200 day MA yesterday. 100 day MA today

The GBPUSD is settling between the 200 day MA below and the 100 day MA below.

The pair yesterday tested and stalled near the 200 day ( green line in the chart above at 1.5345) and today it was the 100 day MA's turn to slow the move higher ( blue line in the chart above at 1.5517 currently) The 50% of the move down from August high comes in at 1.5486 and will be eyed as close intraday support.

It would seem appropriate that the pair settle between the two moving average extremes before the FOMC decision - and then let the post event action decide the fate.

There are some who with the better employment data coming out today, are thinking the BOE might play follow the Fed. So the pair might have some and down and up action tomorrow after the decision. Be on the lookout for support buyers on a dip toward the 200 day MA.

For now, the pair is more bullish on the day but with key overhead resistance... for now.

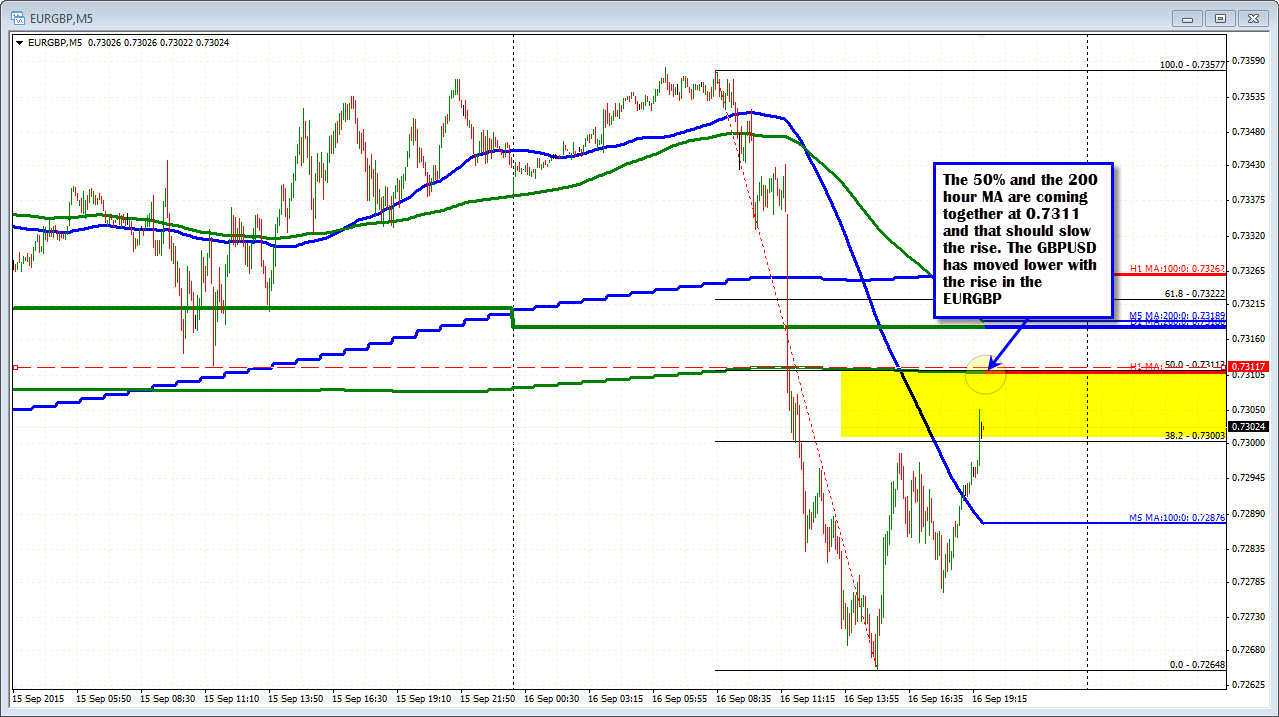

PS EURGBP is moving higher and helping to put a lid on the GBPUSD for now (EURUSD is moving higher).. The EURGBP is down sharply on the day but there seems to be some covering. The pair is approaching the 50% and 200 hour MA at the 0.7311 area. This should slow the corrective move.