The Monday hangover

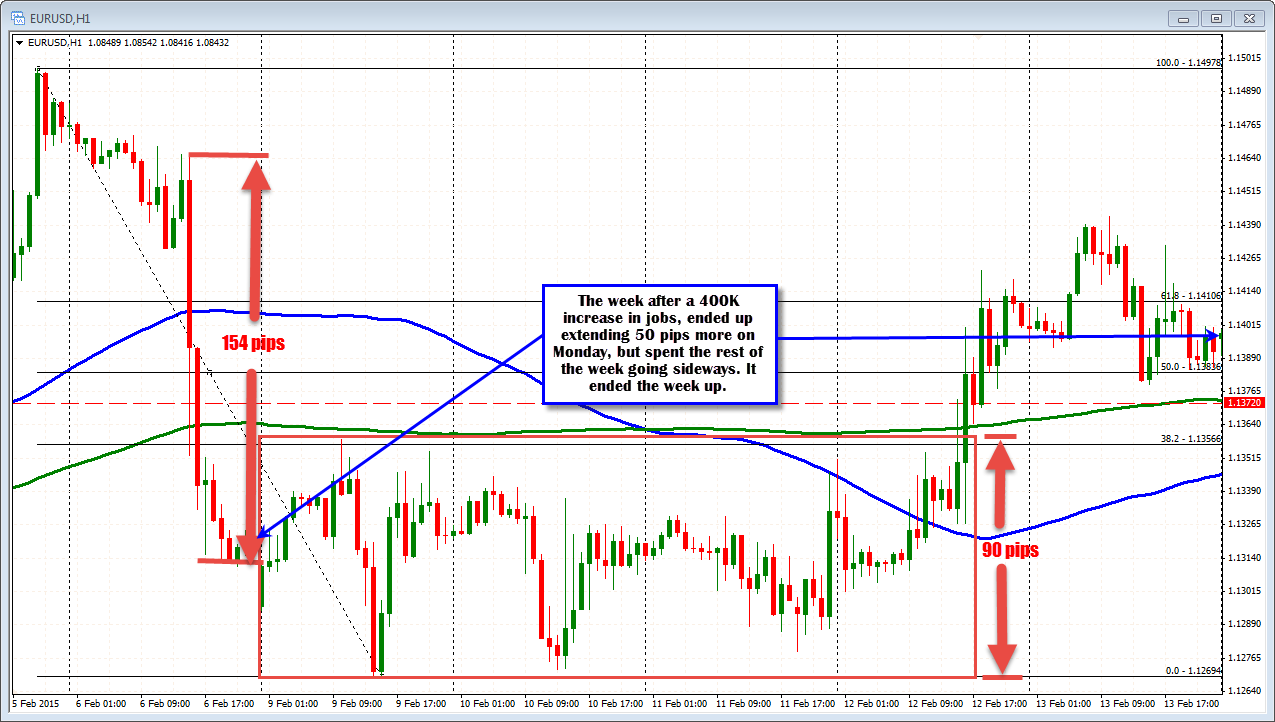

In February, on jobs Friday, the price of the EURUSD fell about 154 pips from the high just before the report to the bottom for the day. Of course that jobs reports showed above consensus jobs gains and a huge revision to the prior 2 months. Overall, the jobs change (including the revision was about 400K jobs.

Today's report did not show that type of gain. With the revisions the net number was only 277K.

However, it was solid.

No wage growth? If jobs are continuing to be added, there will eventually be increases. Just as people get used to getting raises, they can get used to not getting raises. People are finding jobs and are happy to have jobs. It does not make sense to ask for more wages. It takes time. Wage increases tend to come annually. They don't happen often. Anyway, when a company like Walmart says they will raise wages from $9 to $10, that is a hefty increase. It is an overdue increase, but that can make a difference.

Going back to last month, on the Monday after the employment report the EURUSD opened lower, rallied toward resistance (in this case it was the 200 hour MA - green line in the chart above), fell to yet another new low (about 50 pips down from Friday), but closed unchanged on the day (see chart above). The Friday party turned into a Monday hangover, with little accomplished at the end of the day.

For the rest of the week, the downside momentum could not continue and by Thursday, the market gave up on the downside and rallied into Friday. Overall, 400K new jobs and the following week, the EURUSD ended higher. Yuck.

