BOC decision and EUR weakness send the EURCAD tumbling lower

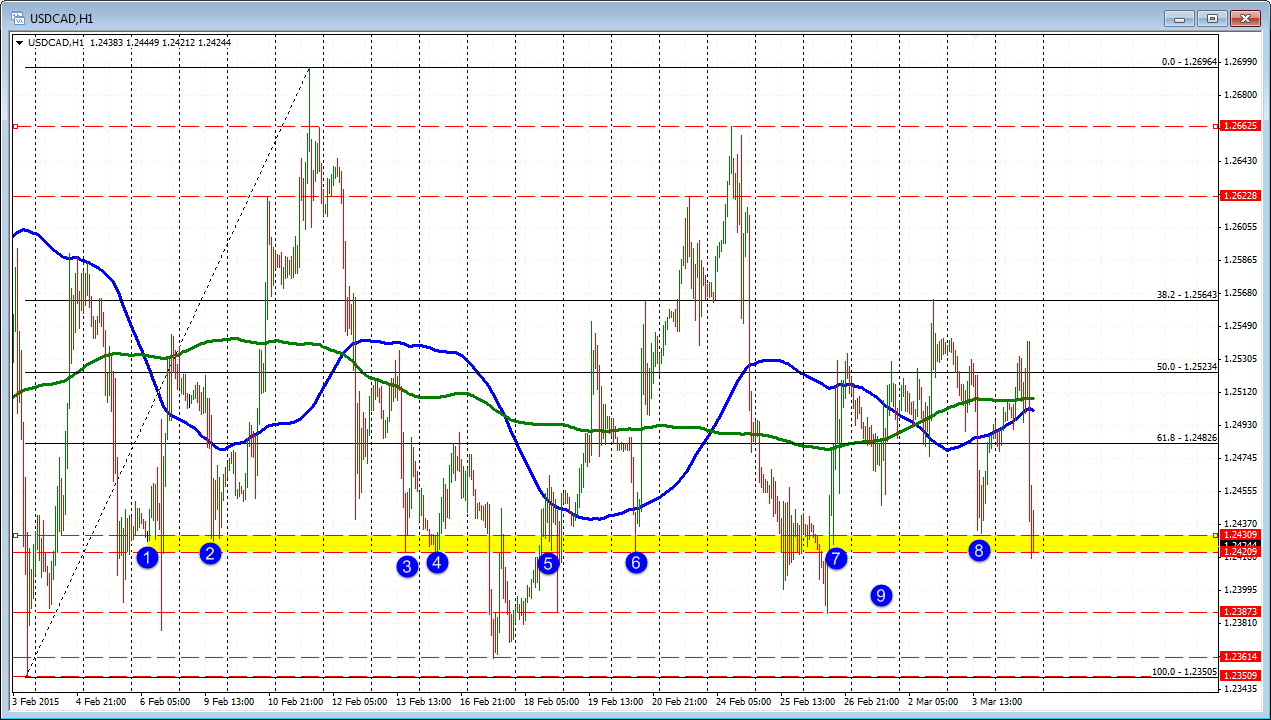

The Bank of Canada kept rates unchanged, and was less dovish in their comments for future action. As a result, the USDCAD fell sharply. The pair has moved to the 1.2420-30 target level where there are a number of swing lows over the last month of trading (see chart below).

The pair might have been lower had the data in the US not been more supportive of the US dollar. Nevertheless, it is a good move and the selling has the potential to continue (currently trading at the lows). The USDCAD is down -0.58% on the day.

