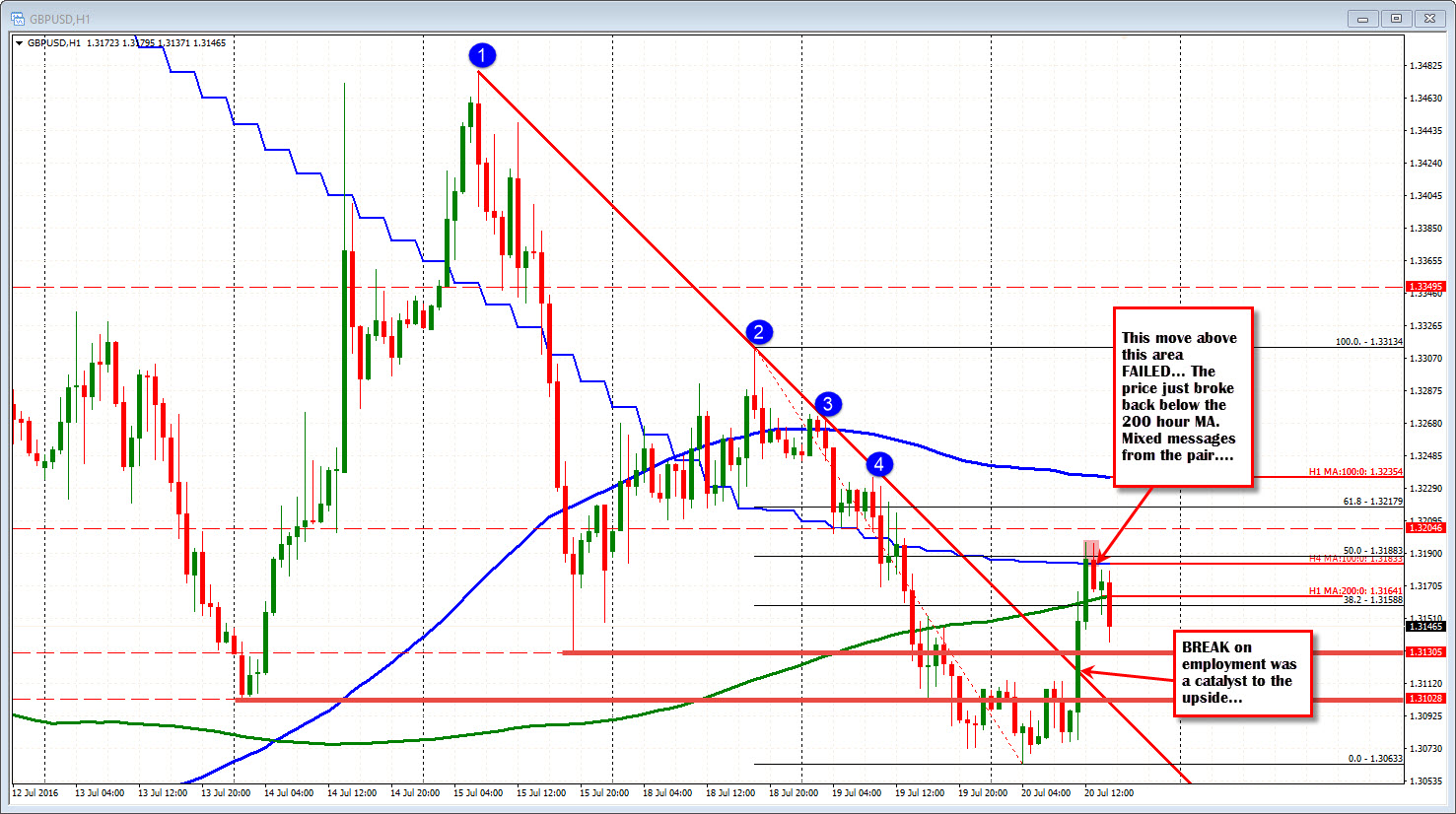

Employment cited for the rally

Yesterday, the GBPUSD was the weakest currency of the major pairs - falling against all the major currencies.

Today it is the strongest albeit in a quiet field. The rally took the price above the 200 hour MA and the 100 bar MA on the 4-hour chart and the 50% of the move down from the weeks high at 1.31883. It could not be sustained, however and we are not seeing a retracement back below those MA levels. The pair is moving back toward the midpoint of the move higher off the employment report at the 1.3166. The 100 bar MA on the 5-minute intraday chart is also a target below.

The range for the day for this pair is about 133 pips. That does not compare to the average over the last 22 days (month) but the month had some pretty hefty ranges from Brexit. Markets are settling in more narrow trading as the summer season is in full swing. The EURUSD range is 41 stinking pips by comparison.

With no data today, traders traded the run up on the breaks of MA lines and even the MAs but those same trader may have just given up on the upside. Pick your spots against risk defining levels. Be patient. Testing intraday support now.