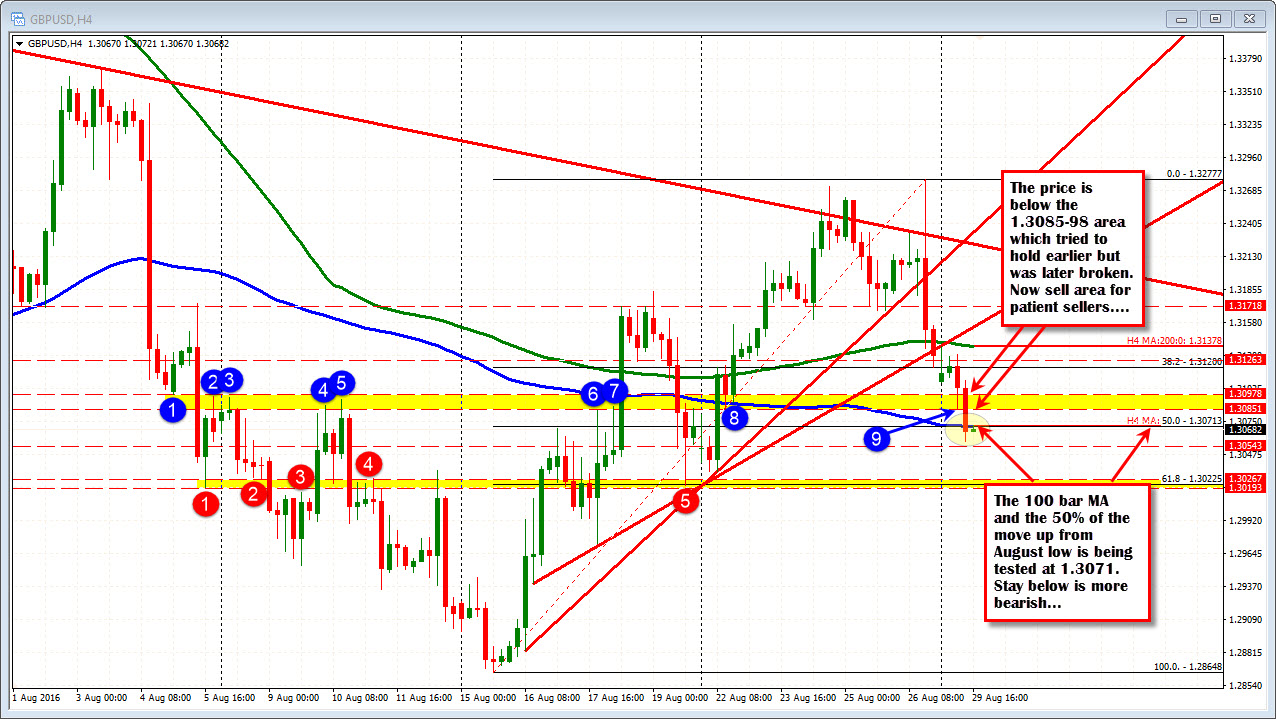

The 1.3071 level has been broken but trades above and below the level

The GBPUSD has continued its move to the downside after seeing selling on Friday on the back of the Fed speakers at Jackson Hole. The pair has moved below the the 1.3085-97 area which was a ceiling earlier in the month (see blue circles). That area is now intraday resistance for patient sellers. It also is a risk level for shorts.

The pair has also moved below the 100 bar MA on the 4-hour chart and the 50% retracement of the move up from the August low. Both those levels come in at 1.30713. The price is trading above and below that technical area over the last hour. With the holiday in London and the US numbers out of the way, the pair is looking for that additional inspiration.

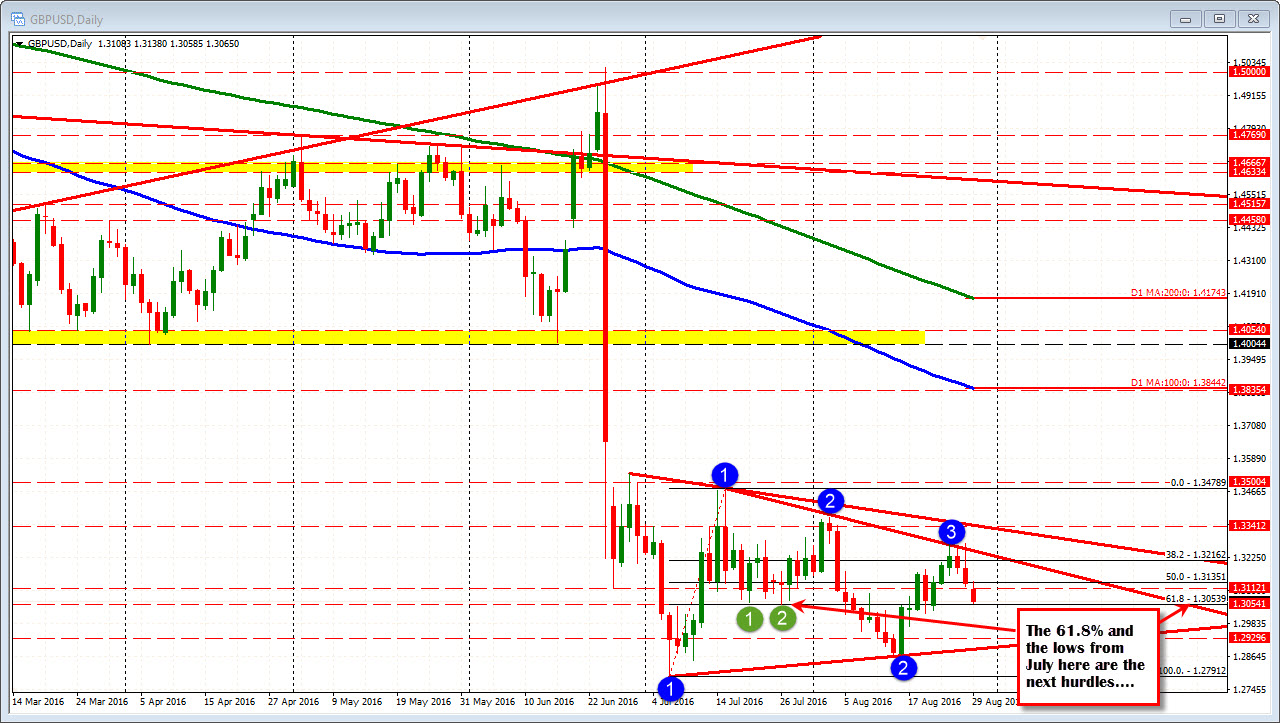

Looking at the daily chart, the price low at 1.30585 is in between lows from the 2nd half of July at 1.3054 and 1.3062. The 61.8% of the move up from the July low also comes in at 1.3054.

In a market that remains in a consolidation mode after Brexit levels - and with summer time trading still limiting action - the market will move from level to level.

The shorter term bias is more negative since Friday and the price just closed the most recent 4-hour bar below the key 100 bar MA and 50% level, but the price action/momentum is slowing/not that strong. Sellers here would need to see a move below the 1.3054 level to help the bearish picture. From there the 1.3019-27 area will be targeted (see red circles in the 4-hour chart above). If the momentum lower can not be maintained (i.e the price starts to trade more above the 1.3071 area, the patient sellers might get another shot at the 1.3085-97 area.