Await the NFP

The EURUSD has an epic bullish day yesterday. The low to high trading range was a record for the year - surpassing the range from March 18 after the Fed took out "patient" from the statement and the pair squeezed to the upside. Yesterday's squeeze occurred after the ECB failed to satisfy traders expectation despite cutting rates and extending the QE timeline.

Today is another big day as focus turns to the US employment report.

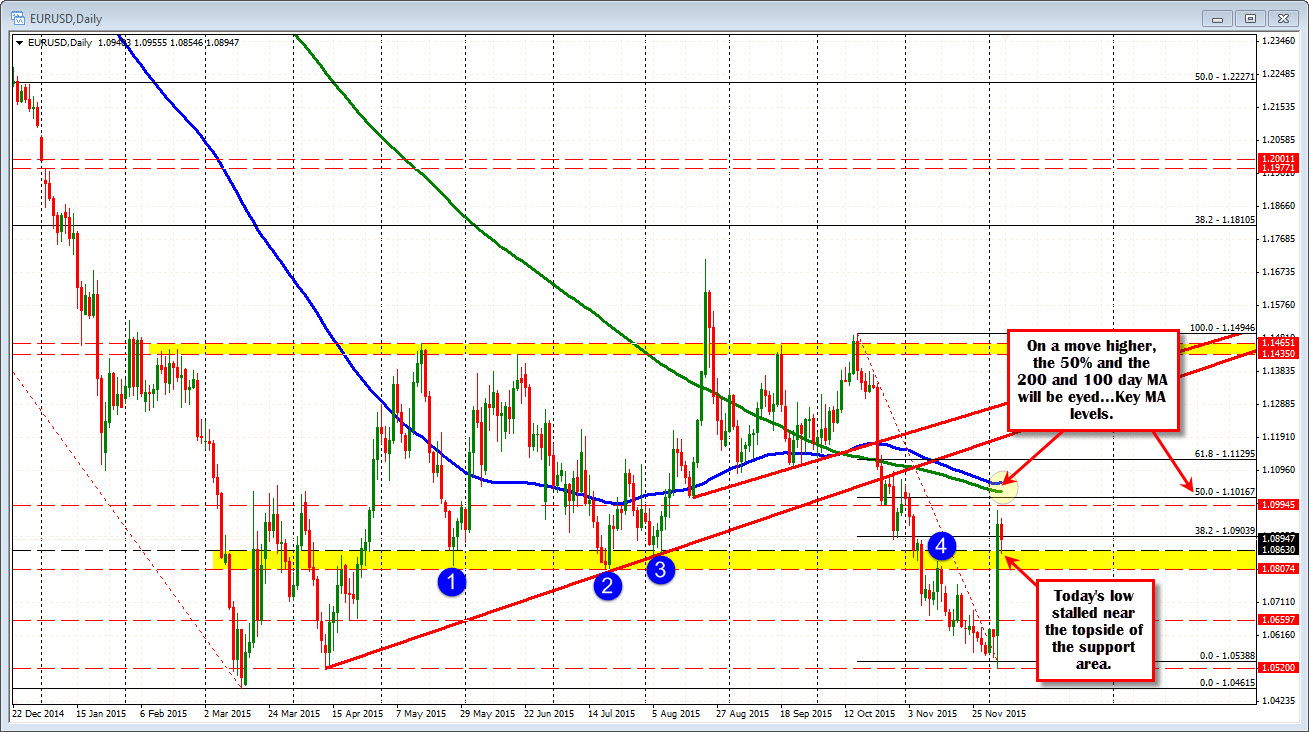

Technically, looking at the daily chart above, the pair has pushed above an old floor area defined by swing lows (see numbered circles). I have that area designated between 1.0807-63 (yellow area). The low in the trading day today corrected to a low of 1.0855. So support buyers have shown up at the top of the area on the first test. Buyers still liking it.

The pair is currently trading near the 1.0890 level which was the original high from yesterday's post Draghi comments (see 5-minute chart below). I guess that makes sense. Give some room to the first key support.

So what happens on the number?

Today is a unique day as it will likely take a really bad number to shake the market from a Fed liftoff. What is a bad number< 150? That will likely still do it. <100K? Maybe. The point is the Fed is looking at the body of work with regard to employment going back years now and the employment picture has checked off the requirements.

So with that backdrop (and all things equal and known), the dollar should get stronger on anything as the Fed will likely still tighten. Not so fast as it is tough to ignore the move yesterday (the ECB) and say the buyers are done with this move. The "big boy" shorts got burned by the ECB at the start but piled on later. Will they continue to take out their anger on the shorts still out there? As a result, I will be really, really focused on what happens on dips.

I have 3 key levels on a sell off.

- 1.0863

- 1.0807 and

- 1.0788

The 1.0807-63 were once again lows from earlier in the year (the yellow area on the daily chart). The 1.0788 was the corrective low we made AFTER Draghi started his presser. The 38.2% of the move up from yesterday's low comes in at 1.08038 - within the range (see 5- minute chart below).

If on a number that keeps the Fed tightening on, the price is able to hold this area on a correction, it will tell me the buyers want to keep control and the squeeze can continue. If it goes below this area, the waters will be more muddy.

ON the topside, a really weak number, the topside will have targets at the 1.1000 level, the 1.10167 (50% of the move down from the October high) and the 200 and 100 day MAs at the 1.1034 and 1.1060 level (green and blue lines in the daily chart). A move above those two moving averages may have traders scratching their heads but remember anything can happen.

A TRADERS WARNING: The unemployment number is a gamble. Market, event and liquidity risk is at the highest level. As Ryan said earlier there is blind luck there is trading. A win with a position taken right now is blind luck. So be aware.