Jobless claims rise to 294K in the current week. Going the wrong way.

The US jobless claims have started to reverse higher and it has weakened the dollar/led to a move higher in the EURUSD.

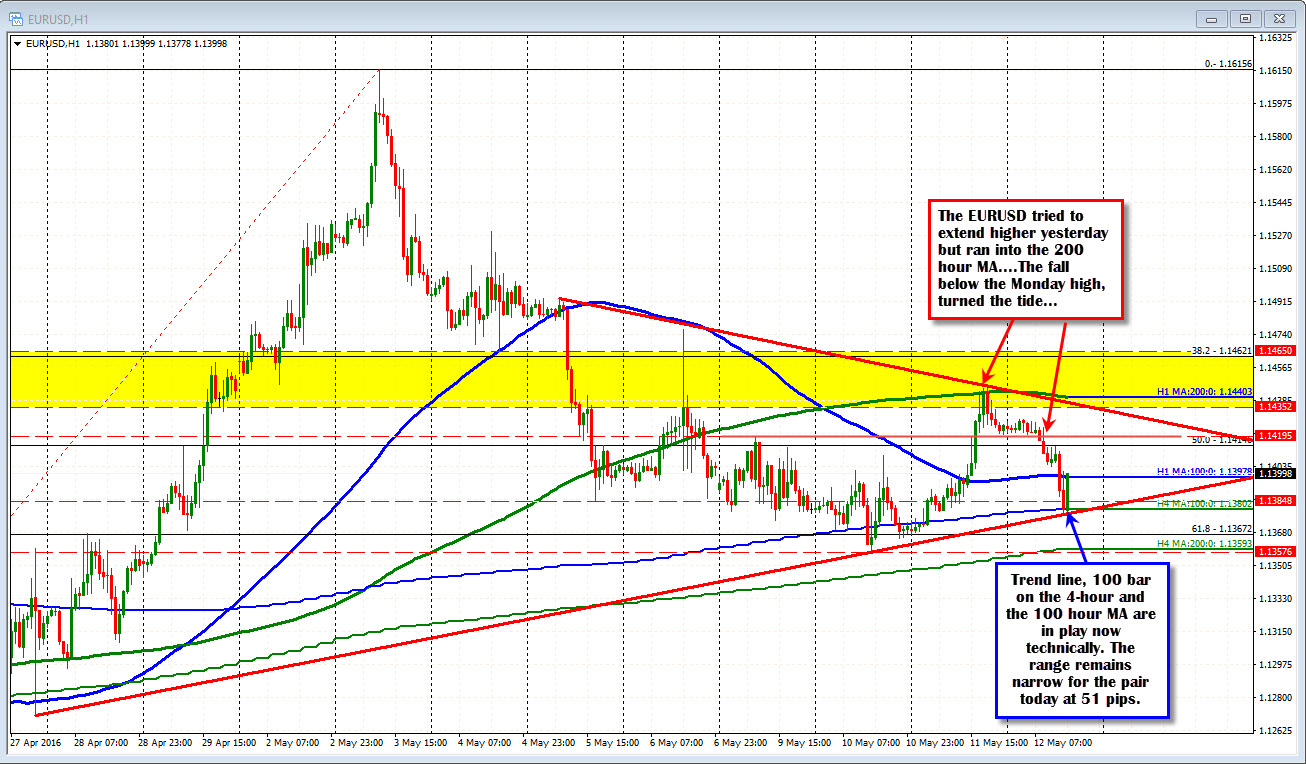

Technically, the pair extended to new week highs yesterday but when the pair could not get above the 200 hour MA (green line in the chart above), the creep lower began. The fall below Monday's high in the Asia-Pacific session led to a further turn in the trading bias.

The fall lower, fell below the 100 hour MA in the European/London session at the 1.1398 level (see blue line in the chart above). The pairs is testing that level as I type after the weaker jobless data. The low today stalled at the 100 bar MA on the 4-hour chart AND a trend line off recent lows (see chart above).

Traders are having a difficult time loving being long or short. They ARE paying attention to levels. It is the breaks and runs which are limited. The extremes at today's lows (trend line/MA line) and at yeaterday's high (against 200 hour MA) area the extremes. The 100 hour MA has so far done a good job at being a dividing line in between (at lest for yesterday and today). Another interim target between the extremes is the 1.1415-19 area. Patience.