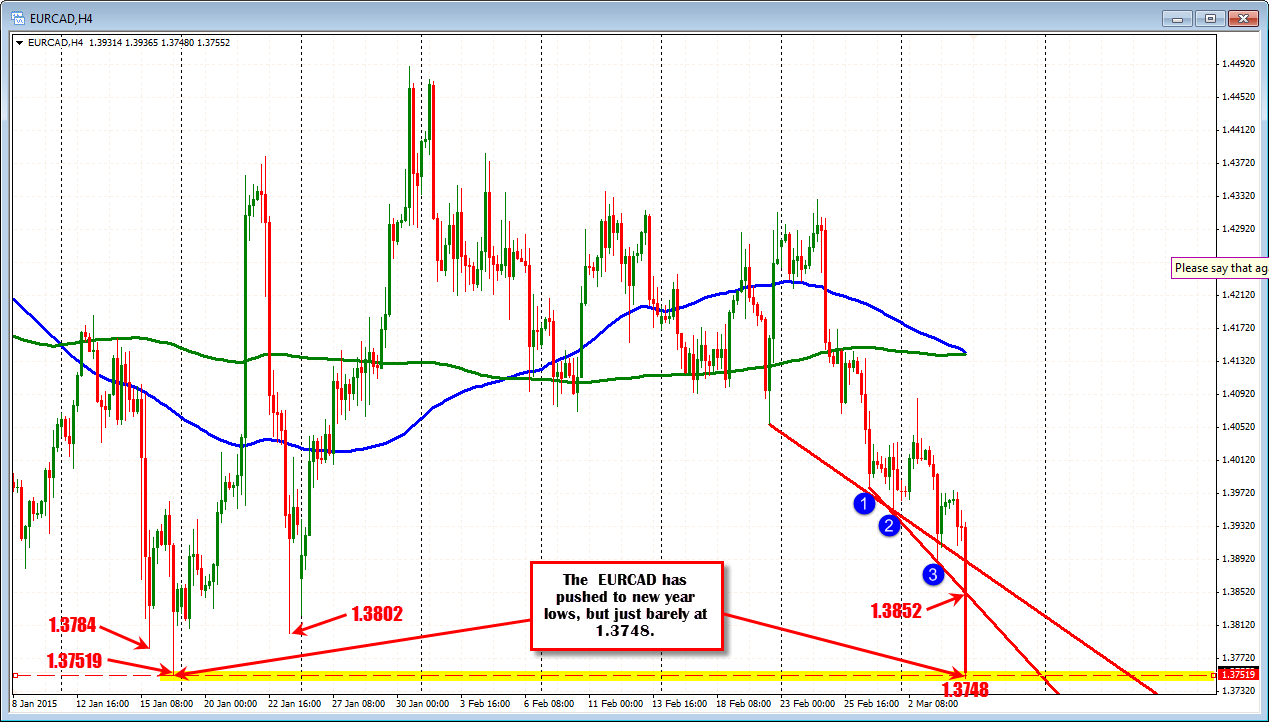

There was no EUR data to impact that currency, however. As a result, the EURUSD has fallen with the dollar strength. That, along with a rise in the CAD has led to an oversized fall in the EURCAD cross. That pair is currently down -1.46% on the day and is the biggest mover of the major currency pairs in trading today.

The move has taken the price below trend line support - the last one at the 1.3852 level. However, the oversized move has found some support buying against the lows going back to January 16th. That low came in at 1.37509. The low today is 1.3748.

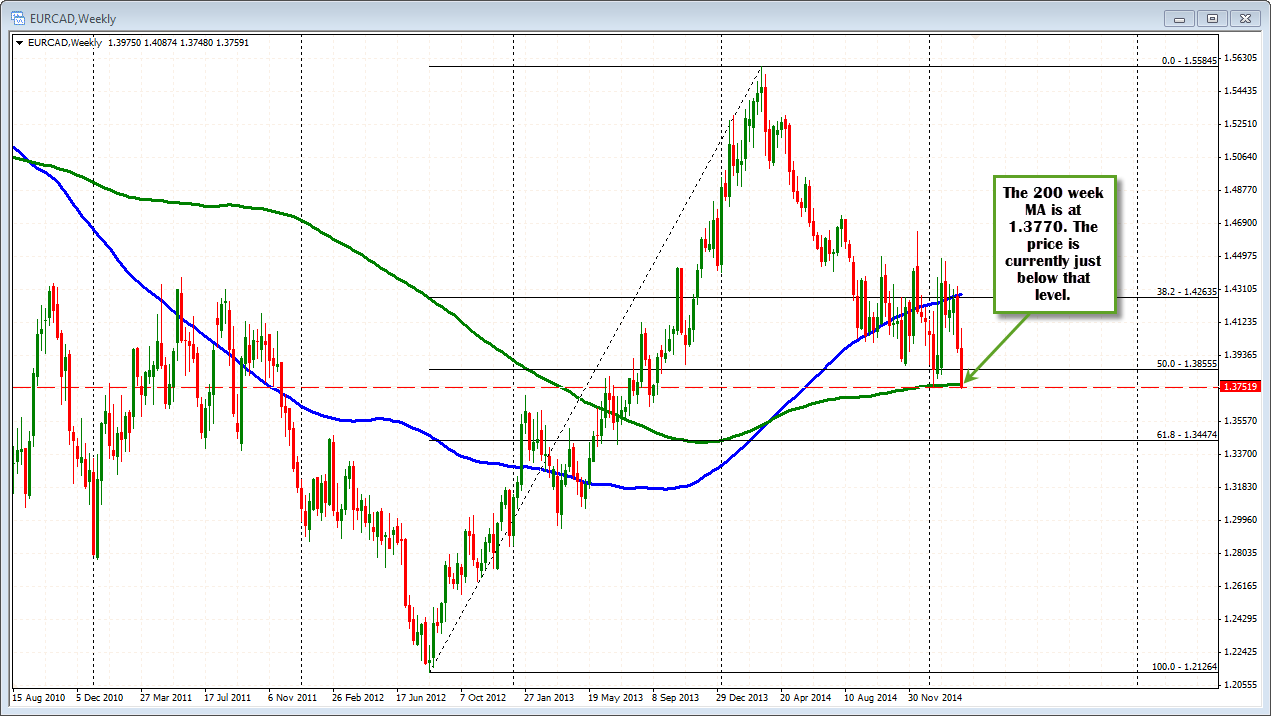

Looking at the weekly chart below, the EURCAD as dipped below the 200 week moving average at the 1.3770 level. With support from the January low at 1.3751 and resistance at the 200 week moving average at 1.3770, the pair is stuck between a rock and a hard place.

Looking at the 5 minute chart, the price has tried a corrective move above the 200 week moving average level - reaching 1.3783, but retreated back below. If the pair is going to have any chance for a further corrective move, a move above the 1.3770 level will be needed. Until then, the bears are still in firm control.