Now what?

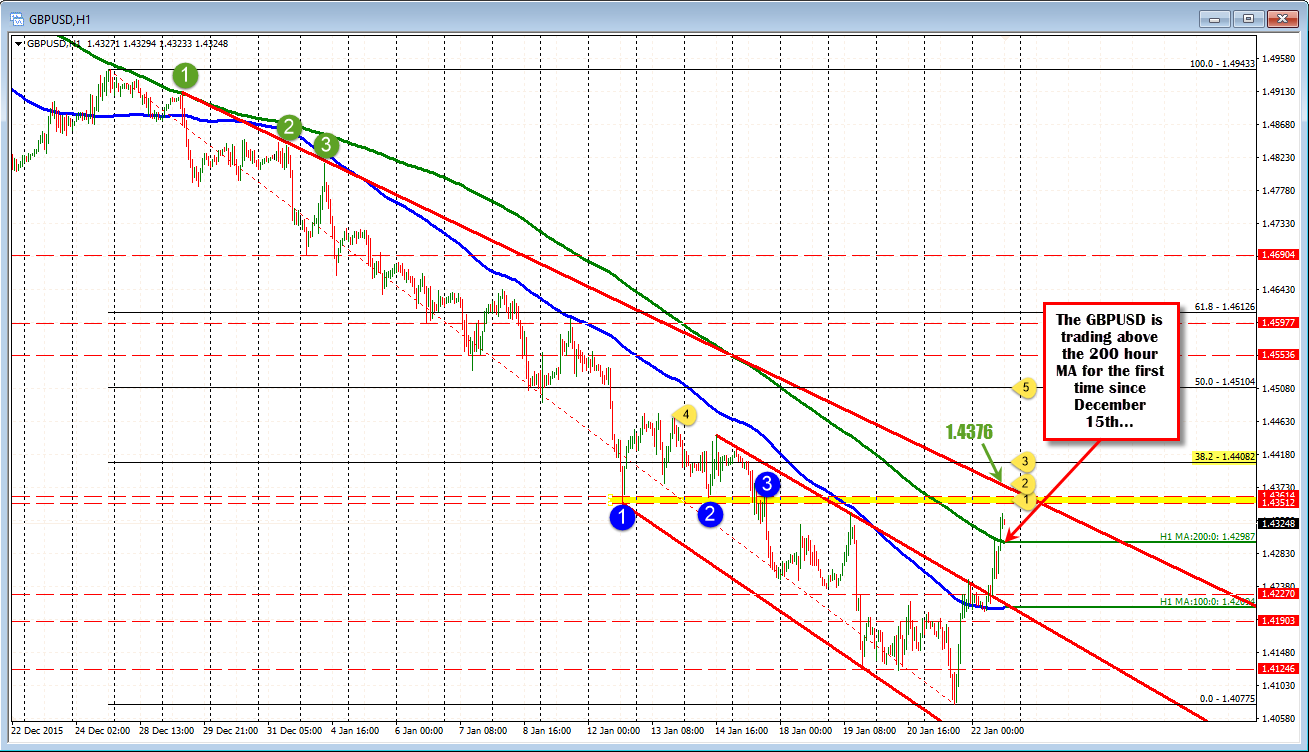

The GBPUSD is trading above the 200 hour MA for the 1st time since December 15th. That is 25 straight days below the MA. Yesterday the pair moved above the 100 hour MA for the first times since December 29th. That too was an impressive run.

Today, the pair based against that 100 hour MA (nice), went to test the 200 hour MA. Did the honorable thing and respected it on the first look (nice), corrected to the middle of the 100 and 200 MAs and then pushed above.

If the price moves above a key MA like the 200 hour MA for the 1st time in 25 trading days, the hope is that the MA now becomes support (risk) and the price moves higher - there is a building of a bullish "building".

The reality of the situation is that the sledding back higher should be tougher, but if the foundation is built, the floors can be built.

Where are the next floors?

- The 1.4351-61. Looking at the hourly chart, this is the swing lows from Jan 12 and Jan 14 and a swing high from Jan 15.

- 1.1476. This is the downward sloping trend line

- 1.4408. This is the 38.2% of the move down from the Dec 24th high That high was a strong test of the 200 hour MA, before the pair tumbled in the new trading year.

Those are the next targets (floors in our building) that need to be built to continue the corrective move.

The building can grow taller. It will depend on "the market". Remember, the pair did move sharply lower for "reasons". That may be Brexit or no tightening, etc. So if those stories can resurface, the building higher may stop. The good news is the price and the tools will tell the story and build the stories. Follow the blue print.