RBNZ decision later this week.

The RBNZ will meet and Gov. Wheeler will announce the interest rate decision on Thursday in New Zealand/ Wednesday at 3 PM ET in the US. It is a close call on whether they cut or not with many joining the cut ranks after worse than expected CPI data (-0.5% for 4Q vs -0.2% estimate). Dairy auction prices are also lower and concerns about China prevail. Nevertheless, there remains some who expect no change.

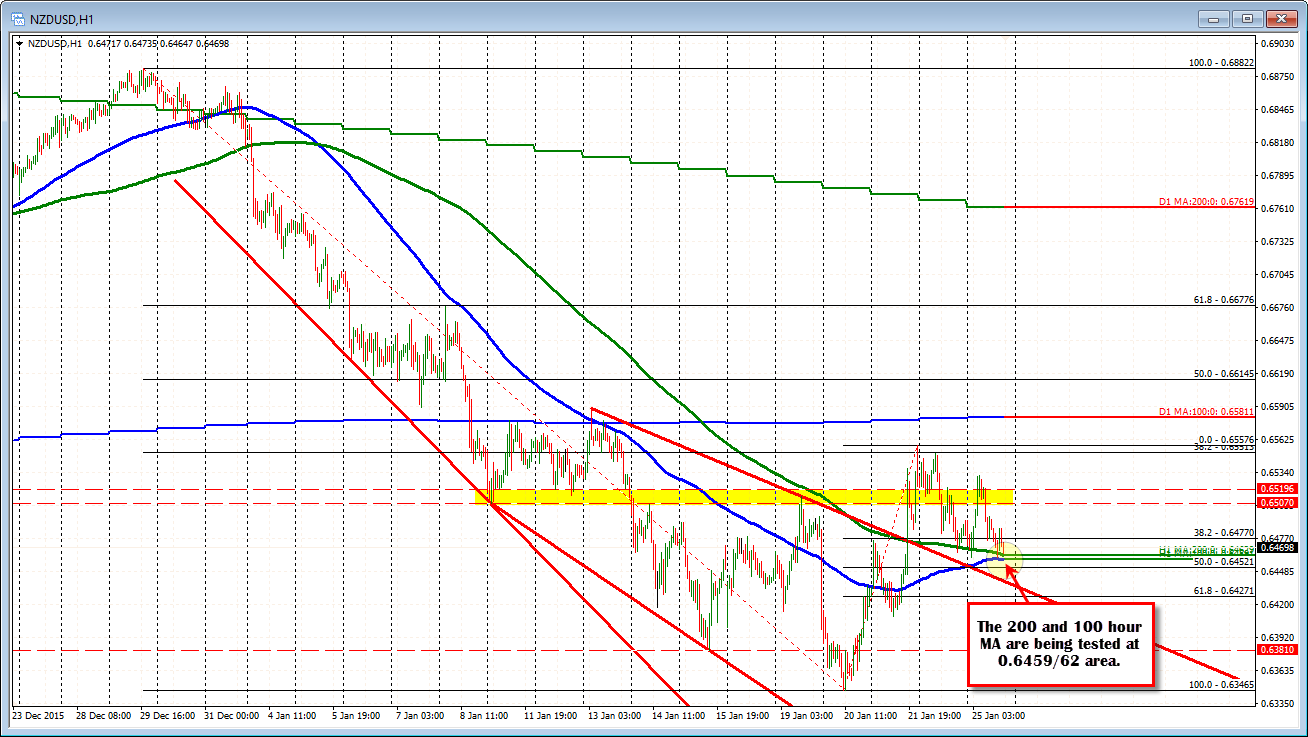

Technically, the pair last week squeezed higher extending to 38.2% of the move down from the December 29 high to the January 20 low. That level came in at 0.6551. The high price last week stalled at 0.6557.

On the rally higher the price extended above the 200 hour moving average (green line in the chart above) for the 1st time since the 1st trading day of the calendar year on January 4. On Friday and again today, that moving average has been tested. The 100 hour moving average has also moved up toward the 200 hour MA making the area,a key borderline today (and going forward). Traders are likely to take bullish or bearish clues from the area.

With the price moving back down to test the MAs for the second time today, we continue to see buyers against the area. That makes sense as risk can be defined and limited. Stay above and the buyers will see how far they can ride the move. However, I would expect that on a break below the MAs, those buyers should simply exit (and there should be more selling interest as well). Right now, the buyers are leaning and hoping for others to do the same and continue the up and down action seen in trading today.