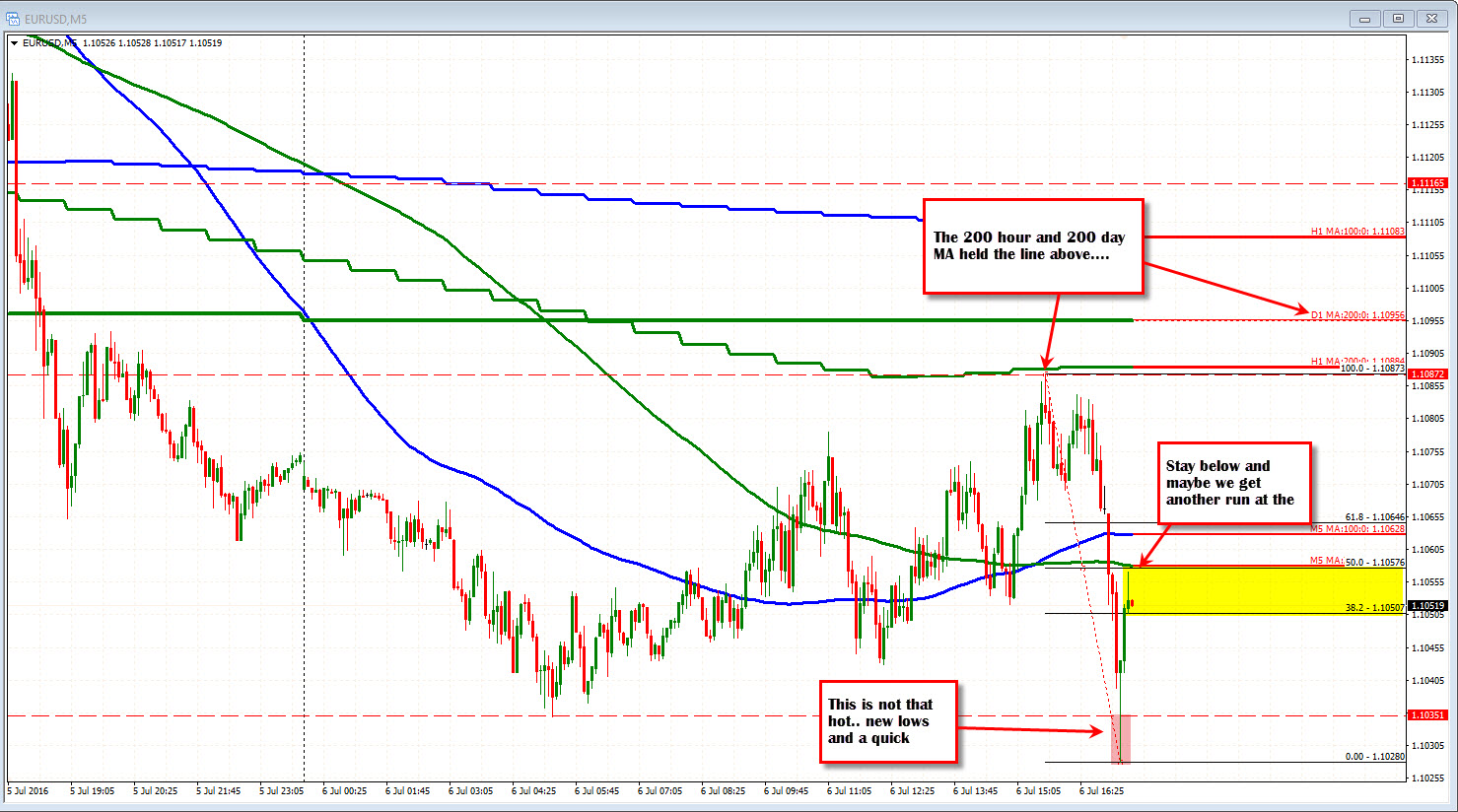

Range extended on the downside and snaps back.

The upside test could not be sustained, thanks to the topside resistance against the 200 hour MA (and above that the 200 day MA). The pair just extended to new lows but that is quickly being reversed in a quick snap back rally. UGH. Liquidity conditions light in this the July 4th holiday week?

Anyway, the range started the NY session at 42 pips. It is now up to 59. Still light. So there is still room to roam. But which way?

Looking at the 5 minute chart the midpoint of the days range comes in at 1.1057 level. Stay below and perhaps....perhaps...we can get something else going to the downside. A move above the 50% and the waters are muddy and I go into a cave..... We may even go and extend to the upside again. Choppy beget choppy. Right now, the sellers are looking for the midpoint line to hold and a reversal back lower. We will see.

IF it can happen, the 1.1022 and 1.1015 are the next downside targets. They represent the low from last Thursday and the 61.8% of the move up from the June 24th low.

Some traders were lamenting the relatively sideways nature of the the EURUSD. Looking at the weekly chart of the EURUSD this is the technical view. The 100 week MA (blue line) is tracking down. The sideways led to a test a few months ago. The trend line was broken a few weeks ago and the underside has been tested the last few weeks. If I could close my eyes and wish for a trend move it would look like this.....