OPEC increases output. Trade data and employment data not so great

The USDCAD moved higher as Canada trade data and employment data was not so great. Also OPECs rise in production has sent oil prices lower. However, the pair quickly ran out of steam above the 1.3400 level and is back down to the middle of the trading range in herky jerky trading.

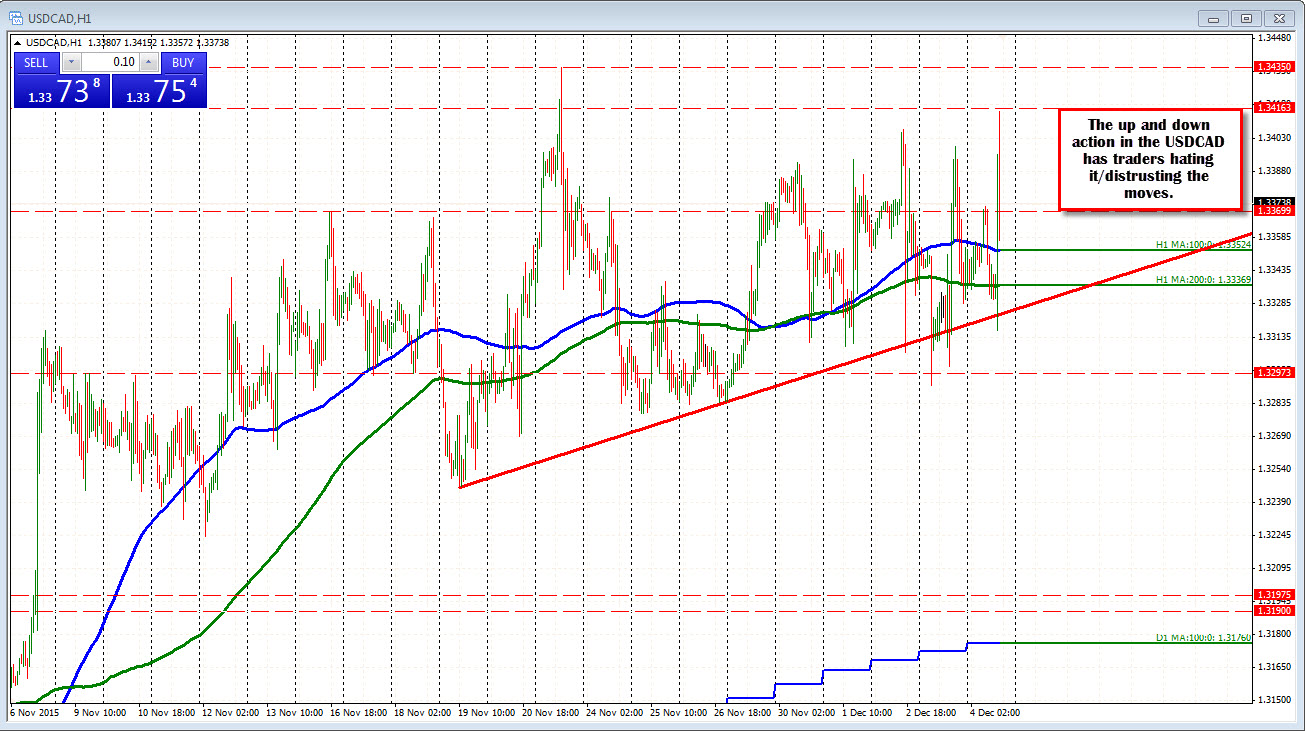

Technically, the pair moved to new session highs, at 1.3415 but fell short of the November high at 1.3435. The lack of follow through seems to be a pattern as the pair trades near going back to 2004

Looking at the price action on the hourly chart recently shows a lot of starts and stops with swings higher and lower. This seems to have traders frustrated in it's wake as nothing can get started one way or the other..

If there is a chance to get something going - and the fundamentals point higher - the price will need to get and stay above the 1.3400 at the very least. The November highs at 1.3435 would be the next hurdle. and then it may be able to start something. Failure to do that and the price can go anywhere. The pair has not been able to sustain any meaningful rally despite oils continued weakness. The 100 hour MA at 1.3352 and the 200 hour MA at 1.3336 should be support.

The range this week is a woeful 124 pips. The last 4 weeks have seen ranges of 124,124, 156 and 124 this week. That is also an indication of a market that is non-trending and not ready to make a commitment.