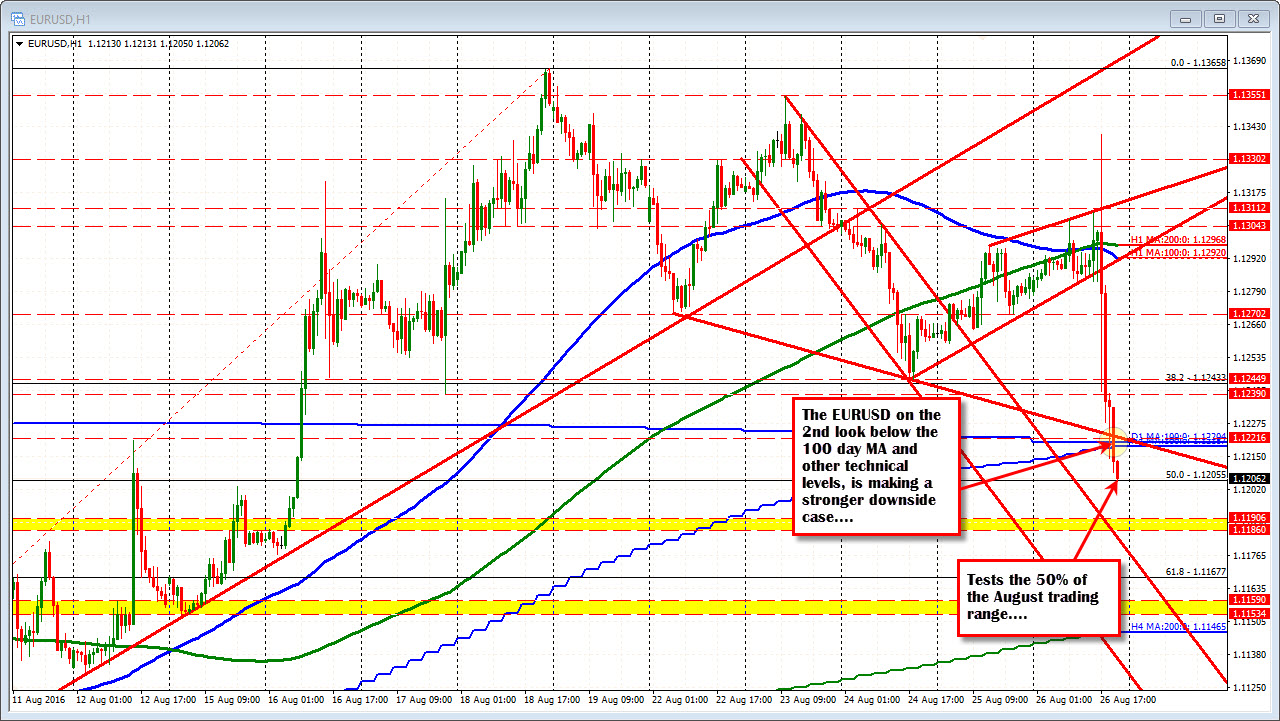

50% of the August range is the next target

The EURUSD has made a better push on the 2nd attempt below the 100 day MA. Earlier - after Fischer's talking - the pair dipped below the 100 day MA/ 100 bar MA on the 4 hour chart at the 1.2018 area (the low reached 1.2014). The correction stalled ahead of the 1.1239 level and that has led to the 2nd break. This one is more convincing.

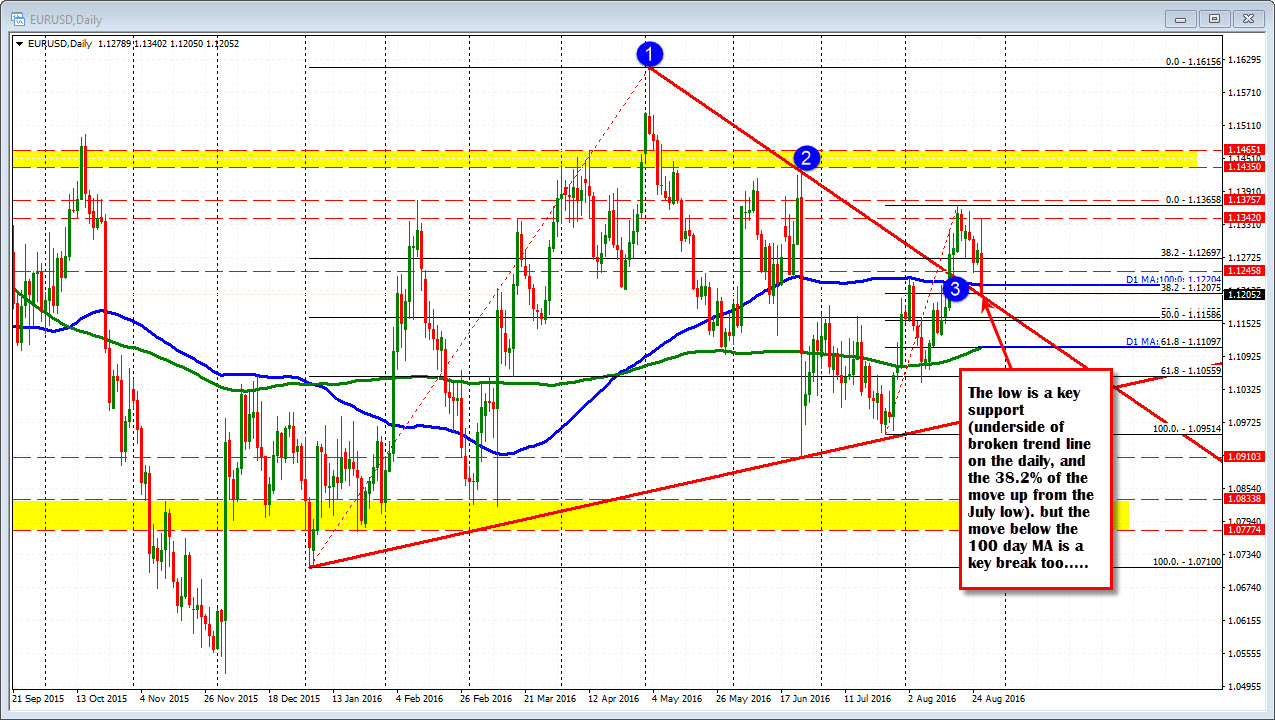

The pair is now down testing the 50% of the August move at 1.12055. Looking at the daily chart, the 1.1205 area is also the 38.2% of the move up from the July low and the underside of a broken trend line. HMMMM good support for a trade but would not risk a lot as I think the topside is probably limited. (to 1.1220).

Risk is now the 100 day MA /100 bar MA combo (a trend line cuts across there too). Stay below, bears in control A break of the 1.1205 should solicit more selling.