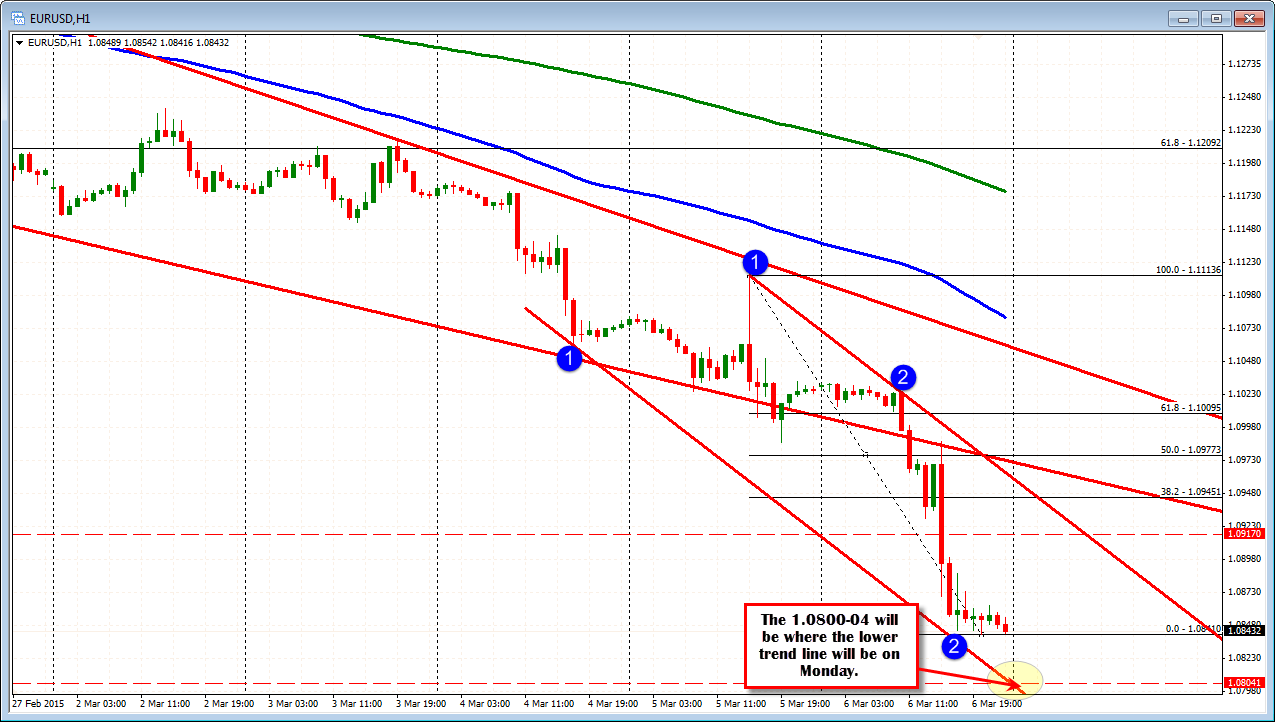

Will we have another Monday hangover next week? Will the follow through selling stall?

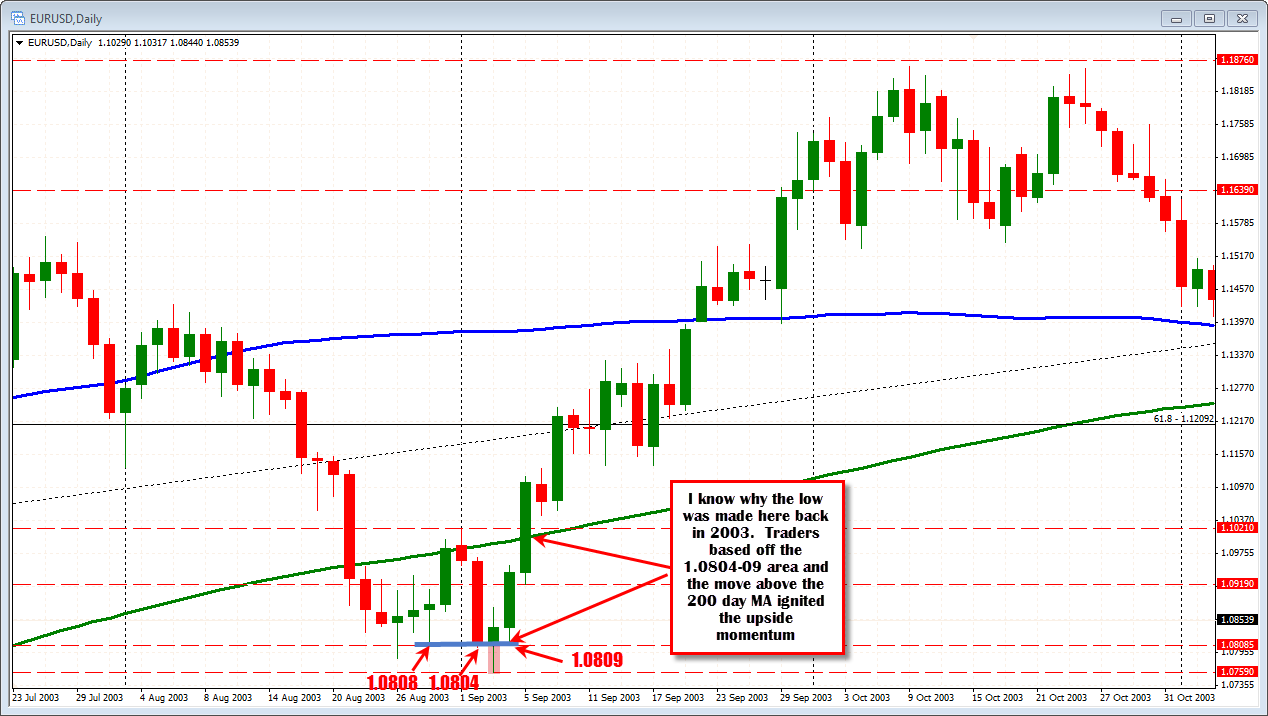

I will want to see the price of the EURUSD move below the 1.0804-1.0809 level on Monday and stay below it.

Why 1.0804-09? In 2003 when the price was last at this level, a series of three separate day lows at 1.0804-09, sandwiched a move to a low at 1.0759 (see chart below).

Looking at the hourly chart below, a lower channel trend line will come in at the 1.0804 area on the opening on Monday. If the price opens lower and goes lower, that area (down to 1.0800) may be tested. A move below that level will have traders looking toward 1.0759. Failure to get below, however, could see a repeat of last month with momentum fading. Traders who are short, may become frustrated and cover. The correction higher may not be much, but it could take the life out of the market again and have that wasteful feeling that often stems from a hangover - when nothing gets accomplished the next day (or even the next week).