Crude oil inventories rise greater than expected

Earlier, the DOE reported that Crude oil inventories increased by 2847K for the week of October 30. This was higher than the 2500K expected and comes on the back of a 3376K build in the prior week. There have been 6 straight weeks of inventory builds. Crude Oil was trading at $47.62 prior to the report. The current price is down to $46.28 (-3.4% on the day).

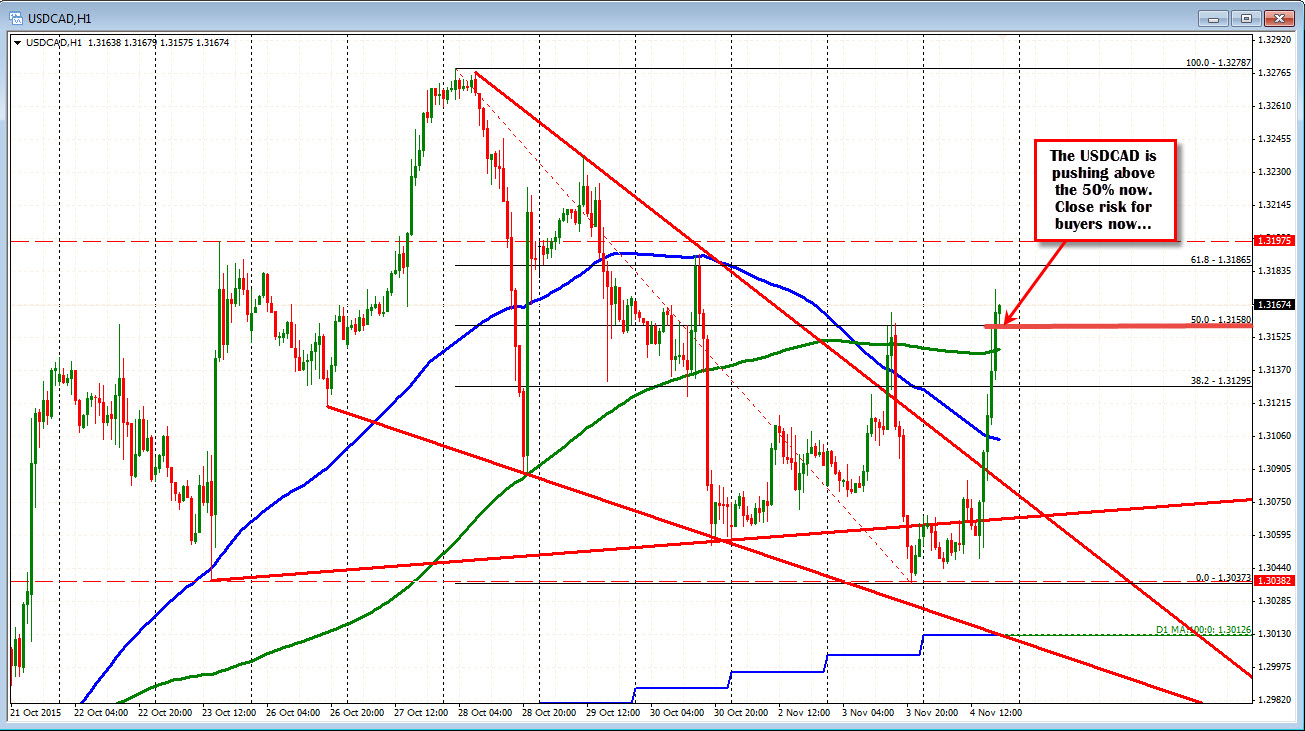

The move back lower - along with a strong dollar on the back of a potential December Fed move - has helped to propel the USDCAD higher.

Technically, the price has surged back up above the 100 and 200 hour MAs (blue and green lines) and also above the 50% of the move down from last weeks high. What was resistance becomes support. SO risk for longs will now be centered on the 50% at 1.3158 and the 200 hour MA at 1.3146. Note the initial move higher did stall at the 50% and backed off, before catching it's breathe and moving above the level in the last few hours.

If the price can stay above the 50%, the buyers are in control and 1.3186 and 1.3200 become the next targets. If there is a rotation back below (and in the current hour, the 50% is holding), the 200 hour becomes the focus again and the bull and bear battle at these highs intensifies.

Right now though, the buyers remain in control.

PS PM Trudeau announced his choice for the new Finance Minister. He tapped Bill Morneau, a pension executive. For other information on Mr. Morneau, CLICK HERE