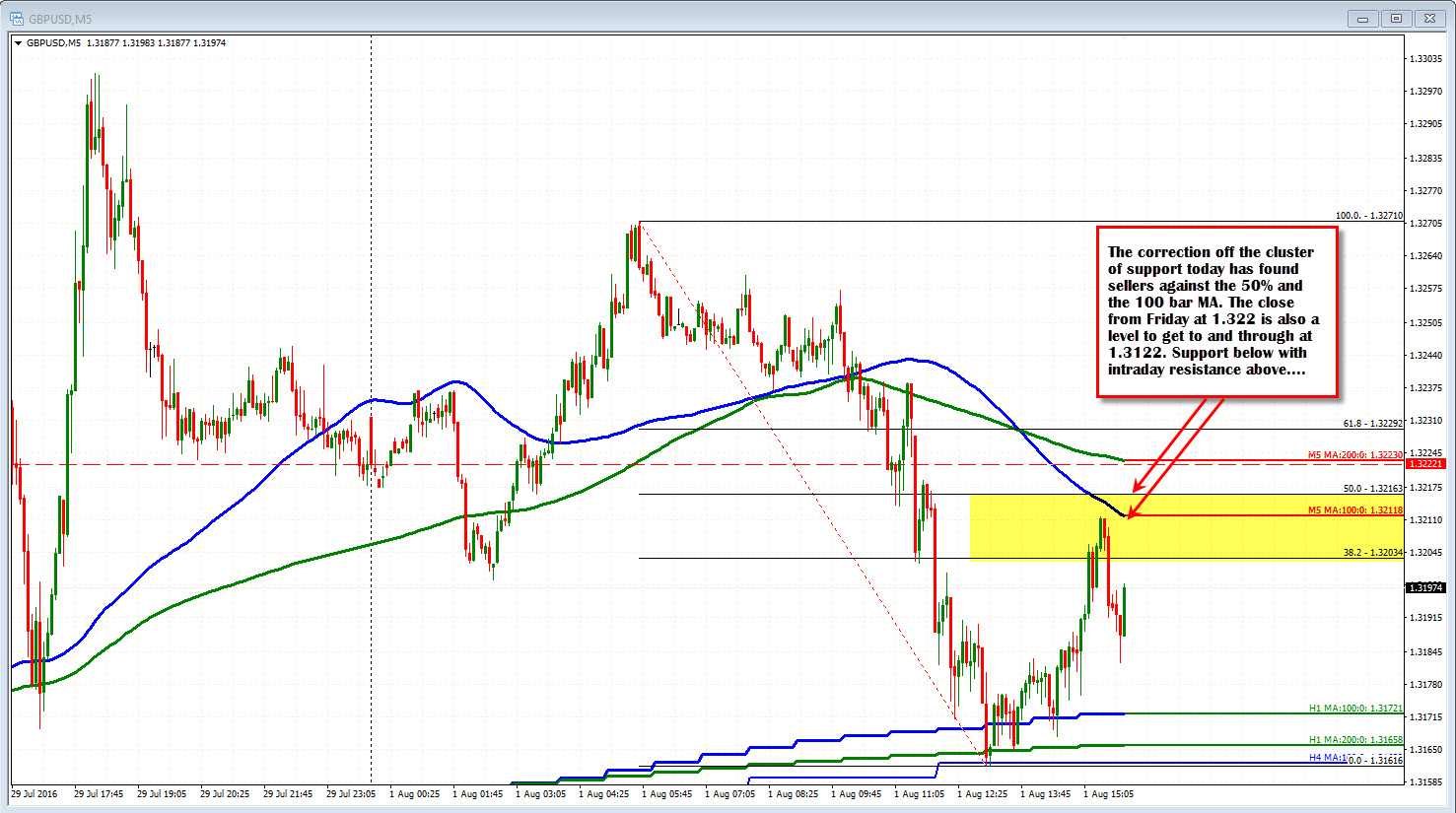

Lots of MA stalls the fall

The GBPUSD has fell to support near a cluster of support defined by the 100 bar MA on the 4-hour chart, the 200 hour MA and the 100 hour MA. Those three moving averages come in at 1.3161, 1.3165 and 1.3171 respectively. The low for the day bottomed at 1.31616.

Drilling down into the 5-minute chart for clues, the correction off the key support area, has stalled ahead of the 50% and 100 bar MA a 1.3216 and 1.32123 (for the 100 bar MA currently) respectively (heading back there now). The close from Friday was 1.3222 and the 200 bar MA (green line in the chart below), is also providing some overhead resistance. The high correction reached 1.3212 so far.

The UK manufacturing PMI data gave the pair the extra downside kick earlier today. but the weakness from the weak US GDP looms in the back of traders minds as well.

So buyers against support/sellers selling the resistance with traders eyeing a break seems like a thing to do. Why not. It is Monday, the UK still has it's hangover from Brexit/new PM to sort through while the US ain't doing too great either with the GDP disappointment. So trade it and we will see if the manufacturing data gives another push outside the intraday range.