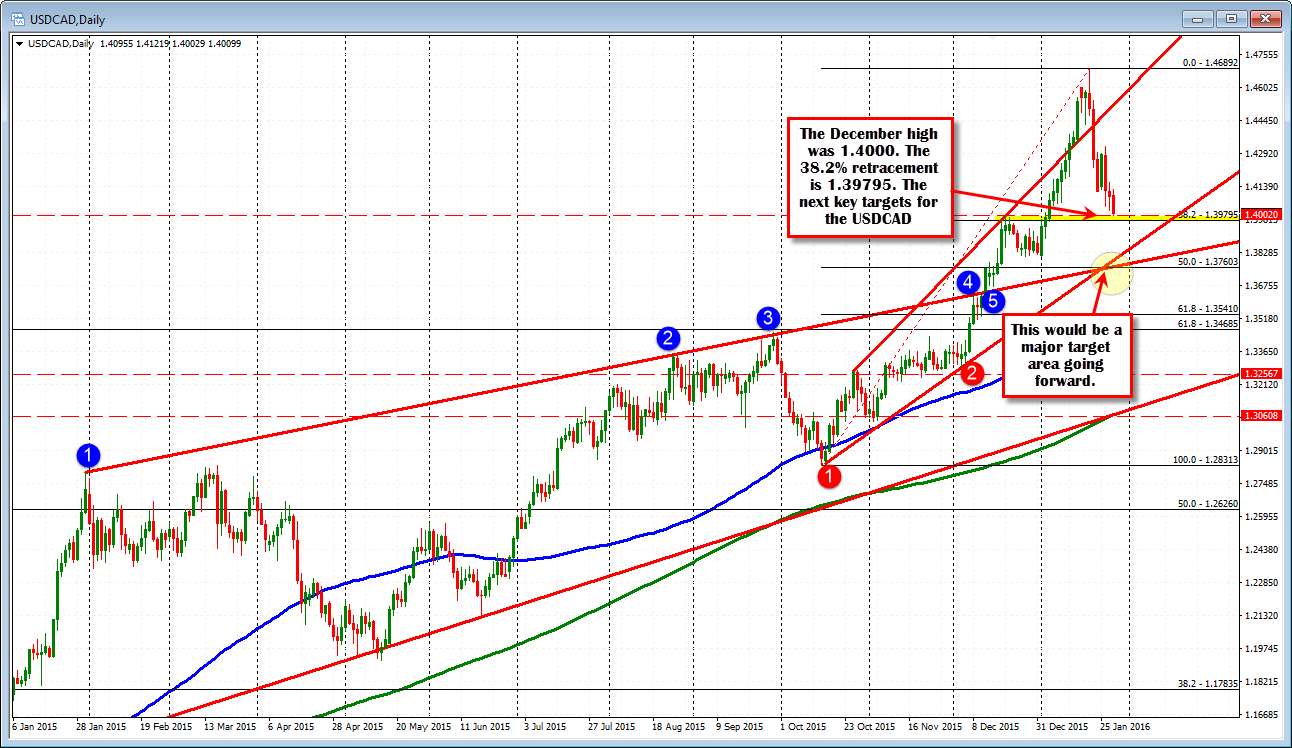

The USDCAD is tumbling as production cuts send will prices surging higher. Technical technically, the price of the dollar Canada has moved below the December high price at 1.4000. It is currently testing the 38.2% retracement of the trend move higher from the October low to the January high. That level comes in at 1.39795.

Needless to say, the USDCAD has been on a moon mission as a result of the tumbling oil prices. Now, with concerns of decreased production (and other supply constraints down the road - it just takes time), the pendulum has swung a bit. It is not a one-way street.

Looking at the daily chart above, the 1.3760 level is a longer-term target should the selling continue. A couple trendlines dissected that area and the 50% retracement of the move up from the October low is also there.

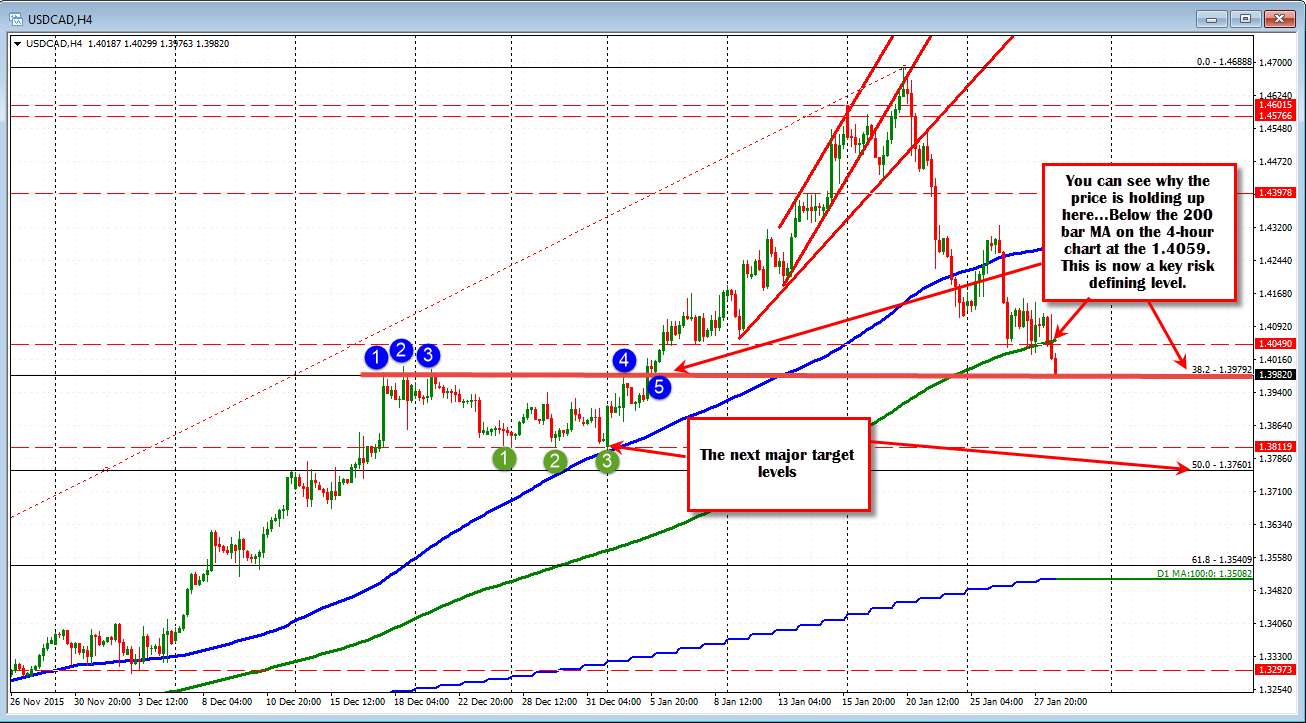

Currently we are seeing some support at the 38.2% retracement

See the 4- hour chart for a closer look. The risk for shorts now comes at 200 bar MA on 4-hour chart. The price is breaking below that MA for the first time since November 4th.