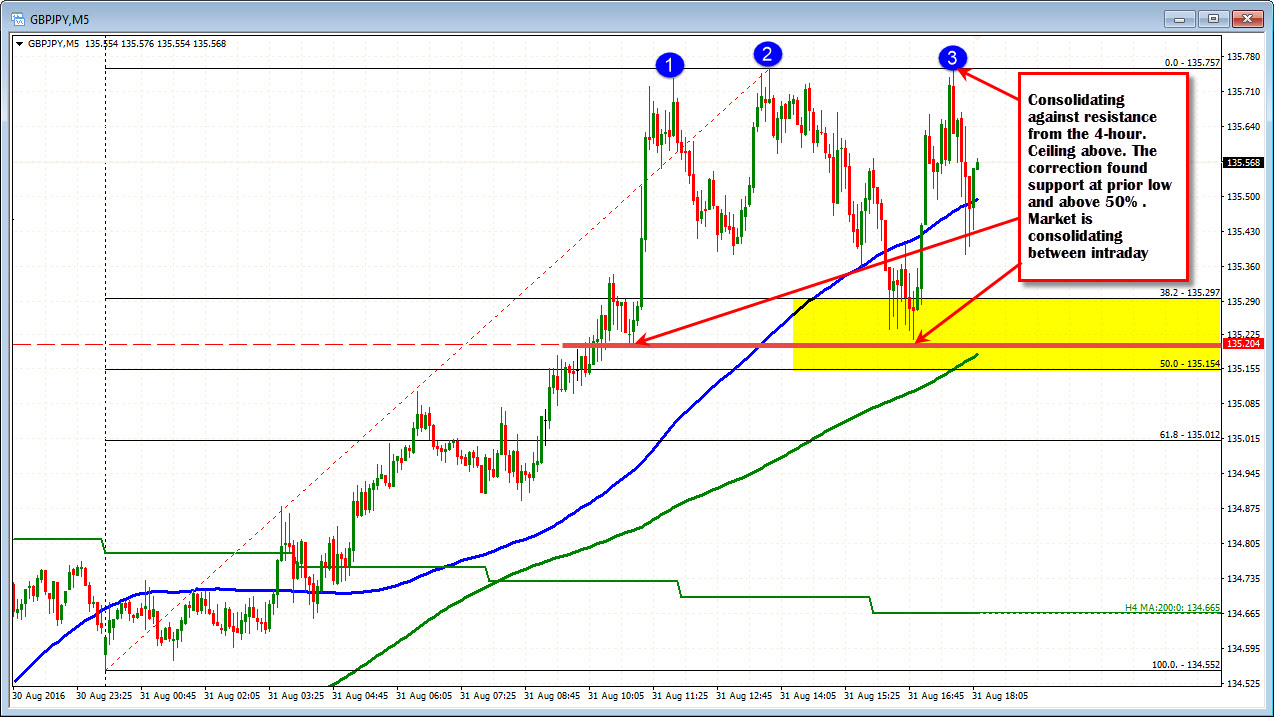

Spiked after breaking above 200 bar MA on 4-hour but found sellers against trend line resistance

The GBPJPY moved above the 200 bar MA on the 4-hour chart for the first time since June 23rd (right before Brexit). I outlined this key level in the post yesterday (click here to view that post). That move above gave buyers a reason to buy and they took the pair higher in the Asian Pacific/London session. The price rise continued at a steady click until the price reached the topside of a channel at the 135.76 level. The high reached 135.757. The price held that line.

The price has rotated lower and traded to a low in the current hour at 135.21. That move took the price to the correction zone between the 38.2-50% of the days range. The price rallied but stalled once again near the highs and that topside trend line (it is up to 135.87 currently).

Traders took profit/sold against the trend line above. Risk was defined and limited. The correction so far shows that buyers are holding more control. The price held against prior low/50%. Consolidating...yes. Keeping bulls in control....Yes. But need to make the next break and stay above. That may be harder to do (today at least).