Has not traded above the MA since September 30th

The 200 hour MA on the GBPUSD is currently at the 1.2299 area. Earlier today, that MA was tested and held. The 2nd look took the price above the MA line on it's way to the day high at 1.23098. That break was the 1st look above the MA since September 30th. You might expect a run higher, right? Wrong. That initial break failed and the price fell back to 1.2283.

We are back testing that MA line as I type. The price just moved to 1.23027 but is back down to 1.2295.

The GBPUSD is at a cross road. Not only is there a key technical level, but the pair is also being swung around by crosses and fundamental news. The GBPUSD is higher today on the back of a softer Brexit but it is also running into an overall dollar bullish move. The EURUSD is trading at session lows. The USDJPY and USDCHF are near highs - but at resistant levels for those two pairs. US stocks are higher and US bond yields are a bit higher too.

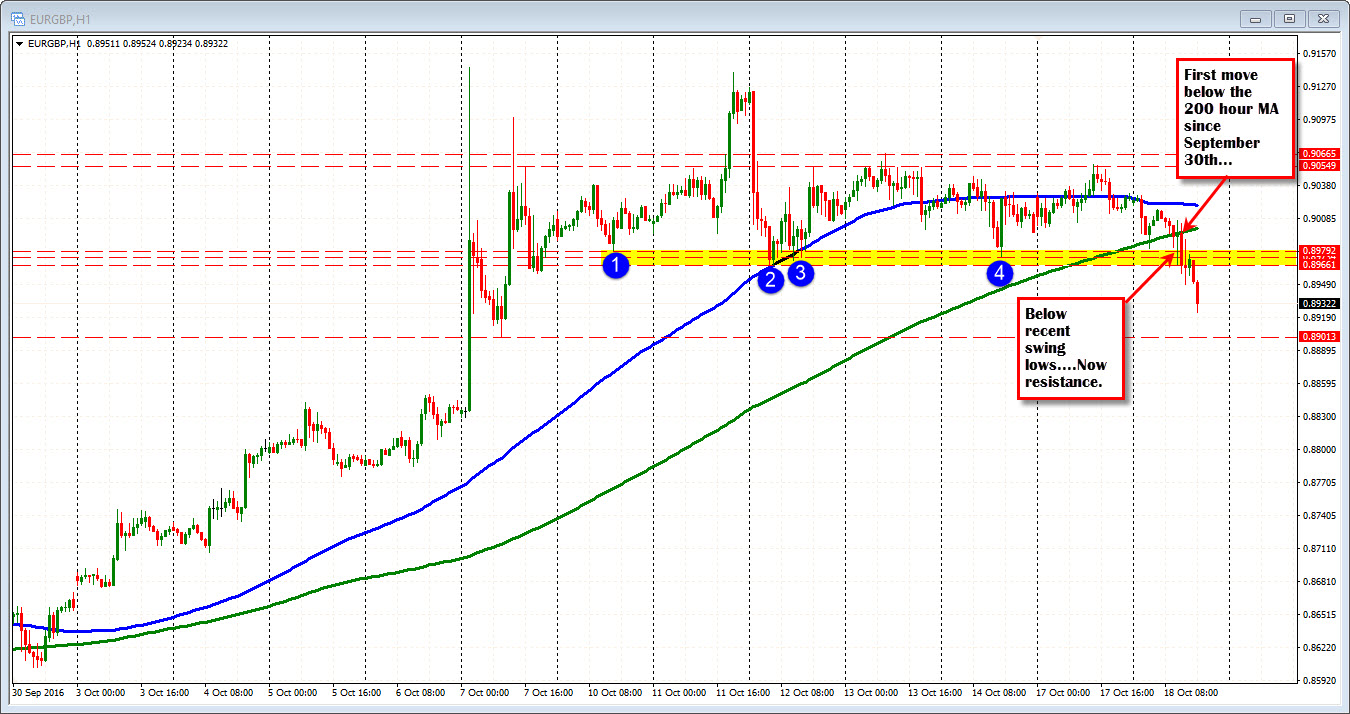

Other influences are the action in the cross pairs. The EURGBP is lower in trading today and looks toward the post crash low at the 0.8913 level (from October 7th). The EURGBP fell below it's 200 hour MA today for the first time since September 30th. Is it leading the way for the GBPUSD? So far, the move is helping but traders are still hesitant to take the GBPUSD above the MA line.

It is a bit tricky with the winds swirling from a lot of directions in this currency pair.