Tech/Option support also in play

Mike Paterson outlined a large option expiry at 1.3000 in the USDCAD and in the minutes running up to the option expiry the price moved to 1.3004 and stopped. Option sellers earn all the premium when the options expire at the strike price. They pretty much expired at the strike price. The option sellers are happy. The option buyers....not so happy.

Of course oil prices were rising into that expiry as well. The price of oil peaked near that time at the $40.91 level. The price has since move lower and trades below the $40 level at $39.30 currently - down about 1.8% on the day.

The subsequent fall in oil and the bounce off the 1.3000 level has sent the price back up toward unchanged on the day at 1.3119 (the high corrective price reached 1.3114 so far). An up and down day for that pair.

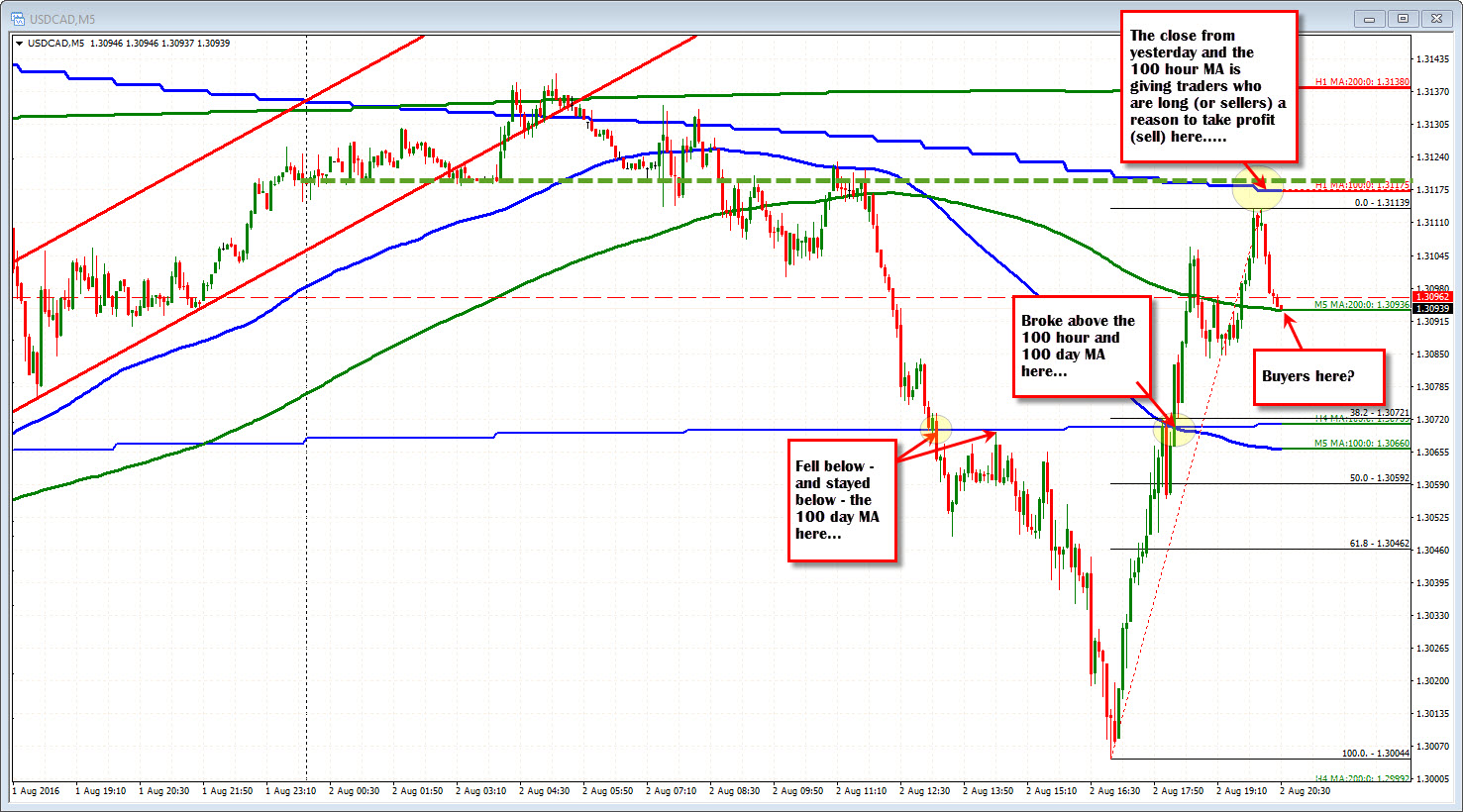

Looking at the chart above. The price rebound took the price back above the 100 hour MA and the 100 day MA (when both were at the 1.3071 level). It has taken the price above the back above the 200 hour MA, but is finding some sellers against the 100 bar MA on the 4-hour chart and perhaps that prior day close at the 1.31175 and 1.3119 level respectively. The 200 hour MA at 1.30937 is currently being tested. If the buyers still love it (and they may or may not given the swings in this pair), they should lean against it. If they had enough, we could see a further move back lower.

This pair is not always the easiest to figure out - especially when it is chasing the swings in oil or being bullied by option positions - but the technicals can still provide some clues for traders. So pay close attention.