Back to the 1.4950 level

The GBPUSD story has been one of a trend move lower today, until that time the Chairwoman started to talk. After a flush to below the 1.4900 (low 1.4894), the price has been grinding higher.

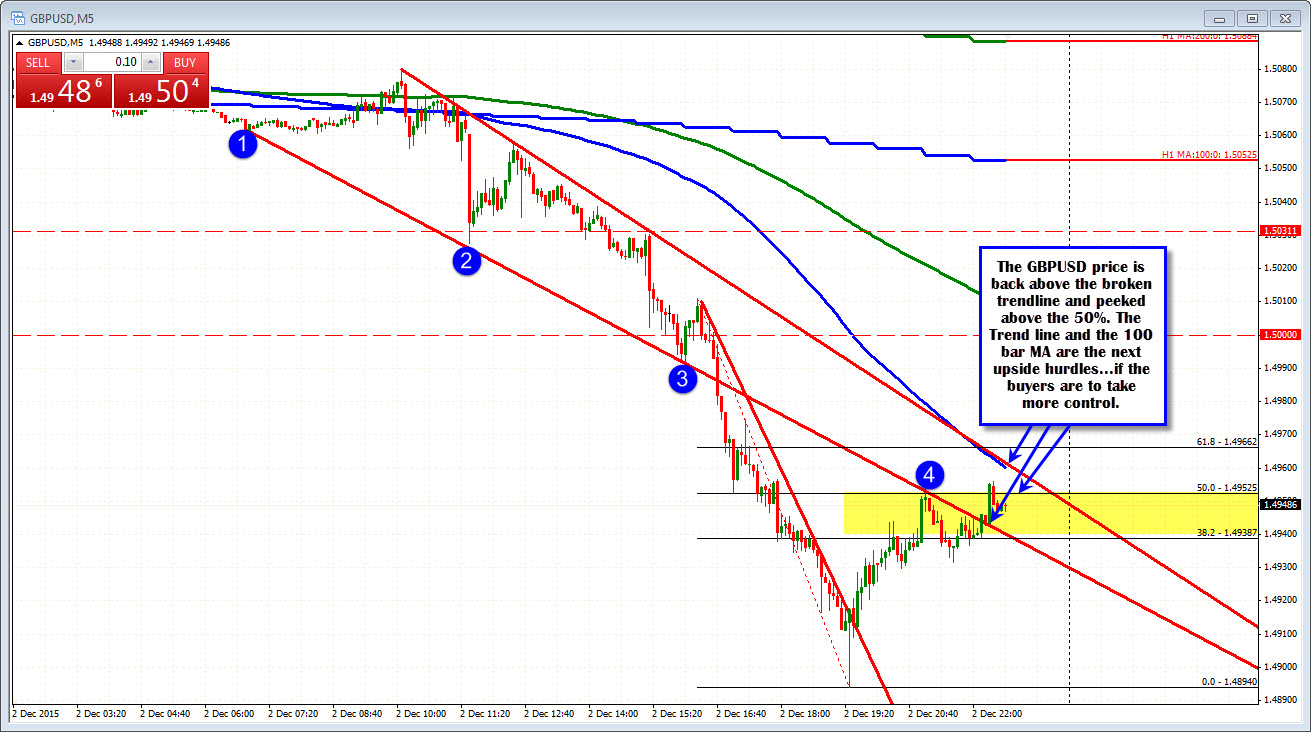

As mentioned in prior posts, holding the 38.2-50% retracement would keep the sellers firmly in control on a correction. That happened initially (the underside of the trend line held as well), but in the last few minutes there has been a return back above a broken trend line and even a look above the 50% of the last trend leg lower (SEE Yellow area). The pair has also traded above the 1.4950 level (which was a swing low going back to January 2015 and a key support level on the way down).

What now?

Some of the "mojo" from the trend day is obviously over. The correction has been the largest of the day. Buyers won a small battle in getting back above the broken trend line and the 50% of the last leg lower.

Why is that important?

Because sellers who were under little pressure and fear all day, now have some. Specifically, traders below the 50% of the last leg lower, are now offsides/losing money.

Also, the correction higher may start to get shorts from above, to start to cover and book profits. When the price is trending all shorts are happy. When it stops, fear starts to enter..

Is it all over for the downside? Maybe. However, the retracement was still the minimum. There are other levels above that may/should be tough to crack. For example a move above the 100 bar MA (blue line in the chart above) and topside trend line (at 1.4958 currently) will now be eyed as the next target. Above that, the 1.5000 level looms large. It was a level of support on the downside. It will be a level of resistance on the topside too.