Moves back above the 200 hour MA.

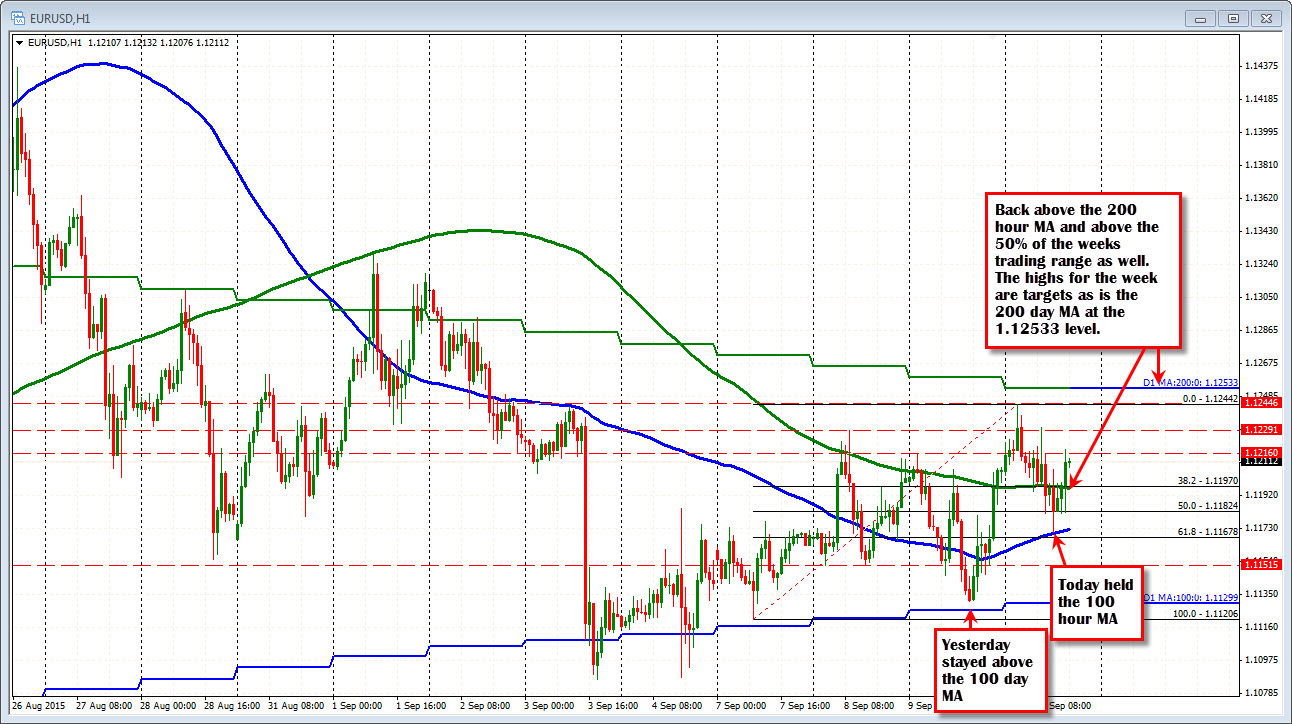

The EURUSD has made a break back to the upside and in the process scooted above the 200 hour moving average at the 1.1196 level (green line in the chart below).

Stock futures in the US are now down (they were up earlier today) and the market in this pair at least, seems to be taking clues from the wiggles and waggles of late (don't hold me to that though as it can change). Technically speaking though....the price moved above the 200 hour MA and that is bullish.

Note that earlier today, the low held right on the 100 hour MA (blue line in the chart above). Traders were leaning against the risk defining levels and those traders who bought there are getting more satisfaction from the break higher.

The low to high trading range is about 73 pips (135 is the 22 day average). The range for the week is only 124 pips. This is the lowest trading range this year (148 is the low).

So that implies either we continue to go no where or we extend the range between now and the close on Friday. The bias is more bulllish currently. Why?

- Held the 100 hour MA

- Above the midpoint of the weeks range at 1.11824.

- Above the 200 hour MA at 1.1196

- Yesterday we held the 100 day MA too

Look for support at the 1.1196 area. If it can hold, there should be some more probing to the upside. Who knows, maybe the 200 day MA above (at 1.1253) will indeed be breached.