Oil prices down 0.81%. Inventory data out later (at 10:30 AM ET).

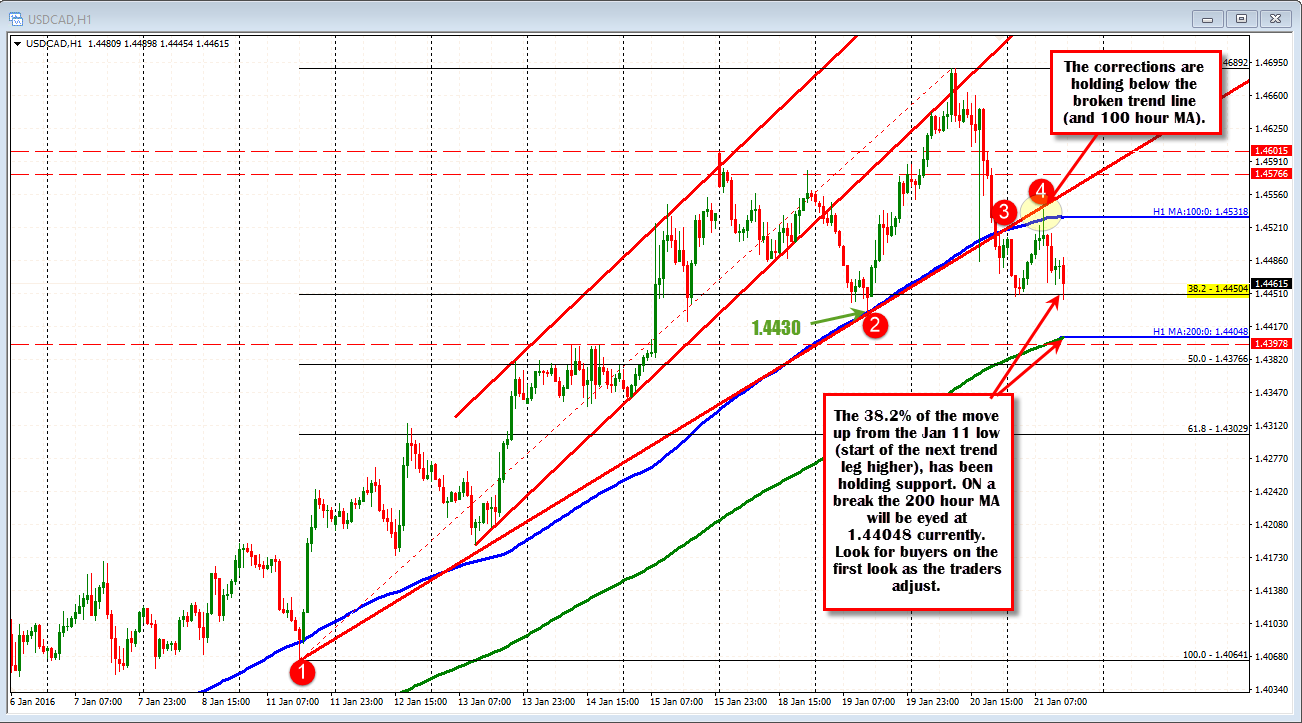

Yesterday's trading flustered and frustrated traders as the BOC decision sent the USDCAD sharply lower but then retraced the entire move before moving lower into the close (and back below the 100 hour MA) blue line in the chart below). The move lower, broke the string of up days at 12.

Today the pair found support at 38.2% of the last trend move higher, corrected to the 100 hour MA and broken trend line (that is now resistance in trading today), and is back down testing the 38.2% retracement. Look for support at the 200 hour MA at 1.4404 on the first look (green line in the chart above).

Oil is down about 0.81%. You will likely notice that the price is around $28 when yesterday, the price was below $27. That is because the March contract is now the front one quoted in the futures market and it trades at a higher price to February delivery. Later today, the oil inventory data will be released. Crude oil inventories are expected to rise by 2200 barrels. Yesterday's API data showed a build of 4.6M barrels. The price reaction off the releases will be eyed closely as all the bad news (with Iran) may be out. That could have an impact on the USDCAD as a result.