Market waiting for the next shoe to drop

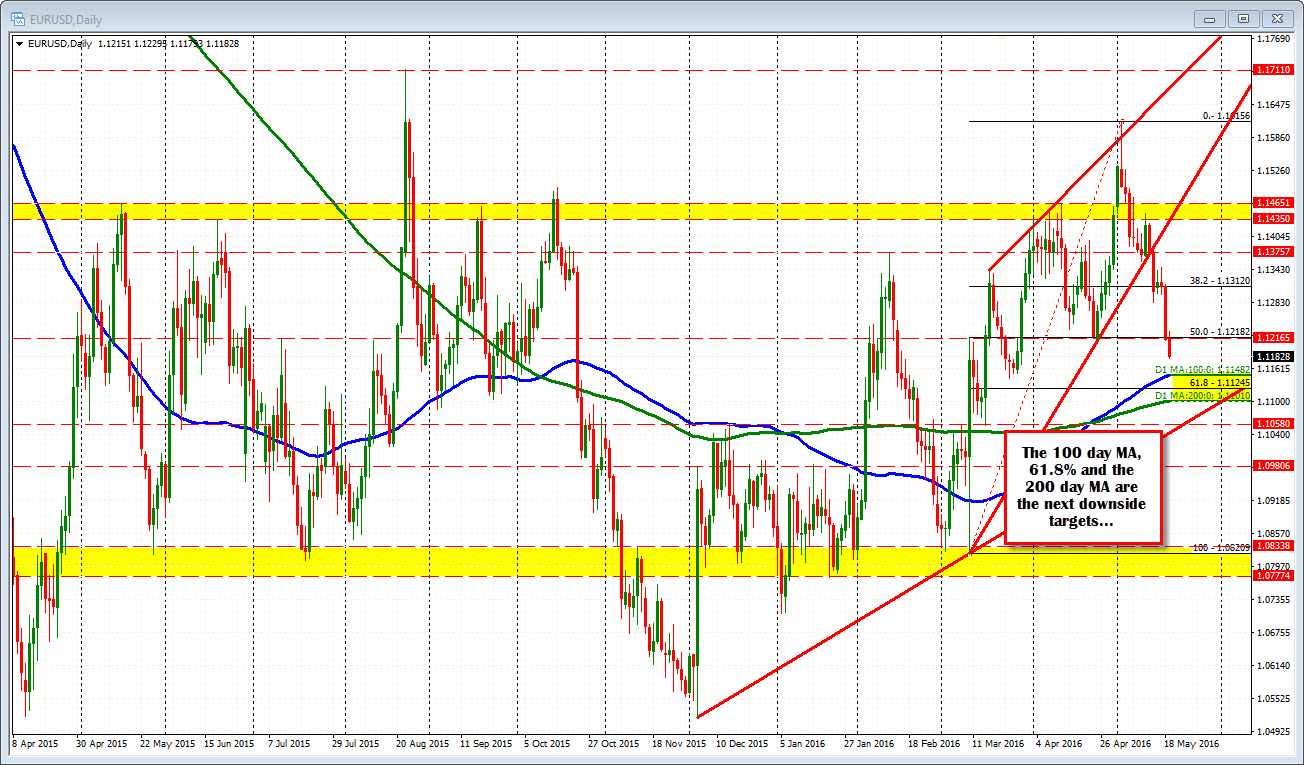

The EURUSD is down testing channel trend line support off the hourly chart at the 1.1181 level. The Philly Fed came in lower than expectations. The weekly claims came back down to more normal levels after the spike higher last week. The Chicago National index was better at 0.10 vs -0.20 estimate. But, the highlight will be the chatter from Fed's Fischer at (9:15 AM ET/ 1315 GMT) and Dudley (at 10:30 AM ET/1430 GMT). The market will be looking for more June rate hike talk of course. Jeffrey Lacker joined in the chorus today that was started on Tuesday with Fed's Williams and Lockhart starting the song. The FOMC meeting minutes were also more hawkish than expectations.

SO it seems the market is pushing the dollar strong button ahead of the talk.

A break of the trend line will next target the 100 day MA at the 1.1148 level today. The EURUSD has not closed below the 100 day MA since March 2nd. The 61.8% of the move up from the March low comes in at 1.11245. The 200 day mA is at 1.1101. Keep the tightening fire burning and those targets are in play.

So far the trend line is holding the line out of respect. Will it remain if the next shoe drops on Vice Chair Fischer's comments? Traders have that dollar higher feeling. CLose risk today for shorts will be around the 1.1204. This is the midpoint of the day's range and the lows from the London early morning session. I can't rule out 1.1214-18 either. The lows in April reached these lows and the 50% of the move up from the March low comes in at 1.12182.