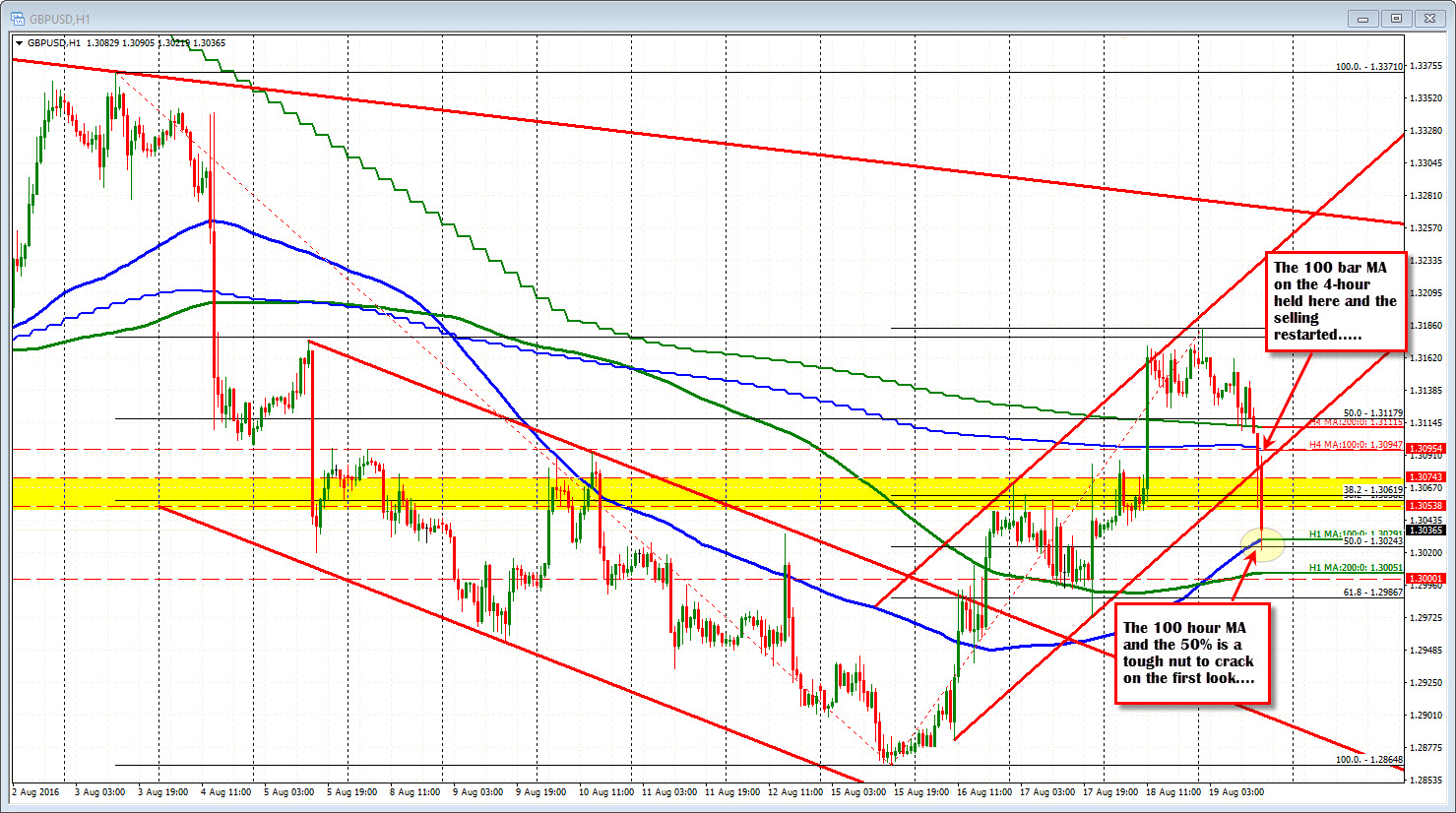

50% and 100 hour MA

The GBPUSD found sellers against the 100 bar MA on the 4-hour chart (see prior post outlining the level) and the "correction zone" of the trend move lower (38.2-50%) at the 1.3088-1.3099). The sellers leaned against resistance (with limited risk) and got some help from UK PM May's headline about official Brexit thoughts.

The fall has taken the price down to the next support area defined by the 100 hour MA and the 50% of the move up from the weeks low to the the weeks high (at 1.3024). There is a bit of a stall but sellers are trying to push. Key test. Key area. A break has additional support target at the 200 hour MA at the 1.3005 level (remember the support earlier this week near 1.30000).

IF the level holds, there could be a move back toward 13048-56. The level is the 38.2-50% of the last leg lower in the trending pair. If the sellers love being short, they should look to cap the correction in this area and stay in firm control. A move above muddies the water for the trend move today.