Picking bottoms continues...

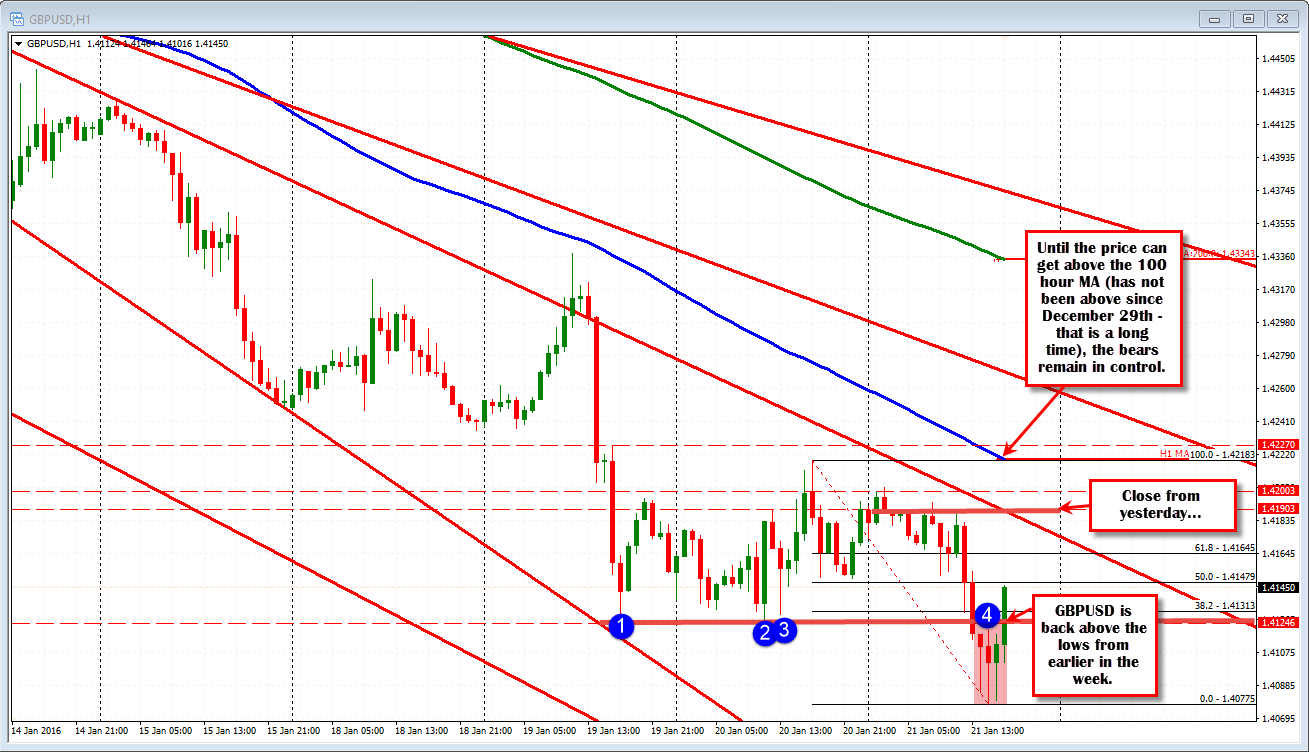

The GBPUSD has moved to new NA session highs. There is a ways to go for the day highs and even to get to the close from yesterday (at 1.4203 for the high and 1.4190 for the close), but it is a more bullish step. The GBPUSD fell below the 1.4100 level for the first time since March 2009 today. The low extended to 1.4077.

The price correction has now also taken the price back above the lows from yesterday at 1.4124 and the low from Tuesday at 1.4128. When trying to pick a bottom (and that has been difficult in this pair), it needs to start from staying above what is a key technical level. For today, if the 1.4124 level holds now, that would be more bullish. A move below and all bets are off. The pair is also above the 38.2% of the move down from yesterday's high at 1.4131. Little nuances.

The next target to get above would be the 1.4147-52 area. Yesterday afternoon and earlier today had lows at those levels. The 50% of the move down from yesterday comes in at 1.4147.

Ultimately, until the price can extend above the 100 hour MA (at 1.4218) - and stay above - the pair is still more bearish than bullish. Nevertheless, intraday traders may still look to have some fun trying to pick the bottom and see what may happen with limited risk (PS look for sellers near the close from yesterday if the price does extend higher).