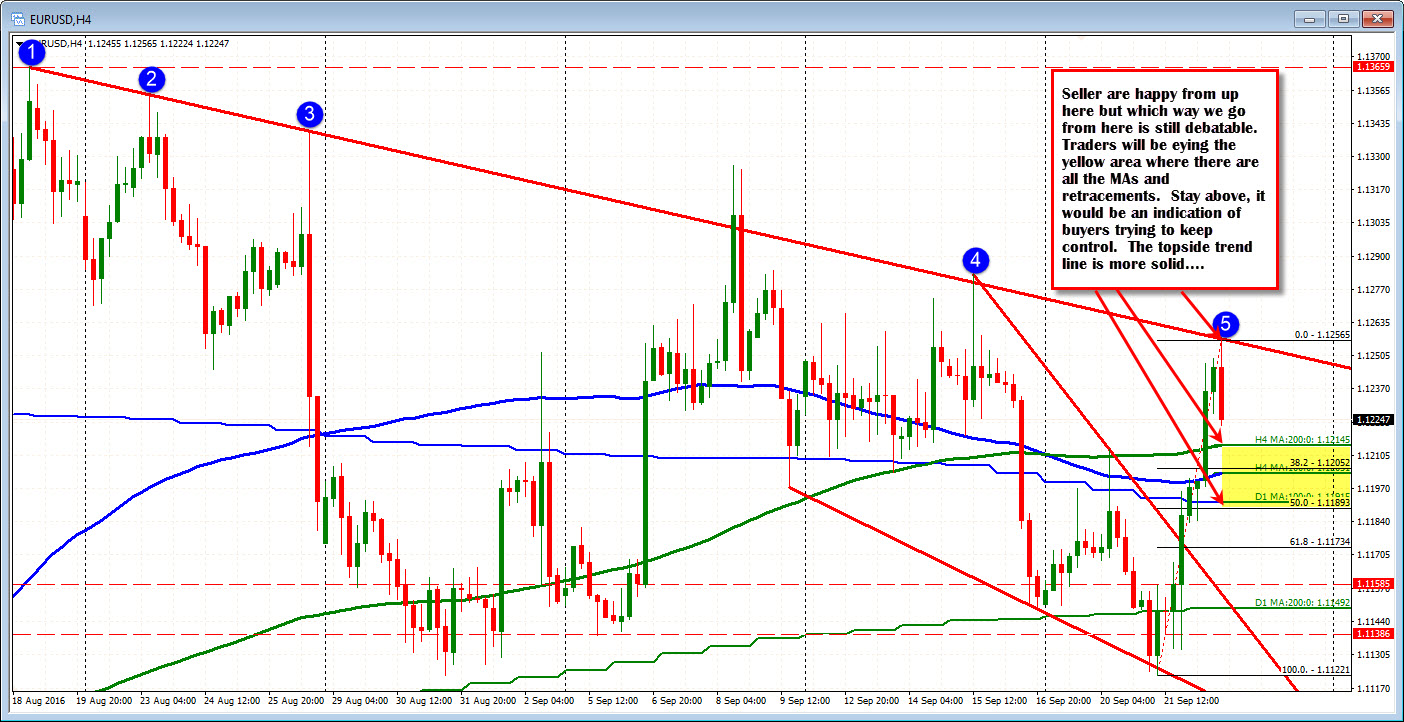

Retracements as well...

The EURUSD stalled at the topside trend line.

But what now?

The pair has continued to wander lower from the trend line but there are bullish things from the day too:

- The price is still higher on the day. The close yesterday was down at 1.1186.

- The price is above a bunch of MAs including the 100 day MA, the 100 and 200 bar MA on the 4 hour chart. They come in between 1.1191 to 1.12145.

- The price is above the 38.2-50% of the move up from the low yesterday at the 1.1205 and 1.1189

A correction that goes down to that yellow area, will look to the buyers to come in and provide support.

If that is done, then the battle will be on between the trend line above and the support against MAs and retracements below.

Any clues from the daily chart?

- Yesterday, the price broke below the 200 day MA and the 50%. That should lead to lower levels. It did until the low from the end of August was tested. The price moved back higher and closed near the 100 day MA.

- Today the price moved above the 100 day MA and moved higher.

So buyerss seem more in control off that picture.

Where could it go if that bullish bias remains?

Off the daily chart, the first topside trend line comes in at 1.1286. Above that the 2nd topside trend line cuts across at 1.1326 area currently. The high from August at 1.13658 is another target.