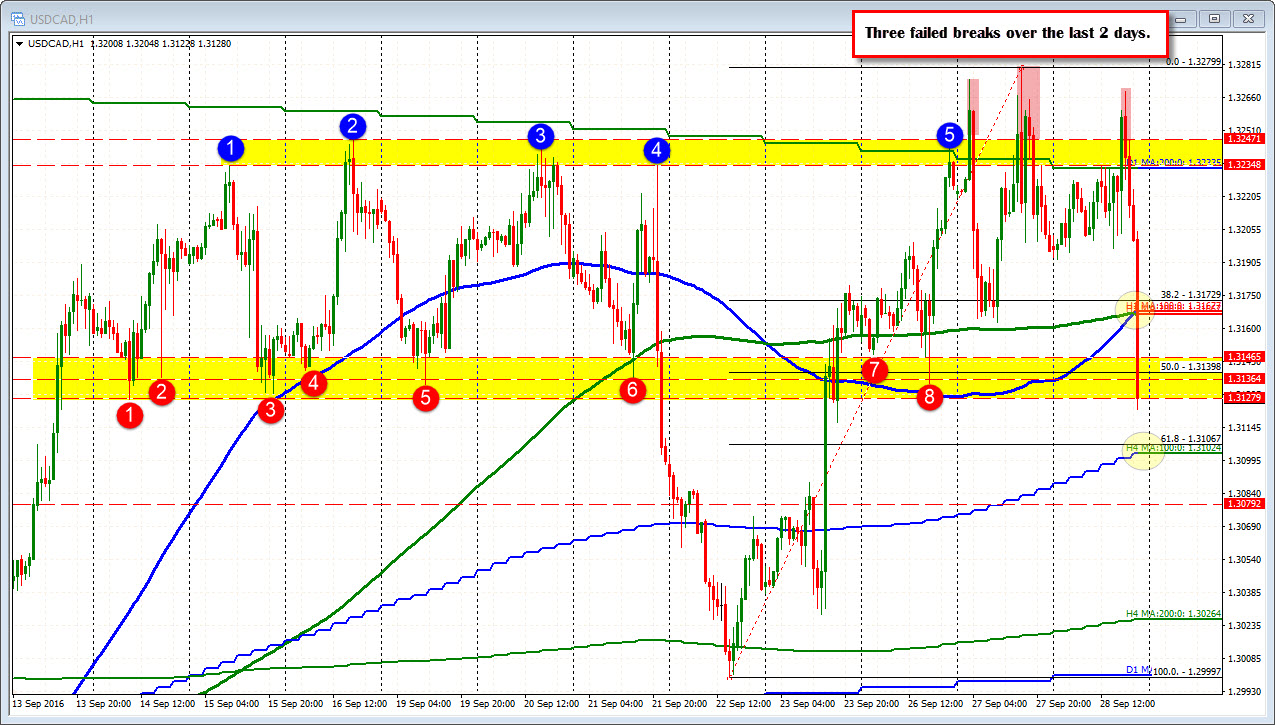

Tests the week lows

The OPEC production cuts has sent the loonie higher, the USDCAD lower. The pair has moved below the 100 and 200 hour MA at the 1.3167 area, and is now trading below the lows for the week AND what was a prior support area (see lower yellow are in the hourly chart below). That area was defined by a series of swing lows (between 1.3128 and 1.31465).

The next target comes near the 1.3102-06 area where the 100 bar MA on the 4-hour chart is found along with the 61.8% of the move up from the September 22nd low.

PS the price has just moved to that next target level. and the fall has stalled for the time being at least. Look for resistance on bounce up toward the 1.3128-40 area (50% is at that area). A break below the 1.3100 area will next have traders looking toward the 1.3000 to 1.3026 area (200 bar MA on the 4-hour chart and the 100 day MA). The 100 day MA at 1.3000 is right near the low from September 22nd.

The November Crude oil contract is trading up at $46.94 for a gain of 5% on the day. OPEC sure played that hand well. Just when you thought for sure nothing was going to happen, something happened.