Trades near highs for the day

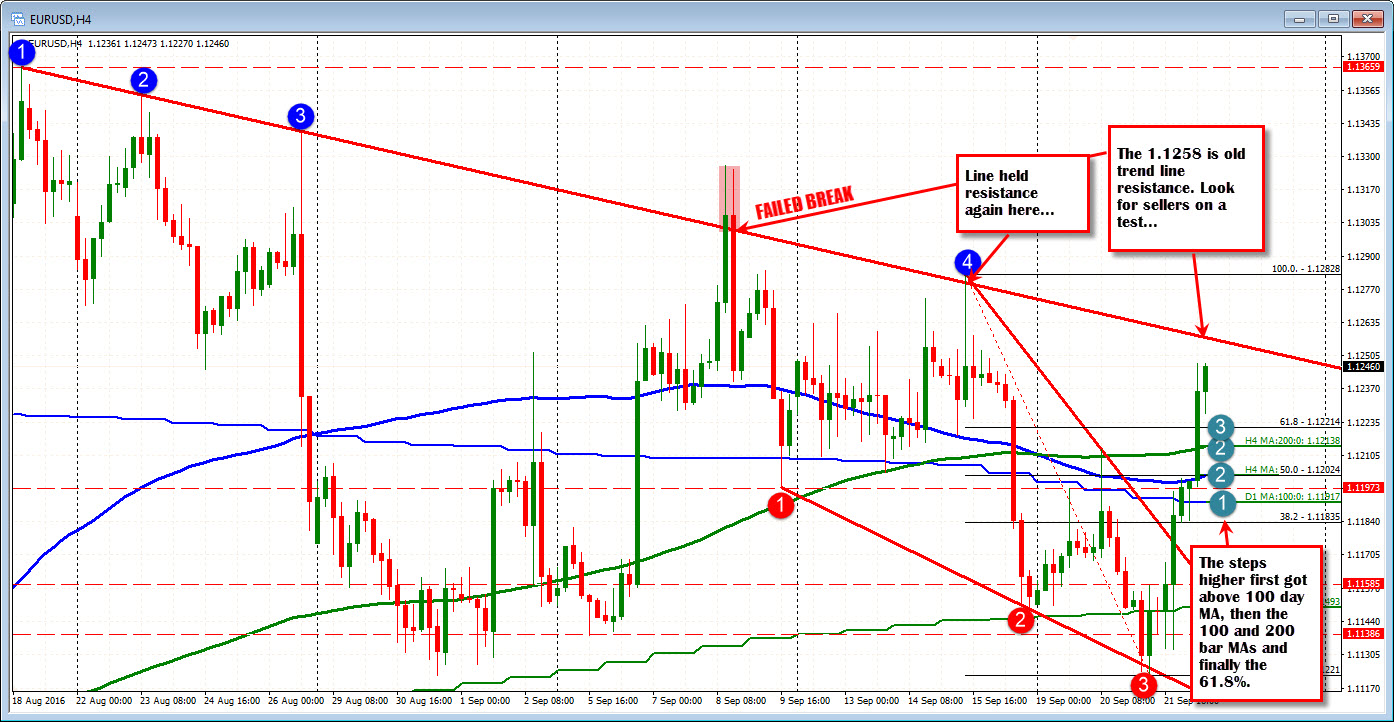

The EURUSD moved higher in trading yesterday (lower dollar) on the back of the FOMC decision and press conference. The pair stalled near the 100 day MA at the 1.11816 level (see chart below). That was step 1.

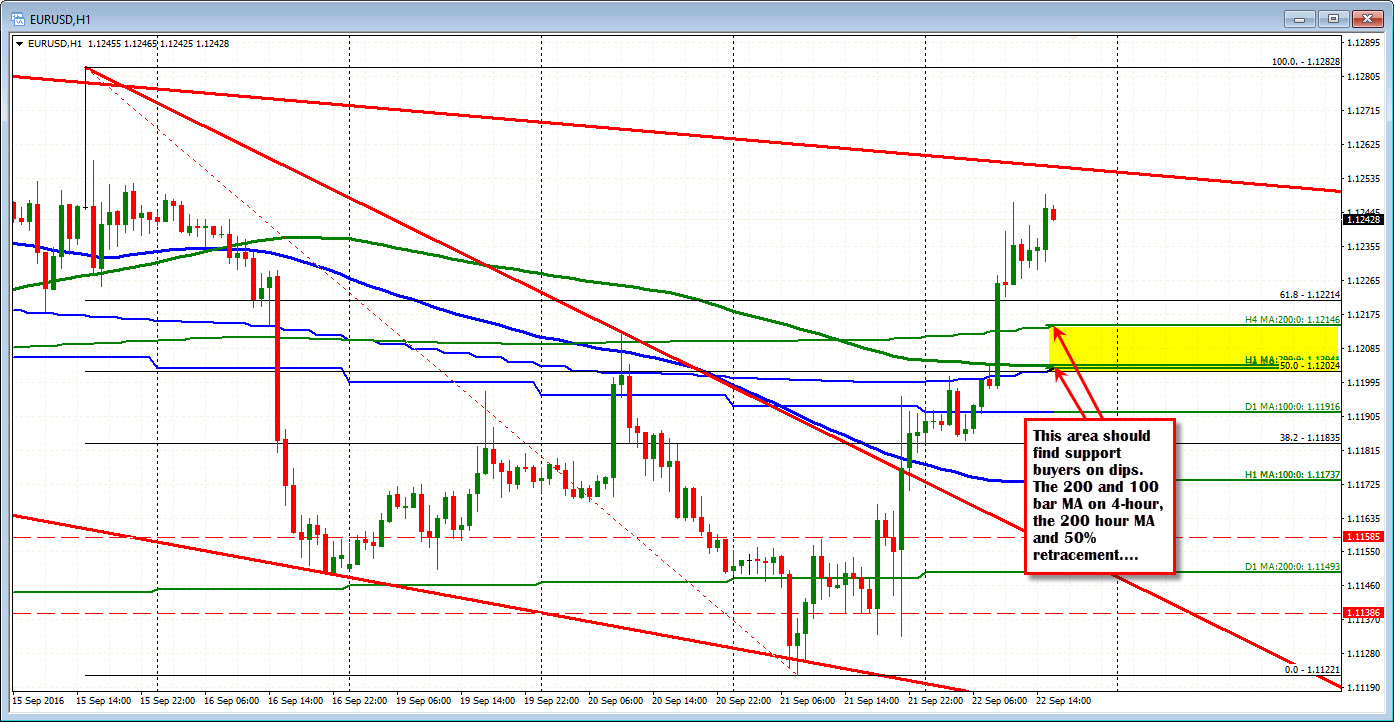

Step 2 included breaks of the 100 day MA and the 100 and 200 bar MAs on the 4 hour chart (blue and green smooth lines in the chart above at 1.12024 and 1.12138 respectively). That led to step 3 which was a break of the 61.8% of the most recent move lower at the 1.12214.

The next step is at the 1.1258 level. That level is the old trend line that connected highs from August 18th, 23rd and 26th. On September 8th, that trend line was broken, but the spike higher failed. What makes the line important was what happened on September 15th (blue circle 4). On the move to that old trend line, the sellers leaned. The line was reestablished as a resistance level.

On a test, I would expect that traders will lean as risk can be defined and limited (stops if the level does not find sellers expected). There is continued support at the 200 hour MA below at 1.12146 and then the 1.1200 area where the 100 bar MA on 4-hour is found (the 200 hour MA is also there). I would also look for buyers on dips against this area.